Question: I need help on both questions. Thank you! Additional risk faced by investors due to uncertainty about values of expected returns causes them to choose

I need help on both questions. Thank you!

I need help on both questions. Thank you!

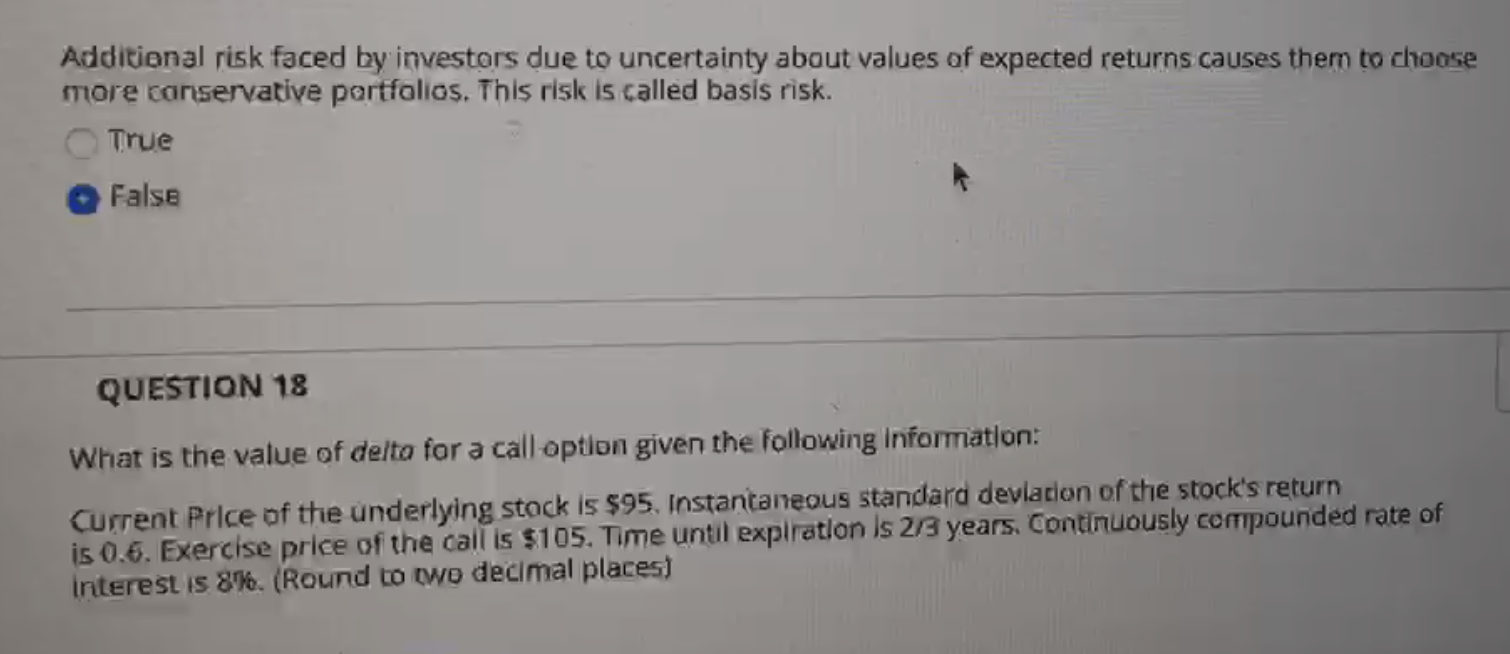

Additional risk faced by investors due to uncertainty about values of expected returns causes them to choose more conservative portfolios. This risk is called basis risk. True False QUESTION 18 What is the value of delta for a call option given the following information: Current Price of the underlying stock is $95. Instantaneous standard deviation of the stock's return is 0.6. Exercise price of the call is $105. Time until expletion is 2/3 years. Continuously compounded rate of interest is 8%. (Round to wo decimal places)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock