Question: I need help on 2b &c and 3 Question Help P4-39 (similar to) The Wamth Radiator Company uses a normal-costing system with a single manufacturing

I need help on 2b &c and 3

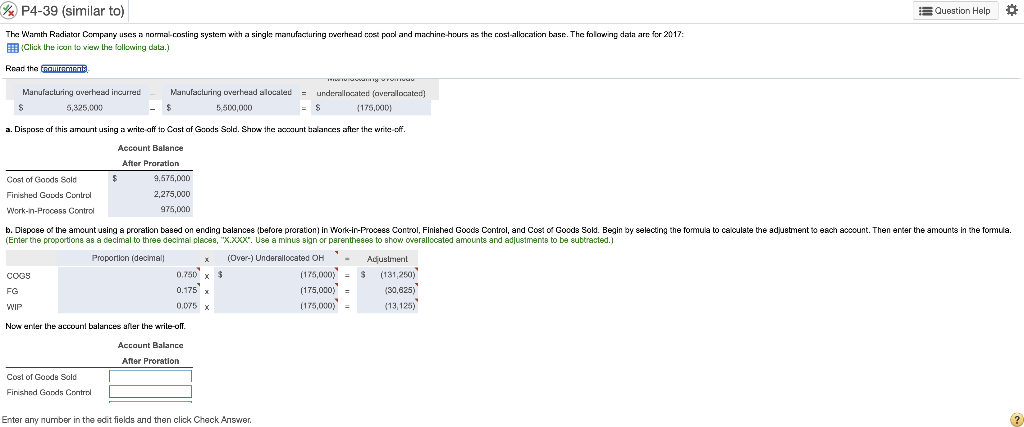

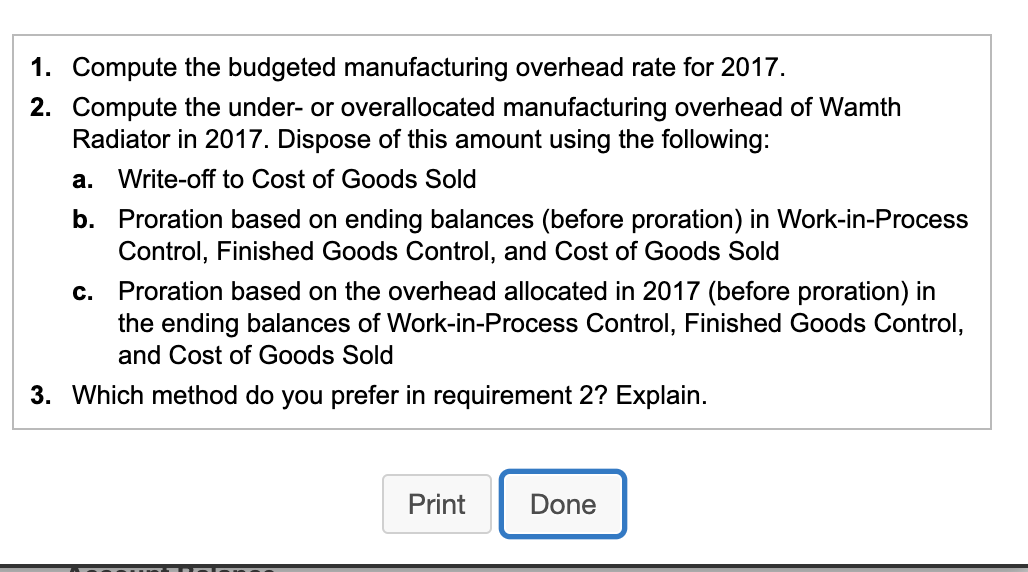

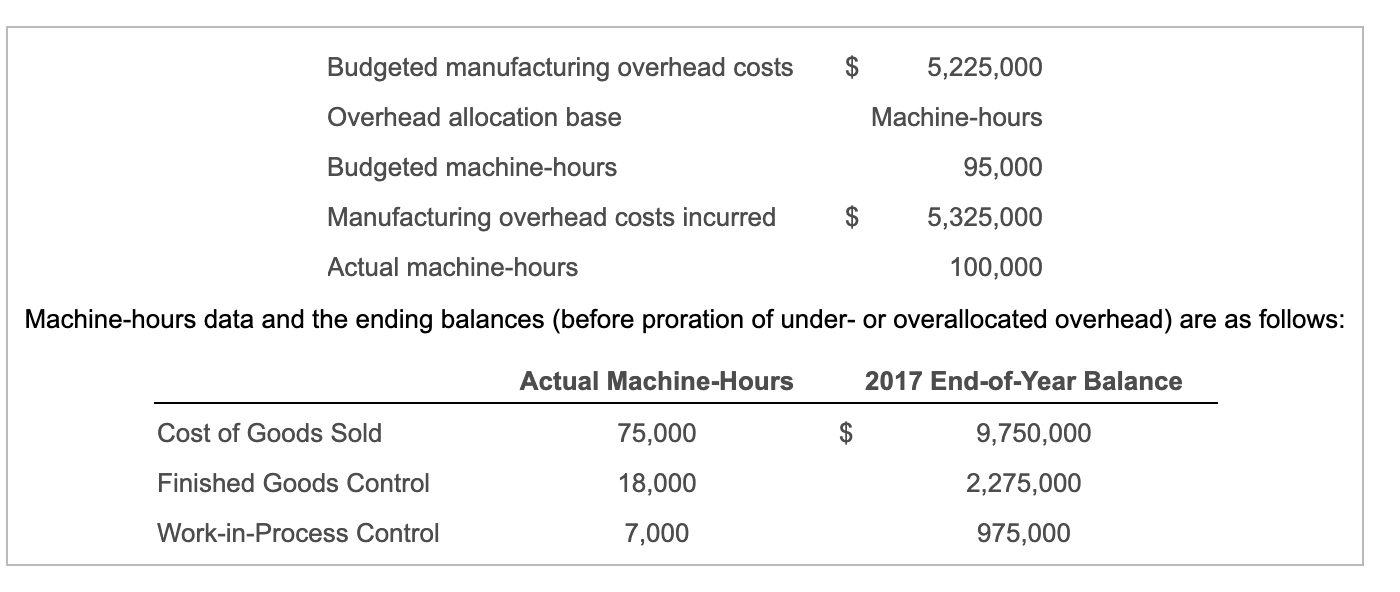

Question Help P4-39 (similar to) The Wamth Radiator Company uses a normal-costing system with a single manufacturing creados por and machine hours as the cost-allocation base. The folowing data are for 2017: Click the icon to view the following dala.) Read the AGB Manufacturing overhead incurred S S 5.325,000 TO TUTTI Manufacturing overhead alocale = underullocated averallocated) $ $ 5,500,000 = $ (175,000) a. Dispose of this amount using a write aff to Cast af Goods Sold. Shin the count balances after the write-off Account Balance 975,000 After Proration $ Cost of Goods Sold 9.575,000 Finished Goods Control 2,275,000 Work-In-Process Control b. Dispose of the amount using a proration based on ending balances before proration in Work-ir-Process Control, Finished Goods Control, and Cost of Goods Sold. Begin by selecting the fomula to calculate the adjustment to each account. Then enter the amounts in the formula (Enter the proportions as a decimal to three decimal place, "X.XXX". Use a minus sign or parentheses to show overallocated amounts and adjustments to be subtracted. Proportion (decimal (Over) Unders located OH Adjustment COGS 0.750 x (175,000) = $ FG (175,000) WIP 0.075 (175,000) (13,125) $ (131,250 (30.625 0.175 x Non enter the account balances afar the wrile-oll. Account Balance After Proration Cost of Goods Sold Finished Goods Control Enter any number in the edit fields and then click Check Answer ? 1. Compute the budgeted manufacturing overhead rate for 2017. 2. Compute the under- or overallocated manufacturing overhead of Wamth Radiator in 2017. Dispose of this amount using the following: a. Write-off to Cost of Goods Sold b. Proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold c. Proration based on the overhead allocated in 2017 (before proration) in the ending balances of Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold 3. Which method do you prefer in requirement 2? Explain. Print Done 5,225,000 Machine-hours Budgeted manufacturing overhead costs Overhead allocation base Budgeted machine-hours Manufacturing overhead costs incurred Actual machine-hours 95,000 5,325,000 100,000 Machine-hours data and the ending balances (before proration of under- or overallocated overhead) are as follows: Actual Machine-Hours 2017 End-of-Year Balance Cost of Goods Sold 75,000 9,750,000 Finished Goods Control 18,000 2,275,000 Work-in-Process Control 7,000 975,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts