Question: I need help making sure my work is correct along with finishing the rest of the requirements. Thank you in advance & sorry for the

I need help making sure my work is correct along with finishing the rest of the requirements. Thank you in advance & sorry for the lack of understanding.

Any help will greatly be appreciated.

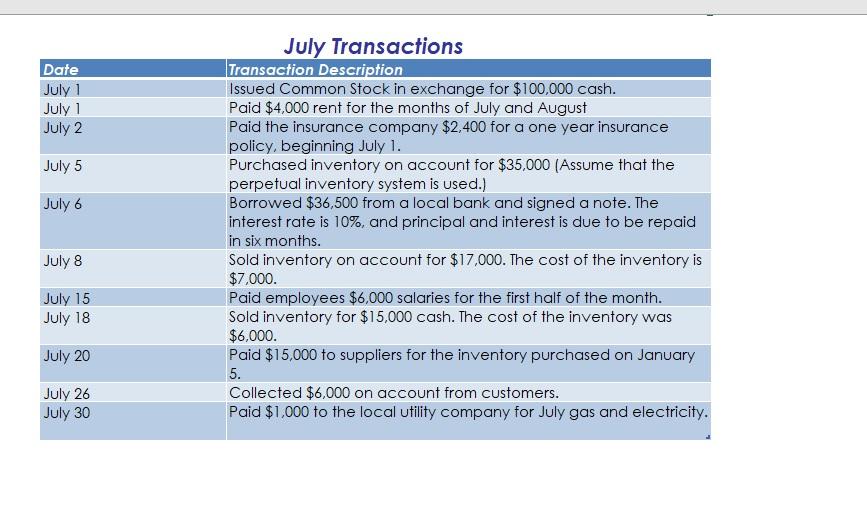

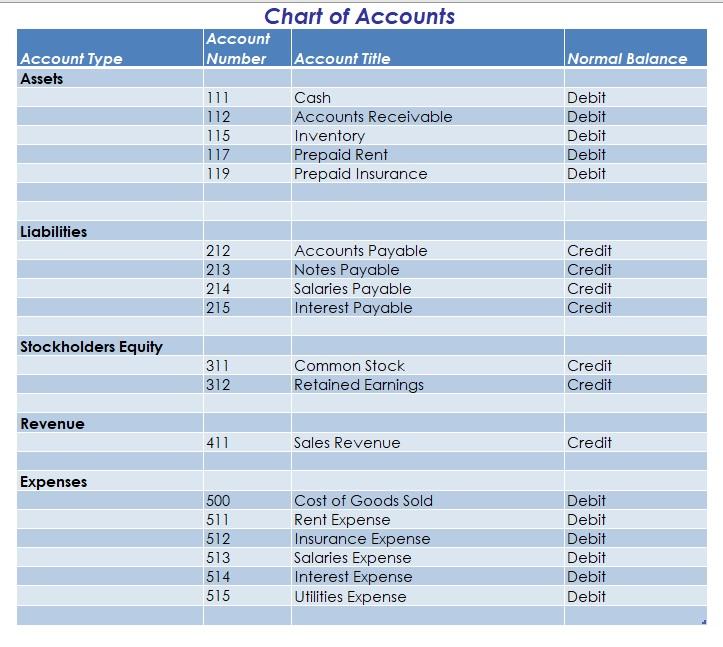

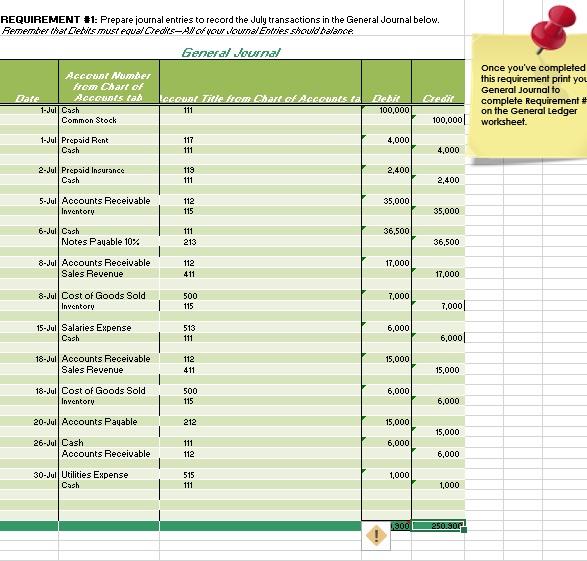

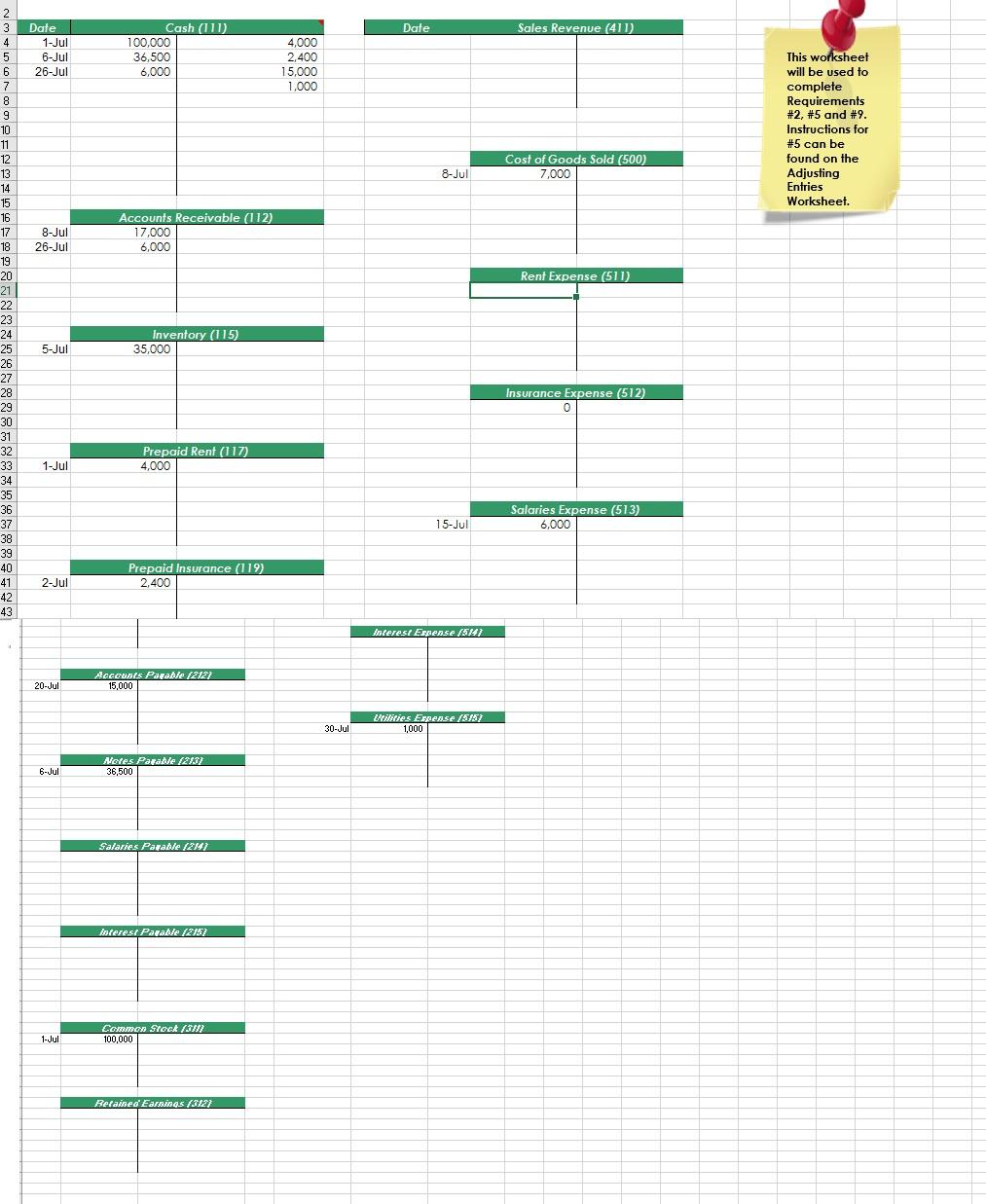

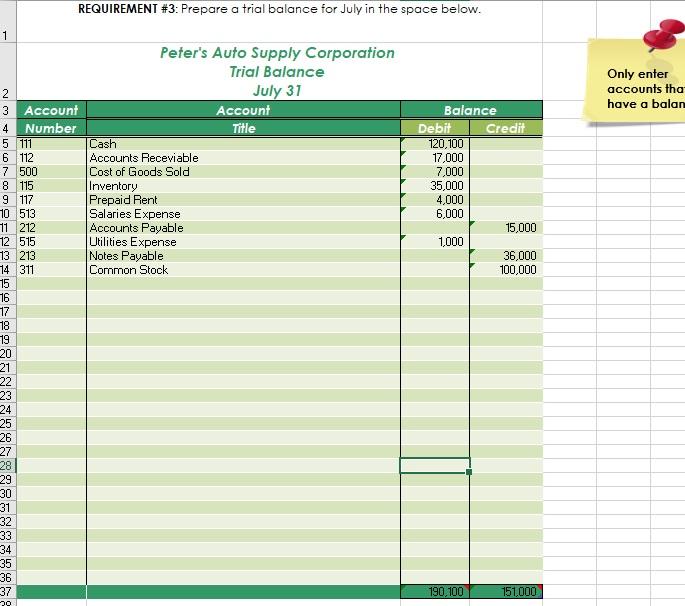

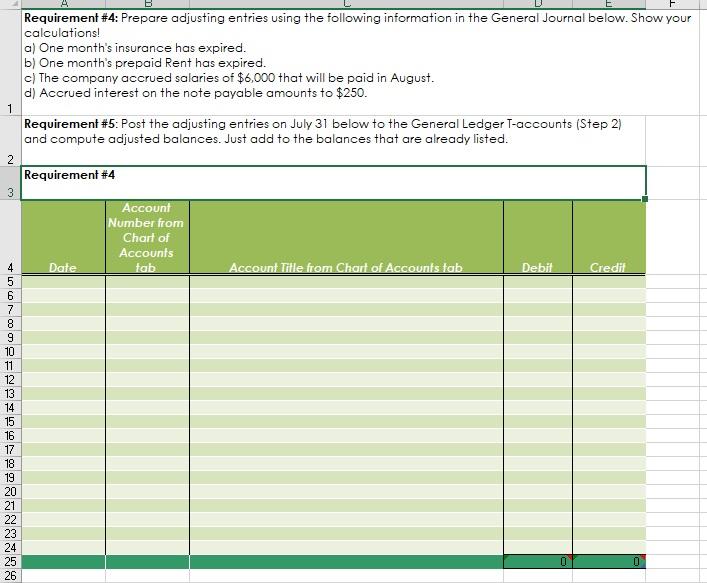

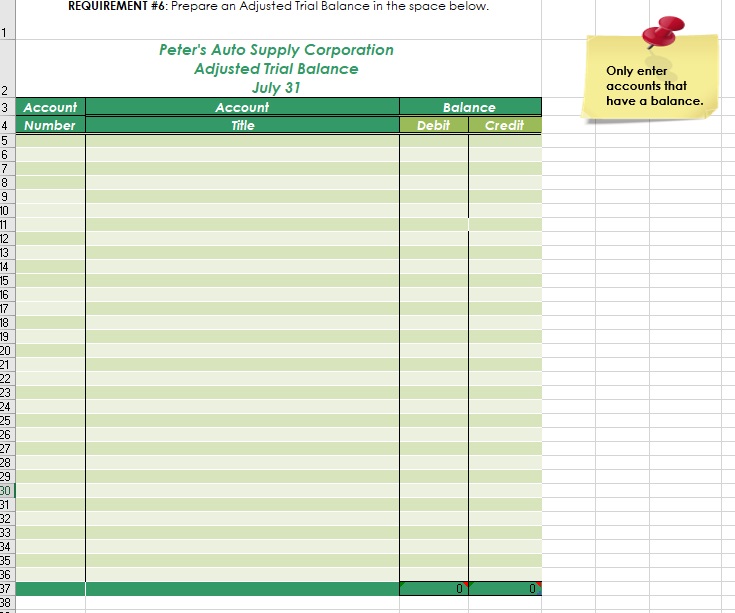

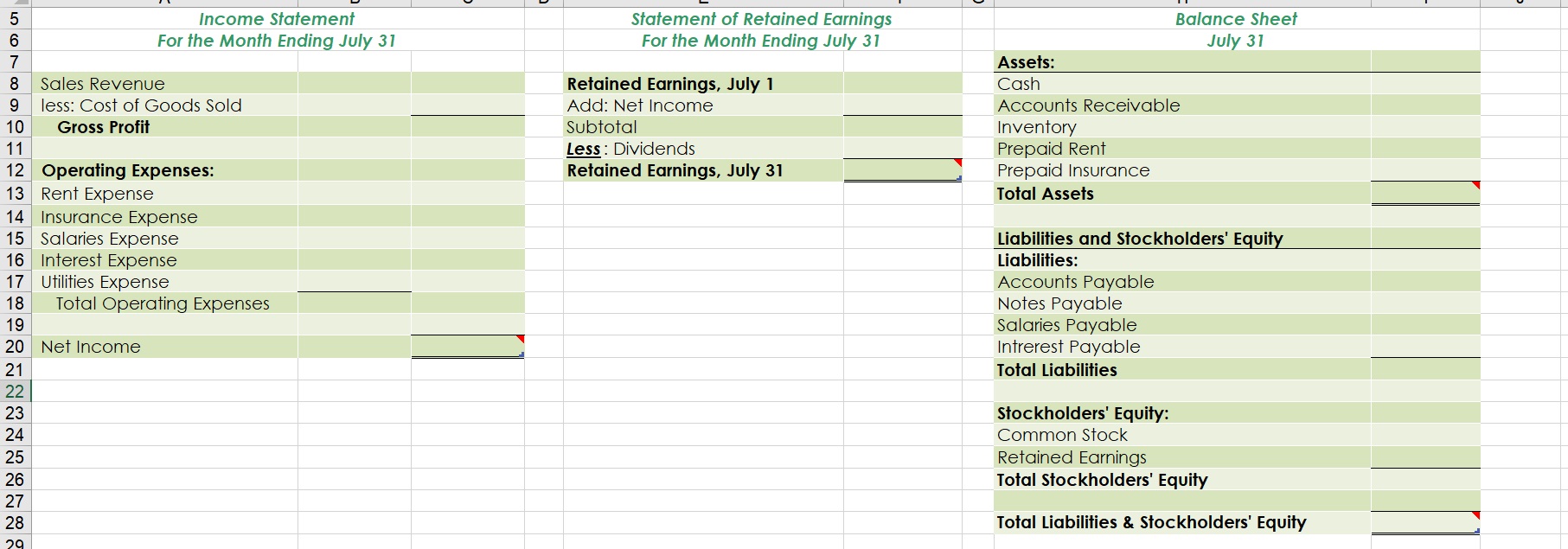

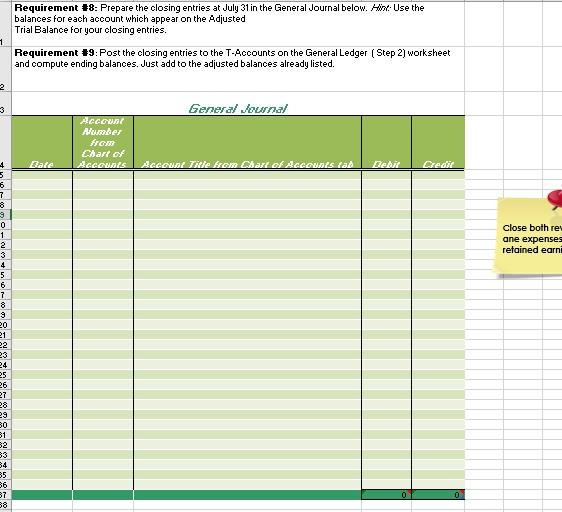

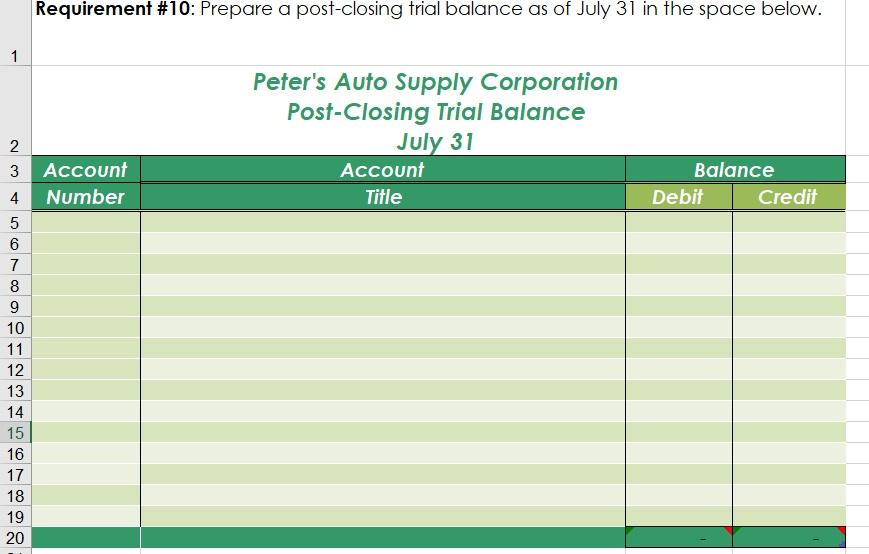

Date July 1 July 1 July 2 July 5 July 6 July 8 July 15 July 18 July 20 July 26 July 30 July Transactions Transaction Description Issued Common Stock in exchange for $100,000 cash. Paid $4,000 rent for the months of July and August Paid the insurance company $2,400 for a one year insurance policy, beginning July 1. Purchased inventory on account for $35,000 (Assume that the perpetual inventory system is used.) Borrowed $36,500 from a local bank and signed a note. The interest rate is 10%, and principal and interest is due to be repaid in six months. Sold inventory on account for $17,000. The cost of the inventory is $7,000. Paid employees $6,000 salaries for the first half of the month. Sold inventory for $15,000 cash. The cost of the inventory was $6,000. Paid $15,000 to suppliers for the inventory purchased on January 5. Collected $6,000 on account from customers. Paid $1,000 to the local utility company for July gas and electricity. Account Type Assets Liabilities Stockholders Equity Revenue Expenses Account Number 111 112 115 117 119 212 213 214 215 311 312 411 Chart of Accounts 500 511 512 513 514 515 Account Title Cash Accounts Receivable Inventory Prepaid Rent Prepaid Insurance Accounts Payable Notes Payable Salaries Payable Interest Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Insurance Expense Salaries Expense Interest Expense Utilities Expense Normal Balance Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Credit Credit Debit Debit Debit Debit Debit Debit REQUIREMENT #1: Prepare journal entries to record the July transactions in the General Journal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. General Journal Date Account Number from Chart of Accounts tab t-Jul Cch Common Stock 1-Jul Prepaid Rent Cash 2-Jul Prepaid Insurance Cach 5-Jul Accounts Receivable Inventory 6-Jull Cash Notes Payable 10% 8-Jul Accounts Receivable Sales Revenue 8-Jul Cost of Goods Sold Inventory 15-Jul Salaries Expense Cach 18-Jul Accounts Receivable Sales Revenue 18-Jul Cost of Goods Sold Inventory 20-Jul Accounts Payable 26-Jul Cash Accounts Receivable 30-Jul Utilities Expense Cash ecount Title from Chart of Accounts t Debit 111 100,000 117 111 113 111 112 115 111 213 112 411 500 115 513 111 112 411 500 115 212 111 112 515 111 4,000 2,400 35,000 36,500 17,000 7,000 6,000 15,000 6,000 15,000 6,000 1,000 1,900 Credit 100,000 4,000 2,400 35,000 36,500 17,000 7,000 6,000 15,000 6,000 15,000 6,000 1,000 250.900 Once you've completed this requirement print you General Journal to complete Requirement # on the General Ledger worksheet. 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 1 Date 1-Jul 6-Jul 26-Jul 8-Jul 26-Jul 5-Jul 1-Jul 2-Jul 20-Jul 6-Jul 1-Jul Cash (111) 100,000 36,500 6,000 Accounts Receivable (112) 17,000 6,000 Inventory (115) 35,000 Prepaid Rent (117) 4,000 Prepaid Insurance (119) 2,400 Accounts Pawable (212) 15,000 Notes Parable (213) 36,500 Salaries Payable (214) Interest Parable (215) Common Stock (311) 100,000 Retained Earnings (312) 4,000 2,400 15,000 1,000 30-Jul Date 8-Jul 15-Jul interest Expense (514) Utilities Expense (515) 1,000 Sales Revenue (411) Cost of Goods Sold (500) 7,000 Rent Expense (511) Insurance Expense (512) 0 Salaries Expense (513) 6,000 This worksheet will be used to complete Requirements #2, #5 and #9. Instructions for # 5 can be found on the Adjusting Entries Worksheet. 1 2 3 4 5 111 6 112 7 500 8 115 9 117 10 513 11 212 12 515 13 213 14 311 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 28828 34 35 36 37 Account Number 20 REQUIREMENT #3: Prepare a trial balance for July in the space below. Peter's Auto Supply Corporation Trial Balance July 31 Cash Accounts Receviable Cost of Goods Sold Inventory Prepaid Rent Salaries Expense Accounts Payable Utilities Expense Notes Payable Common Stock Account Title Balance Debit 120,100 17,000 7,000 35,000 4,000 6,000 1,000 190,100 Credit 15,000 36,000 100,000 151,000 Only enter accounts tha have a balan a) One month's insurance has expired. b) One month's prepaid Rent has expired. c) The company accrued salaries of $6,000 that will be paid in August. d) Accrued interest on the note payable amounts to $250. 1 2 3 AFETERREPRESE PANNKA 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! 26 Requirement #5: Post the adjusting entries on July 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. Requirement #4 Date Account Number from Chart of Accounts tab Account Title from Chart of Accounts tab Debit 0 Credit 0 ~ 34 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 7887888=223588 24 26 29 30 31 33 34 36 REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Account Number Peter's Auto Supply Corporation Adjusted Trial Balance July 31 Account Title Balance Debit 0 Credit 0 Only enter accounts that have a balance. 5 6 7 8 Sales Revenue 9 less: Cost of Goods Sold 10 Gross Profit 11 12 Operating Expenses: 13 Rent Expense Income Statement For the Month Ending July 31 14 Insurance Expense 15 Salaries Expense 16 Interest Expense 17 Utilities Expense 18 Total Operating Expenses 19 20 Net Income 21 22 23 24 25 26 27 28 29 Statement of Retained Earnings For the Month Ending July 31 Retained Earnings, July 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, July 31 Assets: Cash Accounts Receivable Inventory Prepaid Rent Prepaid Insurance Total Assets Balance Sheet July 31 Liabilities and Stockholders' Equity Liabilities: Accounts Payable Notes Payable Salaries Payable Intrerest Payable Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 1 2 3 4 5 6 7 6 9 0 1 2 3 4 5 6 7 8 9 20 21 22 23 24 25 26 27 28 29 30 31 32 83 34 B5 36 37 38 Requirement #8: Prepare the closing entries at July 31 in the General Journal below. An: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the T-Accounts on the General Ledger (Step 2) worksheet and compute ending balances. Just add to the adjusted balances already listed. Bate Account Number Hom Chart of Accounts General Journal Account Title from Chart of Accounts tab Debit 0 Credit 0 Close both rev ane expenses retained earn 1 2 3 Account 4 Number 5 6 7 8 9 10 11 12 13 14 15 Requirement #10: Prepare a post-closing trial balance as of July 31 in the space below. 16 17 18 19 20 Peter's Auto Supply Corporation Post-Closing Trial Balance July 31 Account Title Balance Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts