Question: I need help on my study guide please. What are the answers to these? Given the following information, what is JEM Inc.'s weighted average cost

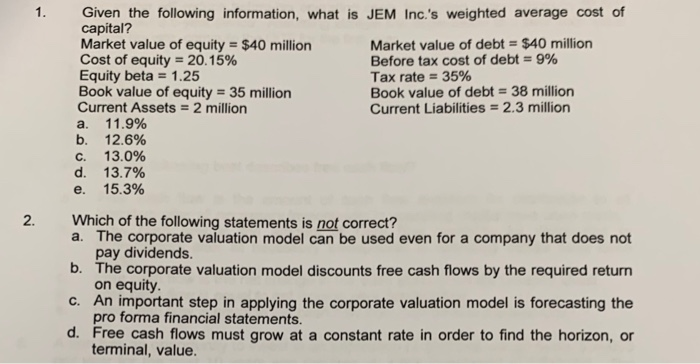

Given the following information, what is JEM Inc.'s weighted average cost of capital? Market value of equity = $40 million Cost of equity = 20.15% Equity beta = 1.25 Book value of equity = 35 million Current Assets = 2 million a. 11.9% b. 12.6% 13.0% d. 13.7% e. 15.3% 1. Market value of debt = $40 million Before tax cost of debt = 9% Tax rate = 35% Book value of debt = 38 million Current Liabilities = 2.3 million C. Which of the following statements is not correct? a. The corporate valuation model can be used even for a company that does not pay dividends. b. The corporate valuation model discounts free cash flows by the required return on equity. c. An important step in applying the corporate valuation model is forecasting the pro forma financial statements. d. Free cash flows must grow at a constant rate in order to find the horizon, or terminal, value. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts