Question: I need help in this question. Please I have only 40 minutes. Please do it correctly and 100% and post complete and correct solution Doughbuddy,

I need help in this question. Please I have only 40 minutes. Please do it correctly and 100% and post complete and correct solution

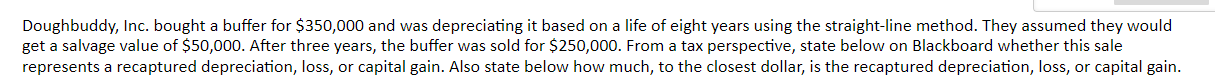

Doughbuddy, Inc. bought a buffer for $350,000 and was depreciating it based on a life of eight years using the straight-line method. They assumed they would get a salvage value of $50,000. After three years, the buffer was sold for $250,000. From a tax perspective, state below on Blackboard whether this sale represents a recaptured depreciation, loss, or capital gain. Also state below how much, to the closest dollar, is the recaptured depreciation, loss, or capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts