Question: I need help on getting the correct answer for what I got wrong in the red boxes and finding the correct label in the blue

I need help on getting the correct answer for what I got wrong in the red boxes and finding the correct label in the blue box.

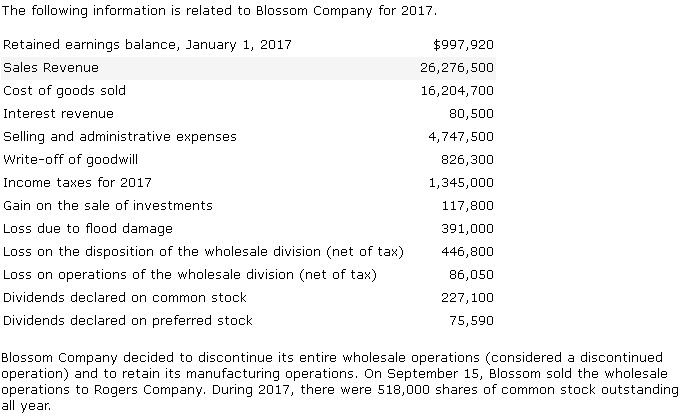

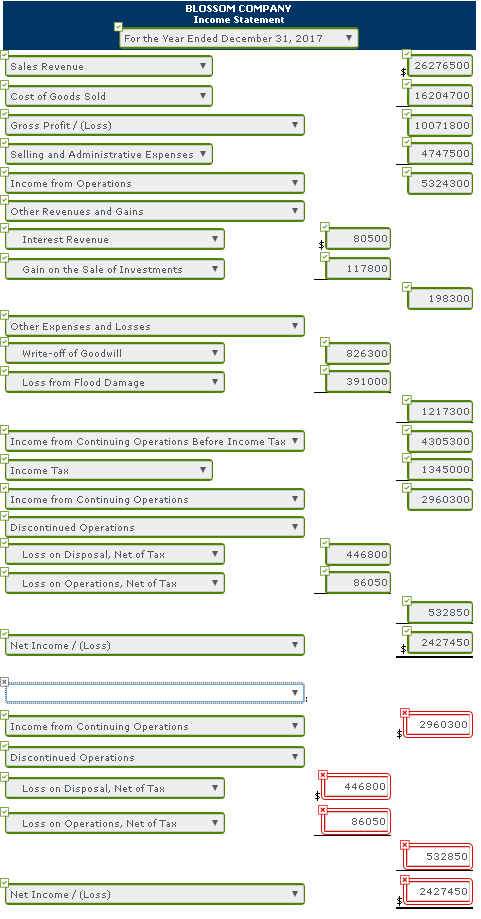

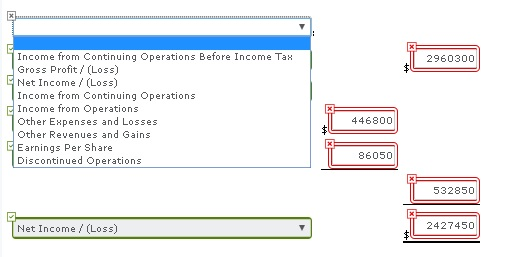

The following information is related to Blossom Company for 2017. Retained earnings balance, January 1, 2017 $997,920 Sales Revenue 26,276,500 Cost of goods sold 16,204,700 Interest revenue 80,500 Selling and administrative expenses 4,747,500 Write-off of goodwill 826,300 Income taxes for 2017 1,345,000 Gain on the sale of investments 117,800 Loss due to flood damaqe 391,000 Loss on the disposition of the wholesale division (net of tax) 446,800 operations of the wholesale division (net of tax) Loss on 86,050 Dividends declared on common stock 227,100 Dividends declared on preferred stock 75,590 Blossom Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Blossom sold the wholesale operations to Rogers Company. During 2017, there were 518,0o0 shares of common stock outstanding all year BLOSSOM COMPANY Income Statement For the Year Ended December 31, 2017 Sales Revenue 26276500 Cost of Goods Sold 16204700 Gross Profit /(Loss) 10071800 Selling and Administrative Expenses 4747500 Income from Operations 5324300 Other Revenues and Gains 80500 Interest Revenue 117800 Gain on the Sale of Investments 198300 Other Expenses and Losses Write-off of Goodwill 826300 Loss from Flood Damage 391000 1217300 Income from Continuing Operations Before Income Tax 4305300 Income Tax 1345000 Income from Continuing Operations 2960300 Discontinued Operations Loss on Disposal, Net of Tax 446800 Loss on Operations, Net of Tax 86050 532850 2427450 Net Income (Loss) 2960300 Income from Continuing Operations Discontinued Operations 446800 Loss on Disposal, Net of Tax 86050 Loss on Operations, Net of Tax 532850 2427450 Net Income/ (Loss) Income from Continuing Operations Before Income Tax Gross Profit /(Loss) Net Income/(Loss) Income from Continuing Operations 2960300 Income from Operations Other Expenses and Losses 446800 Other Revenues and Gains Earnings Per Share Discontinued Operations 86050 532850 2427450 Net Income /(Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts