Question: I need help on 1. and 2., anything will be helpful. Round your answers to two decimal places 1. You are given: The current stock

I need help on 1. and 2., anything will be helpful.

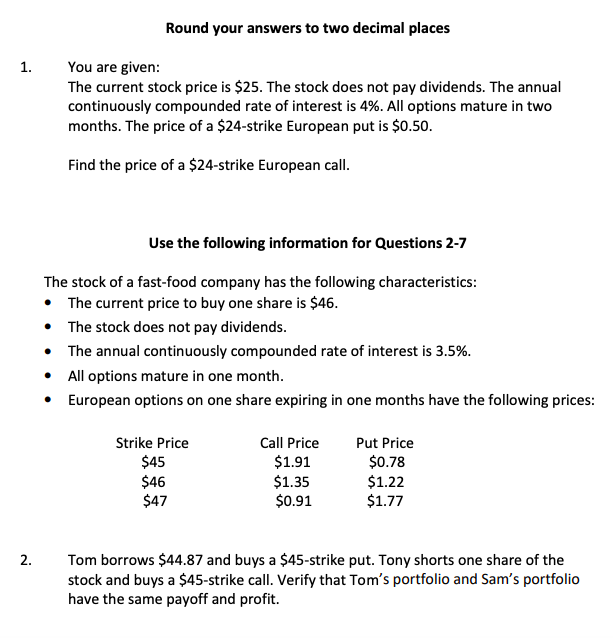

Round your answers to two decimal places 1. You are given: The current stock price is $25. The stock does not pay dividends. The annual continuously compounded rate of interest is 4%. All options mature in two months. The price of a $24-strike European put is $0.50. Find the price of a $24-strike European call. Use the following information for Questions 2-7 The stock of a fast-food company has the following characteristics: The current price to buy one share is $46. The stock does not pay dividends. The annual continuously compounded rate of interest is 3.5%. All options mature in one month. European options on one share expiring in one months have the following prices: Strike Price $45 $46 $47 Call Price $1.91 $1.35 $0.91 Put Price $0.78 $1.22 $1.77 2. Tom borrows $44.87 and buys a $45-strike put. Tony shorts one share of the stock and buys a $45-strike call. Verify that Tom's portfolio and Sam's portfolio have the same payoff and profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts