Question: I need help on Required 2 and 3 The adjusted trial balance of Karise Repairs on December 31 follows. KARISE REPAIRS Adjusted Trial Balance December

I need help on Required 2 and 3

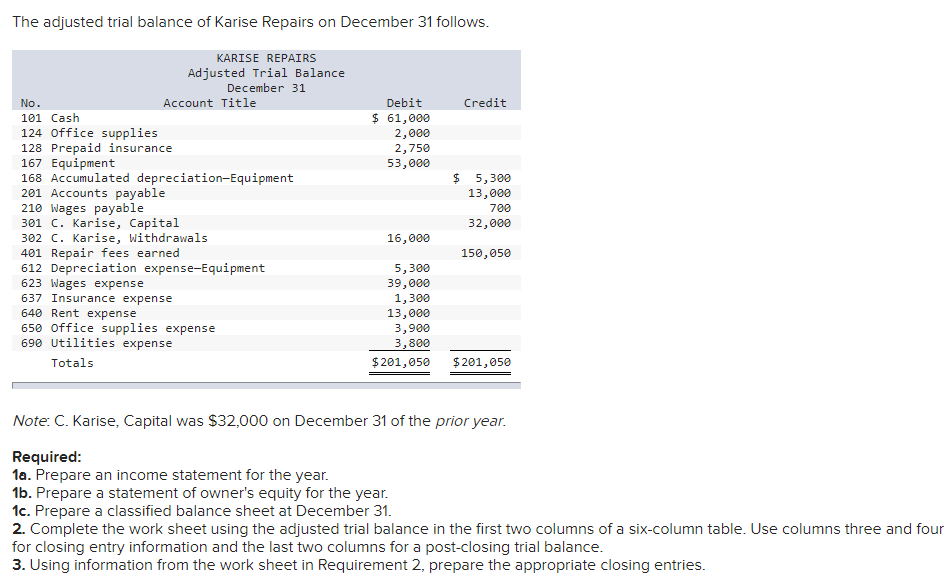

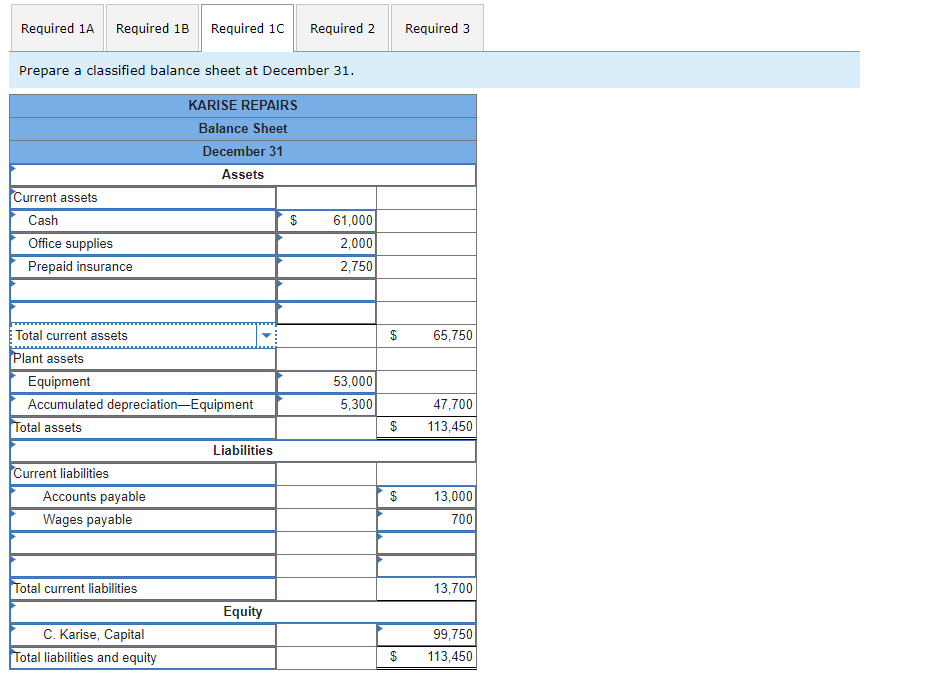

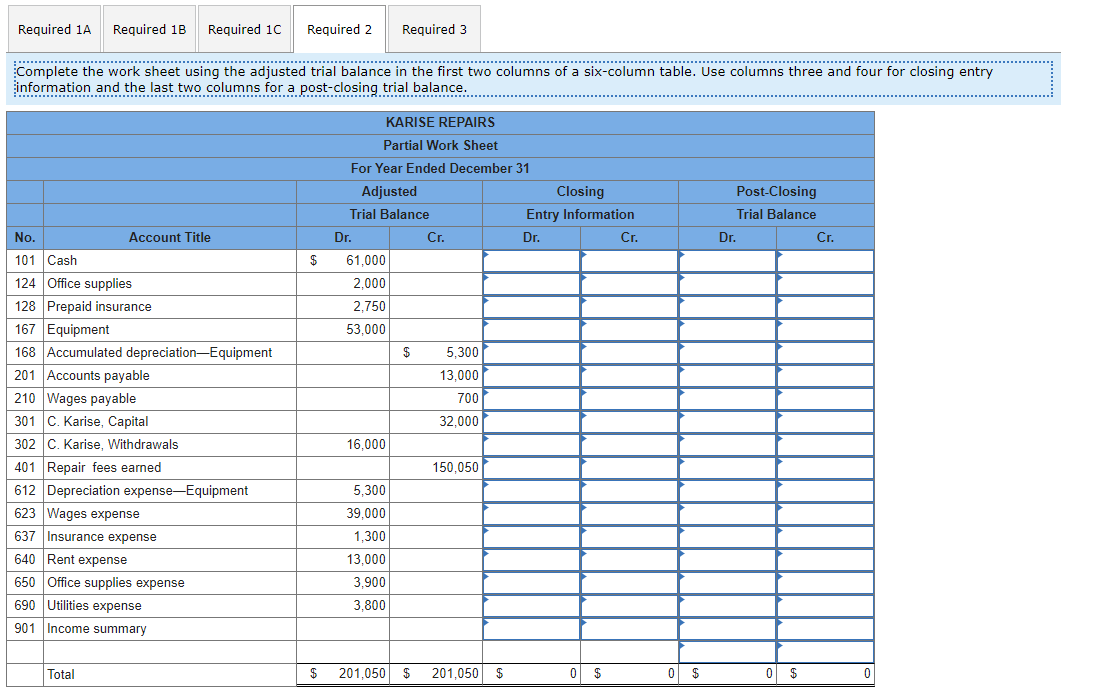

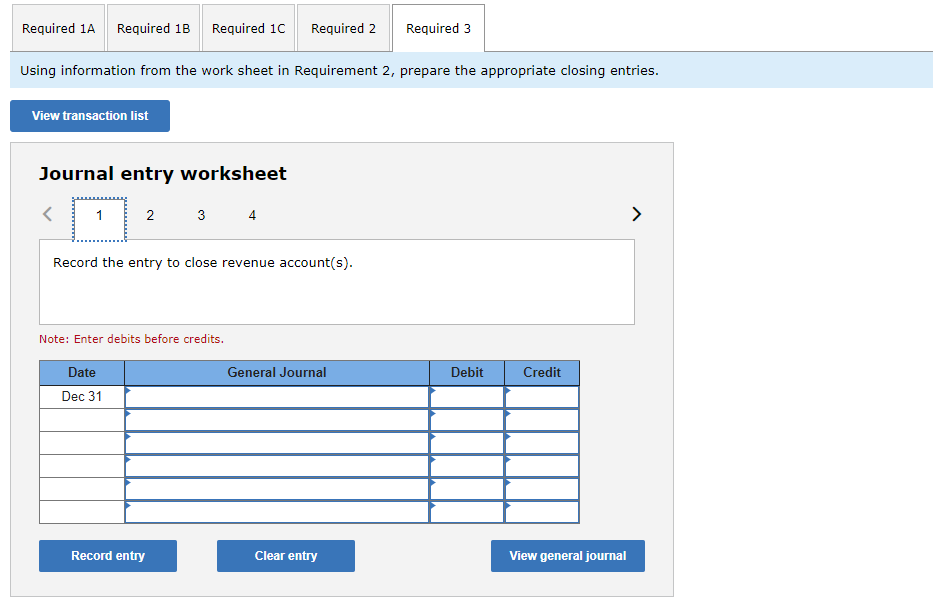

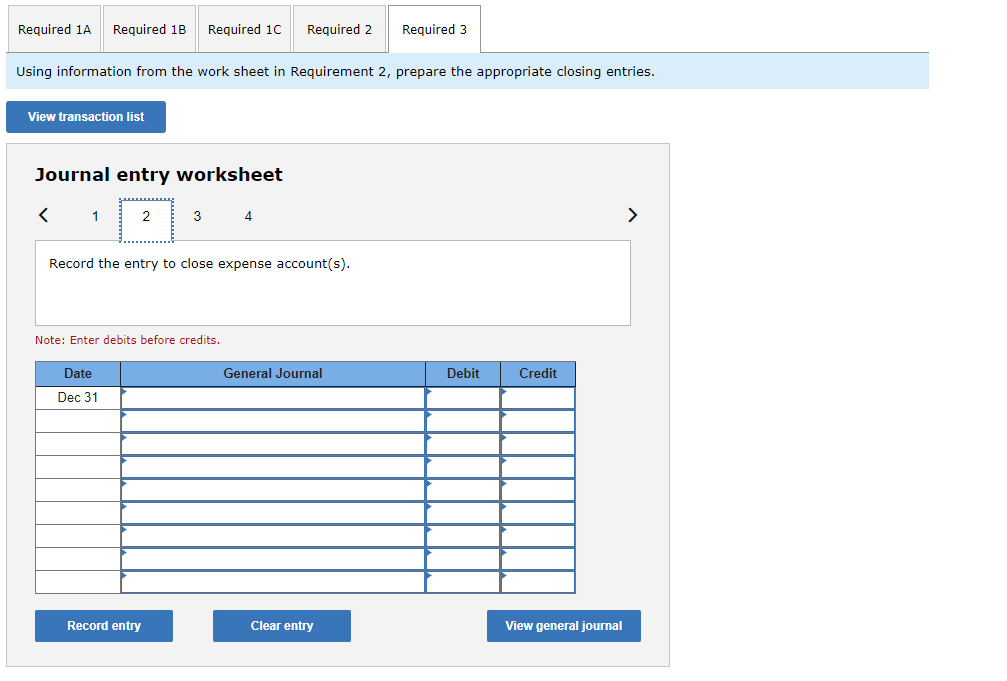

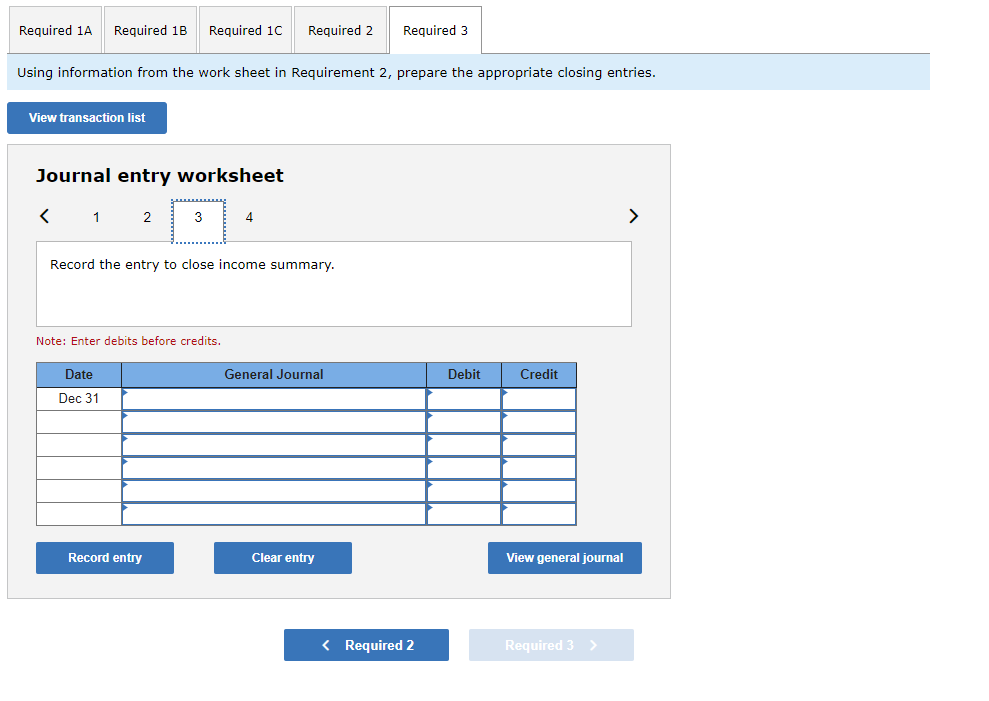

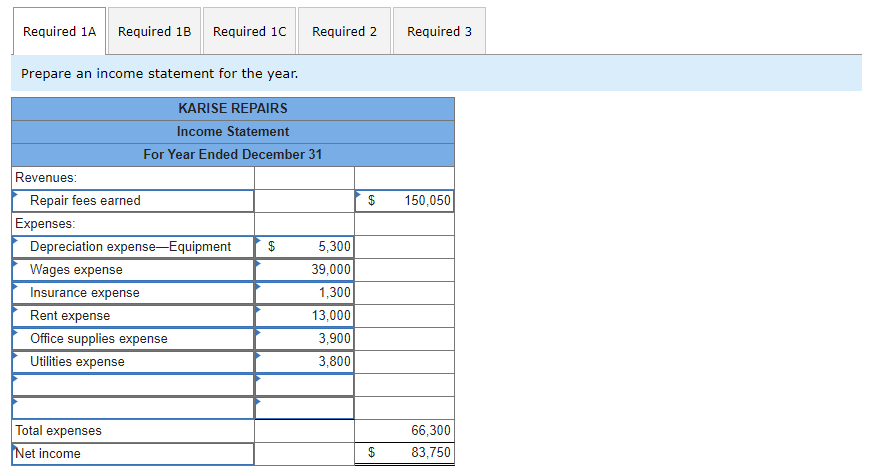

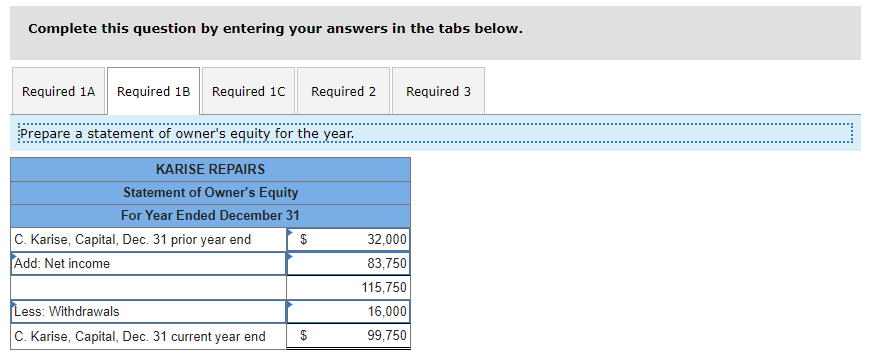

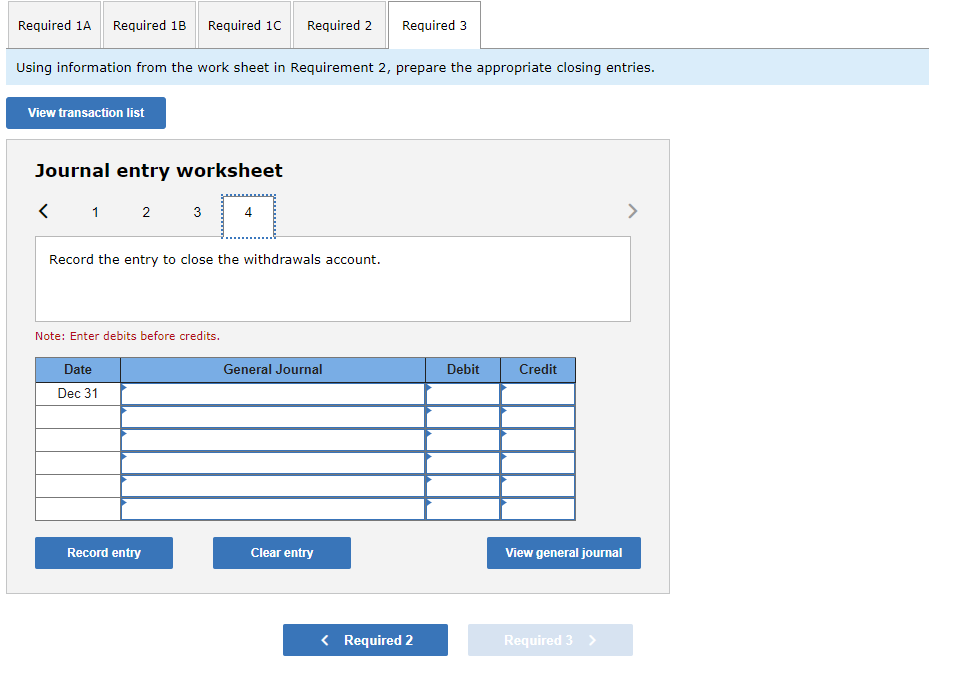

The adjusted trial balance of Karise Repairs on December 31 follows. KARISE REPAIRS Adjusted Trial Balance December 31 No. Account Title Debit Credit $ 61,000 2,000 2,750 53,000 101 Cash 124 Office supplies 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation-Equipment 201 Accounts payable 210 Wages payable 301 C. Karise, Capital 302 C. Karise, Withdrawals $ 5,300 13,000 700 32,000 16,000 401 Repair fees earned 612 Depreciation expense-Equipment 623 Wages expense 637 Insurance expense 640 Rent expense 650 office supplies expense 690 Utilities expense 150,050 5,300 39,000 1,300 13,000 3,900 3,800 Totals $201,050 $201,050 Note: C. Karise, Capital was $32,000 on December 31 of the prior year. Required: 1a. Prepare an income statement for the year. 1b. Prepare a statement of owner's equity for the year. 1c. Prepare a classified balance sheet at December 31. 2. Complete the work sheet using the adjusted trial balance in the first two columns of a six-column table. Use columns three and four for closing entry information and the last two columns for a post-closing trial balance. 3. Using information from the work sheet in Requirement 2, prepare the appropriate closing entries.

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Karise Repairs Income Statement For the Year Ended December 31 Revenues Repair Fees Earned 150050 Ex... View full answer

Get step-by-step solutions from verified subject matter experts