Question: I need help on the business 1a accounting continuing problem all the way to instructions in Accounts Payable was overlooked when edby count was determined

I need help on the business 1a accounting continuing problem all the way to instructions

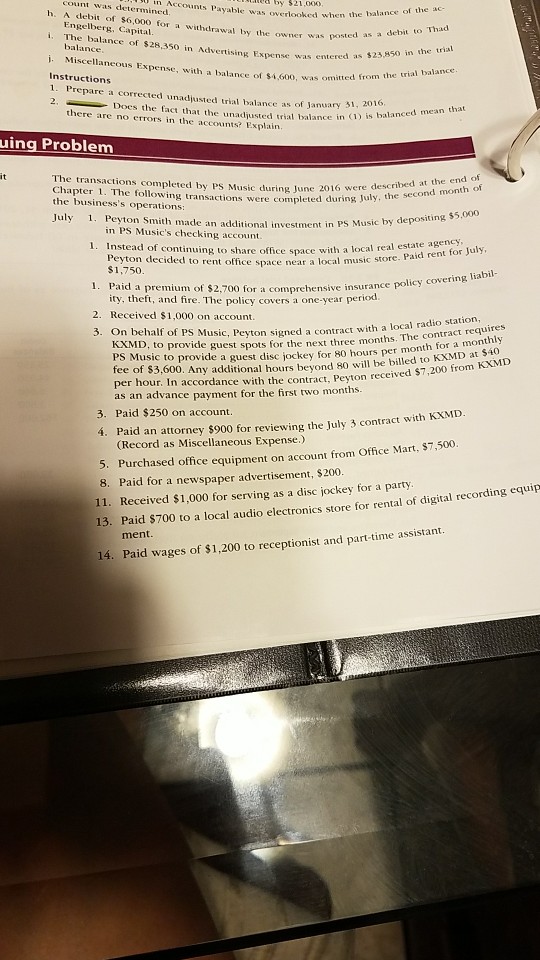

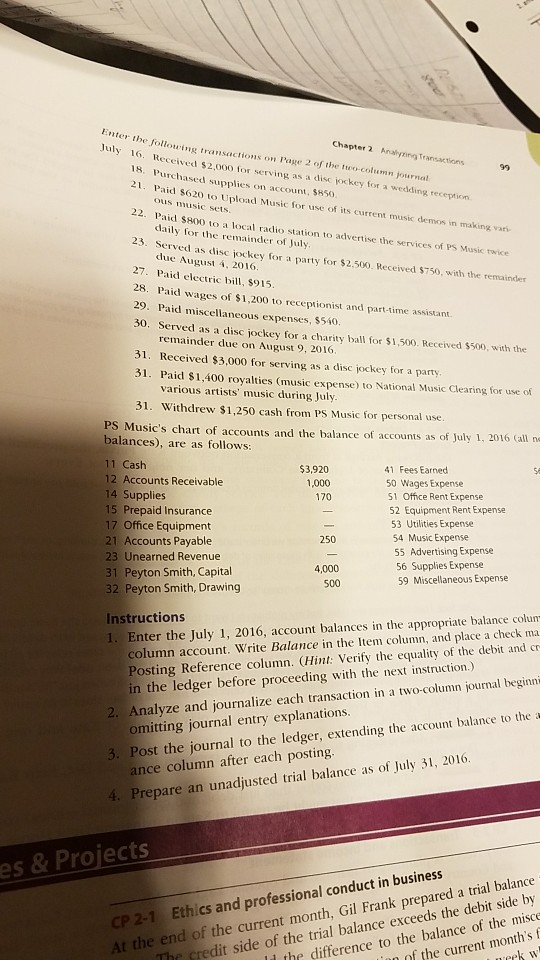

in Accounts Payable was overlooked when edby count was determined 21,000 h. A debit of s6,000 for a withdrawal by the owner was overlooked when the balance of the ac- Engelberg, Capital withdraw The balance of $28,350 in Advertising Expense was balance owner was posted as a debit to Thad trial $28,35 ertising Expense was entered as $23,850 in the i. Miscellaneous Expense, with a balance of $4,600, was o Instructions was omitted from the trial balance Prepare a corrected unadjusted trial balance as of January 31, 2Does the fact that the unadjusted trial balance iv there are no errors in the accounts? Explain n (D is balanced mean tha uing Problem The transactions completed by PS Music during June 2016 were Chapter 1. The following transaction the business's operations July 1. Peyton Sm ting .transactio ith made an additional investment in Ps Music by ine 2016 were described at the end of s were completed during July, the second month of ting $5,000 deposi in PS Music's checking account ng to share office space with a local real estate agency ded to rent office space near a local music store. Paid rent for July, 1. Instead of continui Peyton decided to rent office space near a local music store $1,750 policy covering liabil 1. Paid a premium of $2,700 for a comprehensive insurance 2. Received $1,000 on account 3. On behalf of PS Music, Peyton signed a contract with a ity, theft, and fire. The policy covers a one-year period c, Peyton signed a contract with a local radio station t spots for the next three months. The contract requires $40 PS Music to provide a fee of $3,600. Any additional hours beyond 80 will be billed to KXMD at per hour. In accordance with the contract, Peyton received $7,200 from as an advance payment for the first two months guest disc jockey for 80 hours per month for a monthly 3. Paid $250 on account. KXMD Paid an attorney $900 for reviewing the July 3 contract with (Record as Miscellaneous Expense.) 4. 5. Purchased office equipment on account from Office Mart, $7.500. 8. Paid for a newspaper advertisement, $200. 11. Received $1,000 for serving as a disc jockey for a party 13. Paid $700 to a local audio electronics store for rental of digital recording equip t from Office Mart, $7,500 ment 14. Paid wages of $1,200 to receptionist and part-time assistant. in Accounts Payable was overlooked when edby count was determined 21,000 h. A debit of s6,000 for a withdrawal by the owner was overlooked when the balance of the ac- Engelberg, Capital withdraw The balance of $28,350 in Advertising Expense was balance owner was posted as a debit to Thad trial $28,35 ertising Expense was entered as $23,850 in the i. Miscellaneous Expense, with a balance of $4,600, was o Instructions was omitted from the trial balance Prepare a corrected unadjusted trial balance as of January 31, 2Does the fact that the unadjusted trial balance iv there are no errors in the accounts? Explain n (D is balanced mean tha uing Problem The transactions completed by PS Music during June 2016 were Chapter 1. The following transaction the business's operations July 1. Peyton Sm ting .transactio ith made an additional investment in Ps Music by ine 2016 were described at the end of s were completed during July, the second month of ting $5,000 deposi in PS Music's checking account ng to share office space with a local real estate agency ded to rent office space near a local music store. Paid rent for July, 1. Instead of continui Peyton decided to rent office space near a local music store $1,750 policy covering liabil 1. Paid a premium of $2,700 for a comprehensive insurance 2. Received $1,000 on account 3. On behalf of PS Music, Peyton signed a contract with a ity, theft, and fire. The policy covers a one-year period c, Peyton signed a contract with a local radio station t spots for the next three months. The contract requires $40 PS Music to provide a fee of $3,600. Any additional hours beyond 80 will be billed to KXMD at per hour. In accordance with the contract, Peyton received $7,200 from as an advance payment for the first two months guest disc jockey for 80 hours per month for a monthly 3. Paid $250 on account. KXMD Paid an attorney $900 for reviewing the July 3 contract with (Record as Miscellaneous Expense.) 4. 5. Purchased office equipment on account from Office Mart, $7.500. 8. Paid for a newspaper advertisement, $200. 11. Received $1,000 for serving as a disc jockey for a party 13. Paid $700 to a local audio electronics store for rental of digital recording equip t from Office Mart, $7,500 ment 14. Paid wages of $1,200 to receptionist and part-time assistant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts