Question: I need help making this model on excel If you have built the model correctly, you will have a WACC of 8.2% given the following

I need help making this model on excel

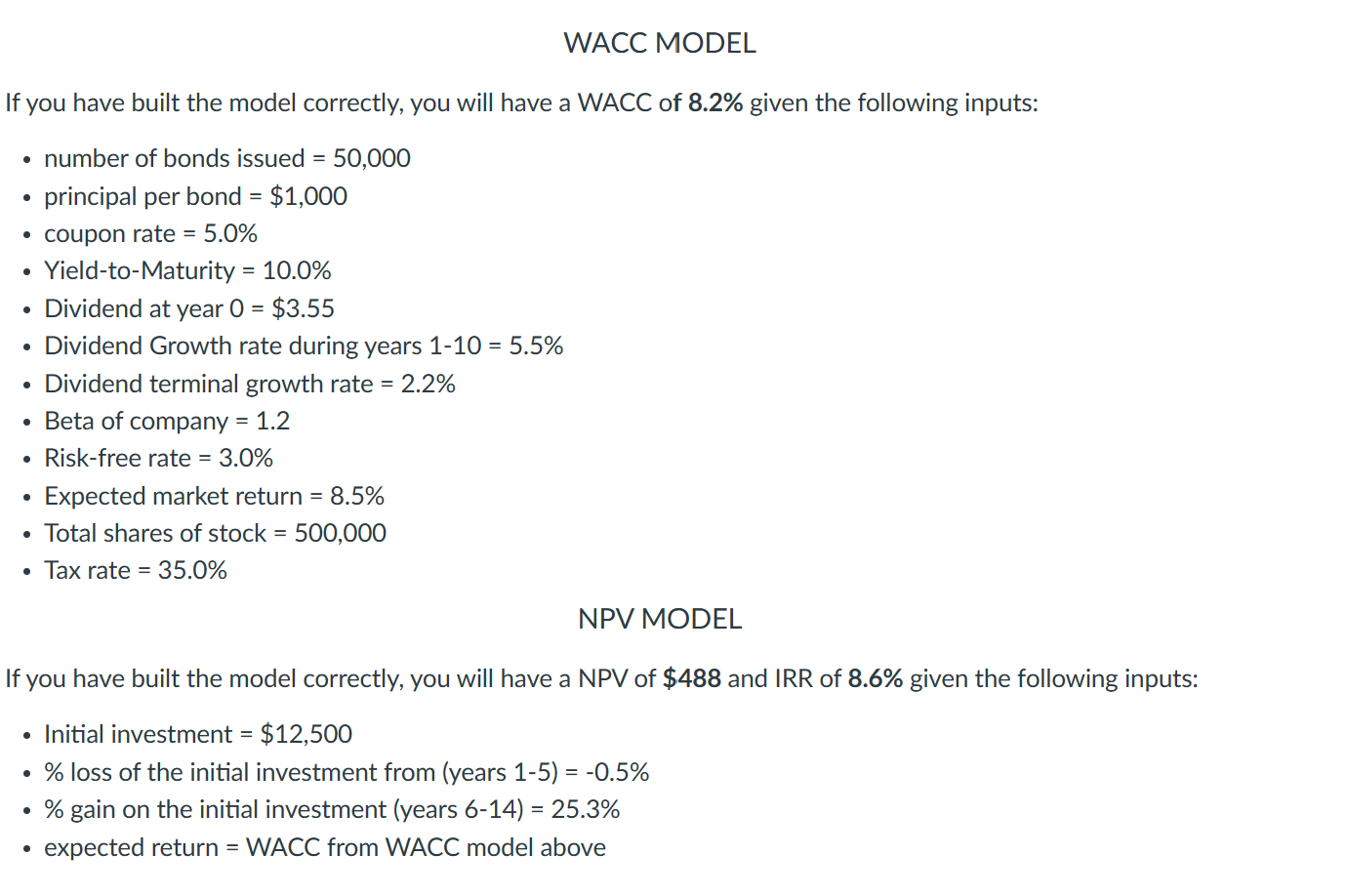

If you have built the model correctly, you will have a WACC of 8.2% given the following inputs: - number of bonds issued =50,000 - principal per bond =$1,000 - coupon rate =5.0% - Yield-to-Maturity =10.0% - Dividend at year 0=$3.55 - Dividend Growth rate during years 110=5.5% - Dividend terminal growth rate =2.2% - Beta of company =1.2 - Risk-free rate =3.0% - Expected market return =8.5% - Total shares of stock =500,000 - Tax rate =35.0% NPV MODEL If you have built the model correctly, you will have a NPV of $488 and IRR of 8.6% given the following inputs: - Initial investment =$12,500 - \% loss of the initial investment from (years 1-5) =0.5% - \% gain on the initial investment (years 6-14) =25.3% - expected return = WACC from WACC model above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts