Question: i need help on problem 6 and 7 4 During the month of September, Lake Corporation's employees earned wages of $60,000. Withholdings related 5 to

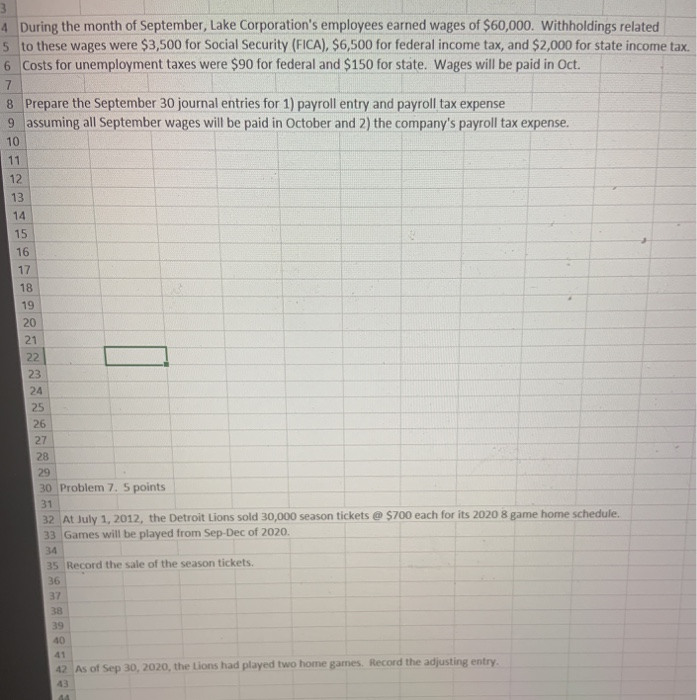

4 During the month of September, Lake Corporation's employees earned wages of $60,000. Withholdings related 5 to these wages were $3,500 for Social Security (FICA), $6,500 for federal income tax, and $2,000 for state income tax 6 Costs for unemployment taxes were $90 for federal and $150 for state. Wages will be paid in Oct. 7 8 Prepare the September 30 journal entries for 1) payroll entry and payroll tax expense 9 assuming all September wages will be paid in October and 2) the company's payroll tax expense 30 Problem 7. 5 points 31 32 At July 1, 2012, the Detroit Lions sold 30,000 season tickets @ $700 each for its 2020 8 game home schedule. 33 Games will be played from Sep-Dec of 2020. 35 Record the sale of the season tickets. 36 37 38 42 As of Sep 30, 2020, the Lions had played two home games. Record the adjusting entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts