Question: i need help , it's the same question but with 6 different requirments Consider the following information which relates to a given company: 2019 Value

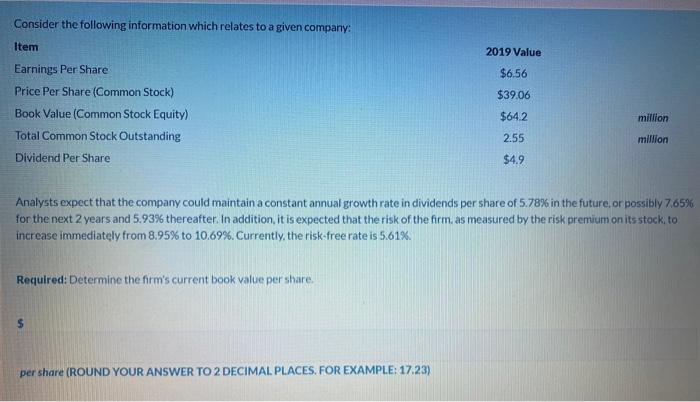

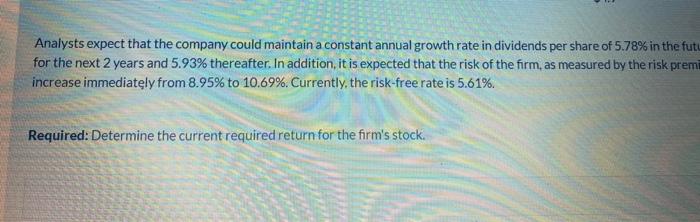

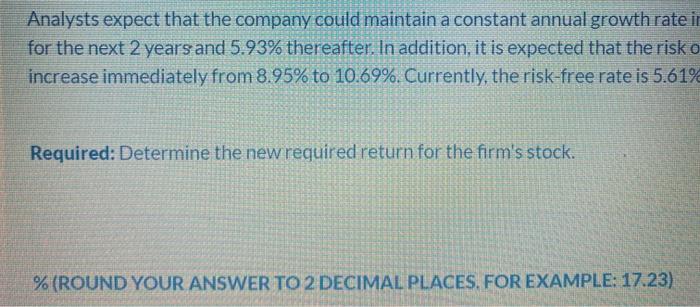

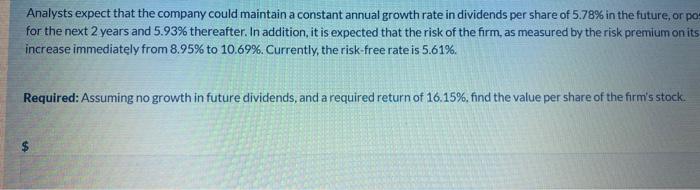

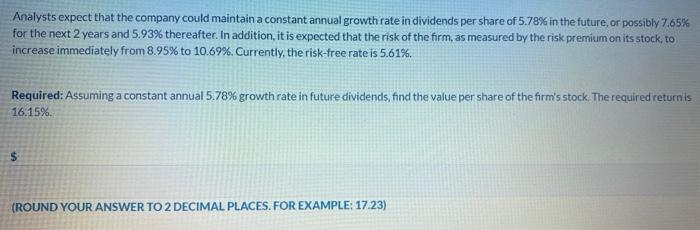

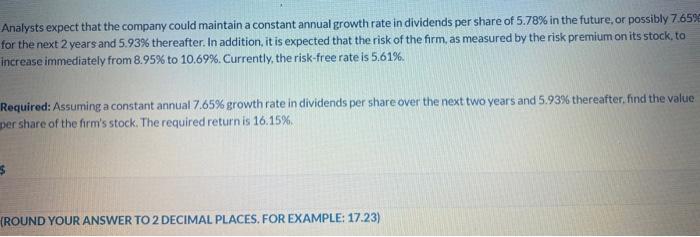

Consider the following information which relates to a given company: 2019 Value $6.56 $39.06 Item Earnings Per Share Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share $64.2 million 2.55 million $4.9 Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 5.78% in the future, or possibly 7.65% for the next 2 years and 5.93% thereafter. In addition, it is expected that the risk of the firm as measured by the risk premium on its stock to increase immediately from 8.95% to 10.69%. Currently, the risk-free rate is 5.61% Required: Determine the firm's current book value per share per share (ROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23) Analysts expect that the company could maintain a constant annual growth rate il for the next 2 years and 5.93% thereafter. In addition, it is expected that the risk o increase immediately from 8.95% to 10.69%. Currently, the risk-free rate is 5.61% Required: Determine the new required return for the firm's stock. % (ROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23) Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 5.78% in the future, or po for the next 2 years and 5.93% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its increase immediately from 8.95% to 10.69%. Currently, the risk-free rate is 5.61%. Required: Assuming no growth in future dividends, and a required return of 16.15%, find the value per share of the firm's stock. $ Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 5.78% in the future, or possibly 7.65% for the next 2 years and 5.93% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.95% to 10.69%. Currently, the risk-free rate is 5.61%. Required: Assuming a constant annual 5.78% growth rate in future dividends, find the value per share of the firm's stock. The required return is 16.15%. (ROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23) Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 5.78% in the future, or possibly 7.659 for the next 2 years and 5.93% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.95% to 10.69%. Currently, the risk-free rate is 5.61%. Required: Assuming a constant annual 7.65% growth rate in dividends per share over the next two years and 5.93% thereafter, find the value per share of the firm's stock. The required return is 16.15% 5 (ROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts