Question: I need help on questions 2, 3, and 8 only. I need to understand what I did wrong please. AYAYAI COMPANY Comparative Balance Sheet December

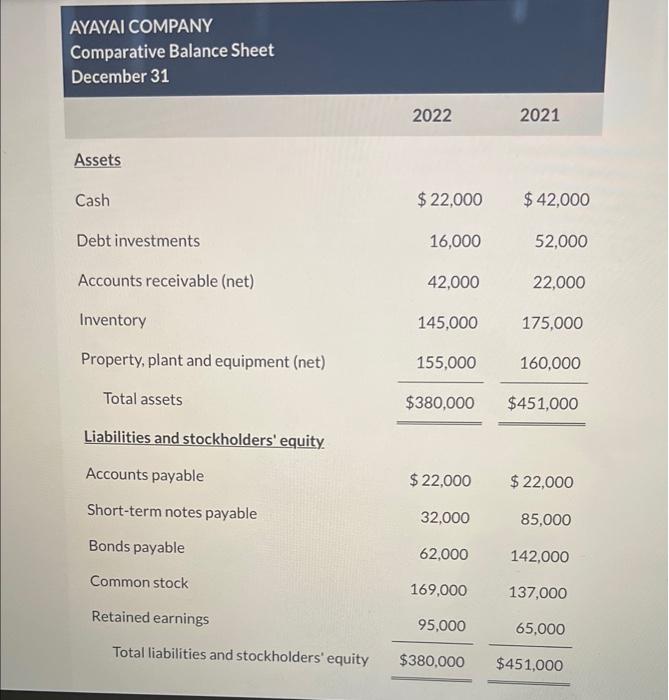

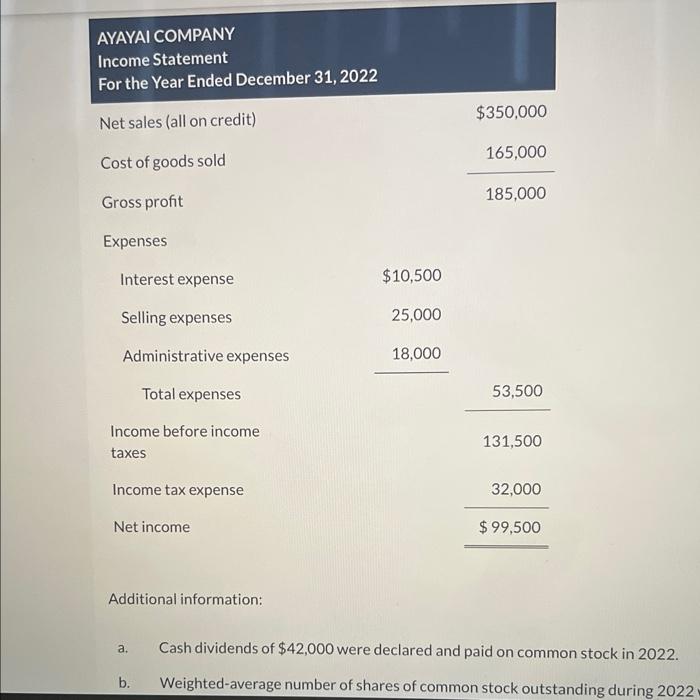

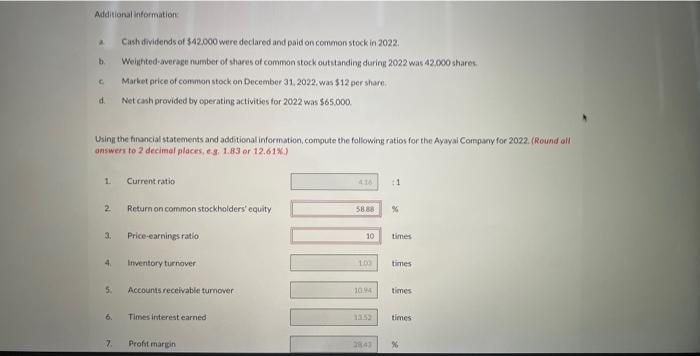

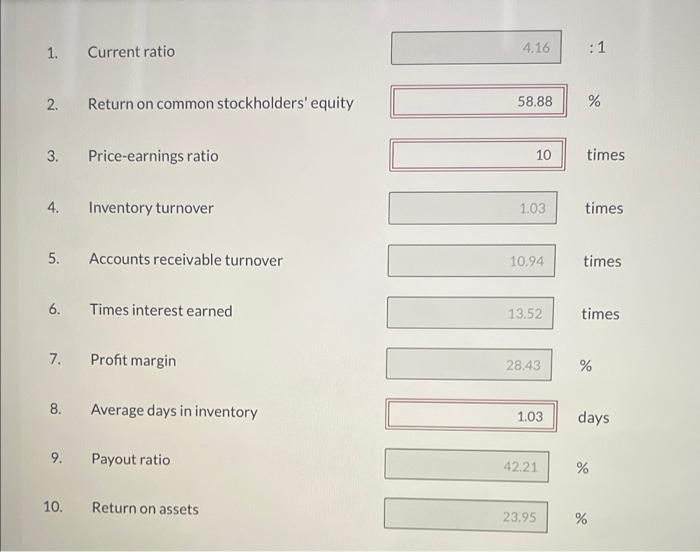

AYAYAI COMPANY Comparative Balance Sheet December 31 Assets Cash Debt investments Accounts receivable (net) Inventory Property, plant and equipment (net) Total assets Liabilities and stockholders' equity. Accounts payable Short-term notes payable 2022 $ 22,000 16,000 42,000 145,000 155,000 $380,000 $ 22,000 32,000 Bonds payable 62,000 Common stock 169,000 Retained earnings 95,000 Total liabilities and stockholders' equity $380,000 2021 $ 42,000 52,000 22,000 175,000 160,000 $451,000 $ 22,000 85,000 142,000 137,000 65,000 $451,000 AYAYAI COMPANY Income Statement For the Year Ended December 31, 2022 Net sales (all on credit) Cost of goods sold Gross profit Expenses Interest expense Selling expenses Administrative expenses Total expenses Income before income taxes Income tax expense Net income Additional information: $10,500 25,000 a. 18,000 $350,000 165,000 185,000 53,500 131,500 32,000 $ 99,500 Cash dividends of $42,000 were declared and paid on common stock in 2022. b. Weighted-average number of shares of common stock outstanding during 2022 Additional information: A b. C d Using the financial statements and additional information, compute the following ratios for the Ayayai Company for 2022. (Round all answers to 2 decimal places, e.g. 1.83 or 12.61%) 1 2 3. 4. 5. 6. Cash dividends of $42.000 were declared and paid on common stock in 2022. Weighted average number of shares of common stock outstanding during 2022 was 42,000 shares Market price of common stock on December 31, 2022, was $12 per share. Net cash provided by operating activities for 2022 was $65.000. 7. Current ratio Return on common stockholders' equity Price-earnings ratio Inventory turnover Accounts receivable turnover Times interest earned Profit margin 416 TUDO :1 58.88 % 10 times 1.00 times 10.94 times times 2843 % 1. Current ratio 2. Return on common stockholders' equity 3. Price-earnings ratio 4. Inventory turnover 5. Accounts receivable turnover 6. Times interest earned 7. Profit margin 8. Average days in inventory 9. Payout ratio 10. Return on assets 4.16 58.88 10 1.03 10.94 28.43 1.03 42.21 23.95 :1 % 13.52 times times times times % days % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts