Question: i need help on 17 i dont know if its 67.14 or 73 Question 17 5 pts Cobia Industries is considering changes in its working

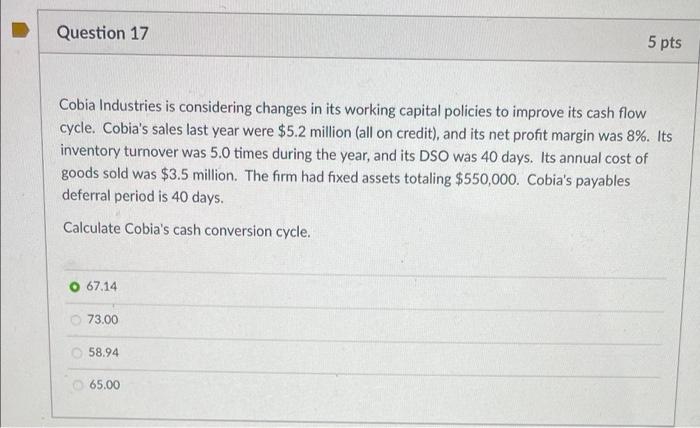

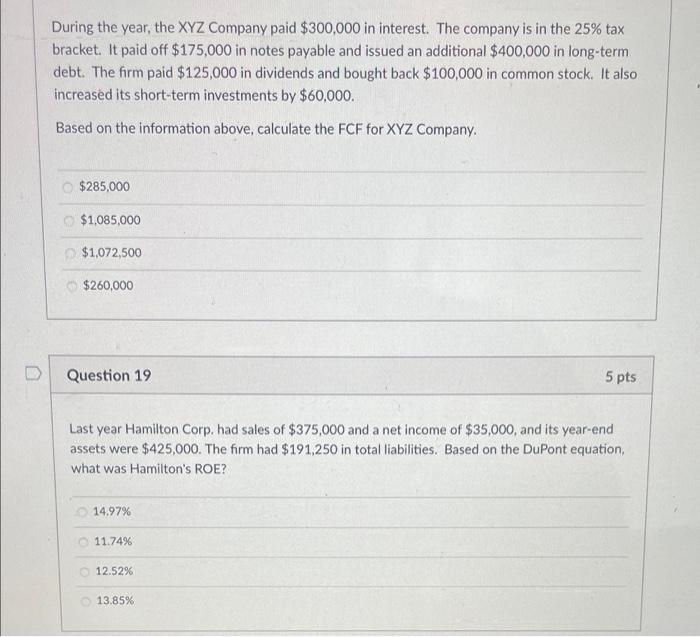

Question 17 5 pts Cobia Industries is considering changes in its working capital policies to improve its cash flow cycle. Cobia's sales last year were $5.2 million (all on credit), and its net profit margin was 8%. Its inventory turnover was 5.0 times during the year, and its DSO was 40 days. Its annual cost of goods sold was $3.5 million. The firm had fixed assets totaling $550,000. Cobia's payables deferral period is 40 days. Calculate Cobia's cash conversion cycle. 67.14 73.00 58.94 65.00 During the year, the XYZ Company paid $300,000 in interest. The company is in the 25% tax bracket. It paid off $175,000 in notes payable and issued an additional $400,000 in long-term debt. The firm paid $125,000 in dividends and bought back $100,000 in common stock. It also increased its short-term investments by $60,000 Based on the information above, calculate the FCF for XYZ Company. $285,000 $1,085,000 $1,072,500 $260,000 Question 19 5 pts Last year Hamilton Corp. had sales of $375,000 and a net income of $35,000, and its year-end assets were $425,000. The firm had $191,250 in total liabilities. Based on the DuPont equation, what was Hamilton's ROE? 14.97% 11.74% 12.52% 13.85%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts