Question: I need help on number 2 (general ledger) & 3 (unadjusted trial balance) Thank you Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment

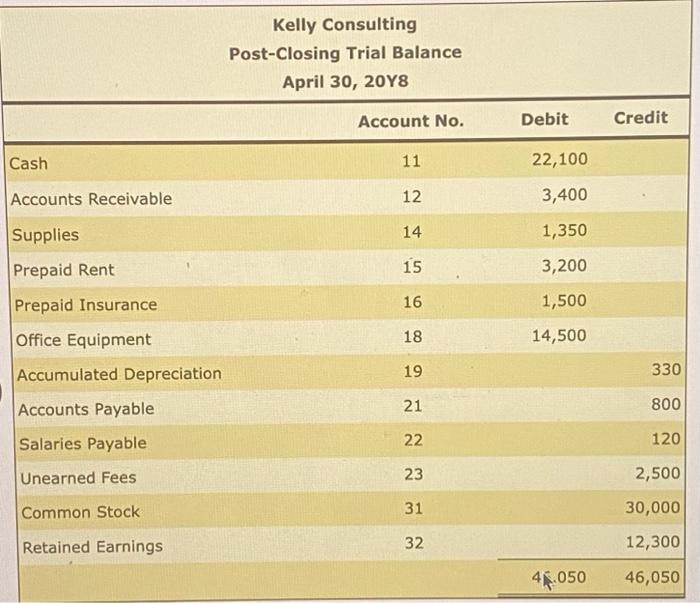

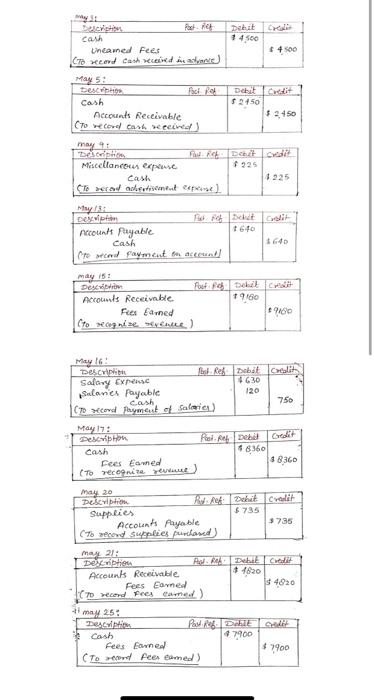

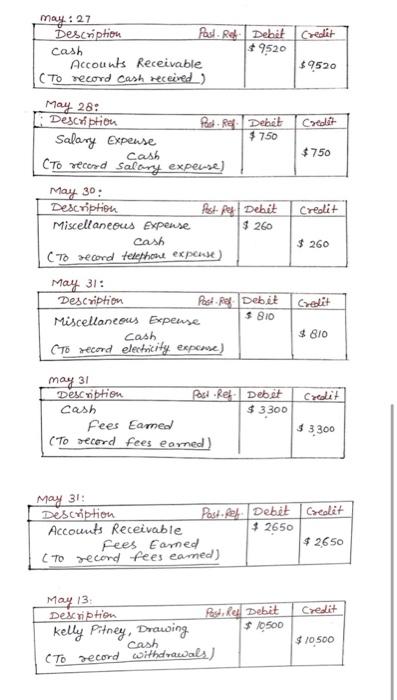

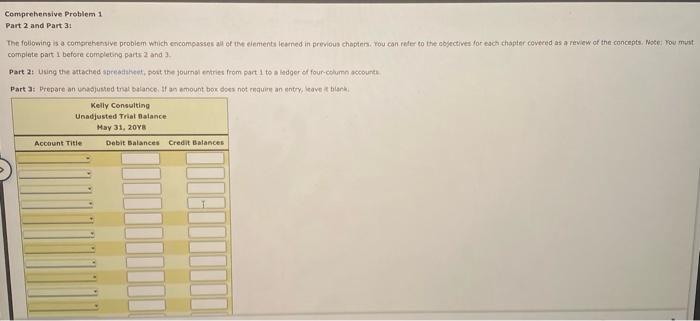

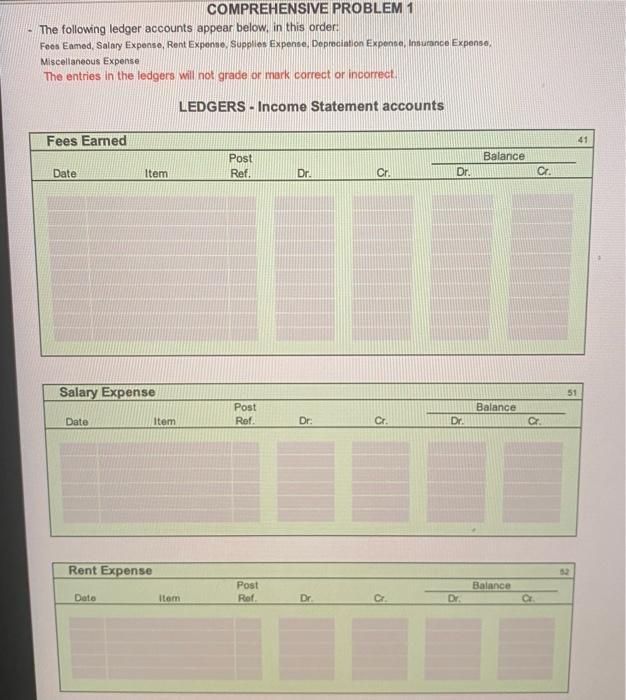

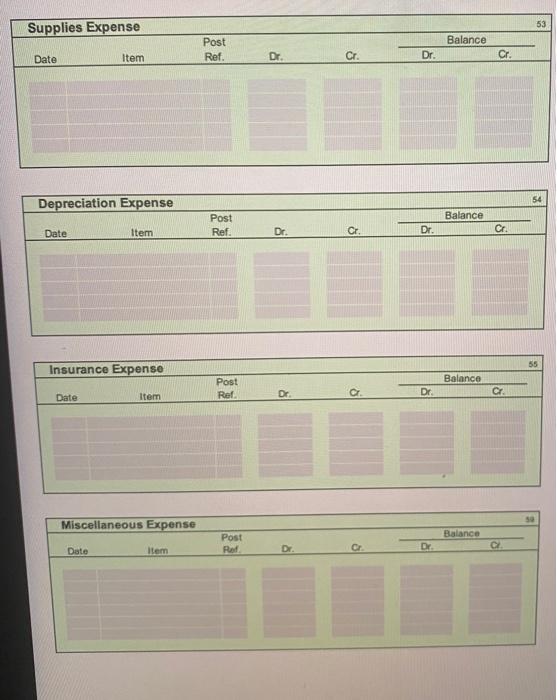

Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees Common Stock Retained Earnings Kelly Consulting Post-Closing Trial Balance April 30, 20Y8 Account No. 11 12 14 15 16. 18 19 21 22 23 31 32 Debit 22,100 3,400 1,350 3,200 1,500 14,500 44.050 Credit 330 800 120 2,500 30,000 12,300 46,050 may st cash Uneamed Fees (To record cash received in advance) May 5: Description Cash Accounts Receivable (To record cash received) may 9: Description Miscellaneous expense Cash To recent advertisement expense) May 16: May 13: Description Accounts Payable Cash (To record payment on account] Description Salary Expense Salaries Payable may 15: Description Accounts Receivable Fees Earned (to recognize sevence) May 17: Description cash Post. Rea May 20 Description Pack Pok Supplies cash, (TO record Payment of salaries) may 21: Description Accounts Receivable Fees Earned (To recognize revenue) 31 may 25: Description Cash Fast Ref Debit credit 225 Accounts Payable (To record supplies purchased) Debit $4,500 Feb. Fieb Debit Galit 4640 Debit Credit $2450 Fees Earned (70 record fees camed) $ 4500 Foot Feb Debit calit 19160 Pist. Ref Debit $2,450 4.225 fost Ref Debit Crealit 4630 120 Fees Earned (To record fees camed) 1640 46360 $9160 Pud. Ref: Debit Credit $735 750 48,360 Pol. Red Debit Credit 4 4820 3735 $4820 Post Ref. Debit Sedit 47900 $7,900 may : 27 Description cash Accounts Receivable (To record cash received) May 28: Description May 30: Description Miscellaneous Expense Salary Expense Cash CTO record salary expense) May 31: Past Ref Debit Credit $9520 Cash CTO record telephone expense) may 31 Post Reg Debit $750 Description Miscellaneous Expense Description Cash Cash (To record electricity exponse) May 31: Description Accounts Receivable Past per Debit $260 Post-Ref Debit $ 810 May 13: Description kelly Pitney, Drawing cash (To record Fees Eamed (To record fees earned) Post Ref Debit $ 3300 Post Pet Debit $ 2650 Fees Eamed (TO record fees eamed) Post Re Debit $ 10500 withdrawals) $9520 Credit $750 Credit $ 260 Credit $ 810 Credit $3,300 Crealit $ 2,650 Credit $ 10,500 Comprehensive Problem 1 Part 2 and Part 3: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete part 1 before completing parts 2 and 3. Part 2: Using the attached spreadsheet, post the journal entries from part 1 to a ledger of four-column accounts Part 3: Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank. Kelly Consulting Unadjusted Trial Balance May 31, 2018 Debit Balances Credit Balances Account Title . The following ledger accounts appear below, in this order: Fees Eamed, Salary Expense, Rent Expense, Supplies Expense, Depreciation Expense, Insurance Expense, Miscellaneous Expense The entries in the ledgers will not grade or mark correct or incorrect. Fees Earned Date Salary Expense Date Item Rent Expense Date Item COMPREHENSIVE PROBLEM 1 LEDGERS-Income Statement accounts Item Post Ref. Post Ref. Post Ref. Dr. Dr: Dr. Cr. Cr. Dr. Dr. Dr. Balance Balance Balance Cr. Cr. a. 41 51 52 Supplies Expense Date Depreciation Expense Date Item Date Insurance Expense Item Date Item Miscellaneous Expense Item Post Ref. Post Ref. Post Ref. Post Ref. Dr. Dr. Dr. Dr. Cr. Cr. Cr. Dr. Dr. Dr. Dr. Balance Balance Balance Balance Cr. Cr. Cr. C 53 54 55 59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts