Question: I need help on the question that I've highlighted. if possible the answer can be given in table form preferably. Subject is about investment management.

I need help on the question that I've highlighted. if possible the answer can be given in table form preferably. Subject is about investment management. Thank you

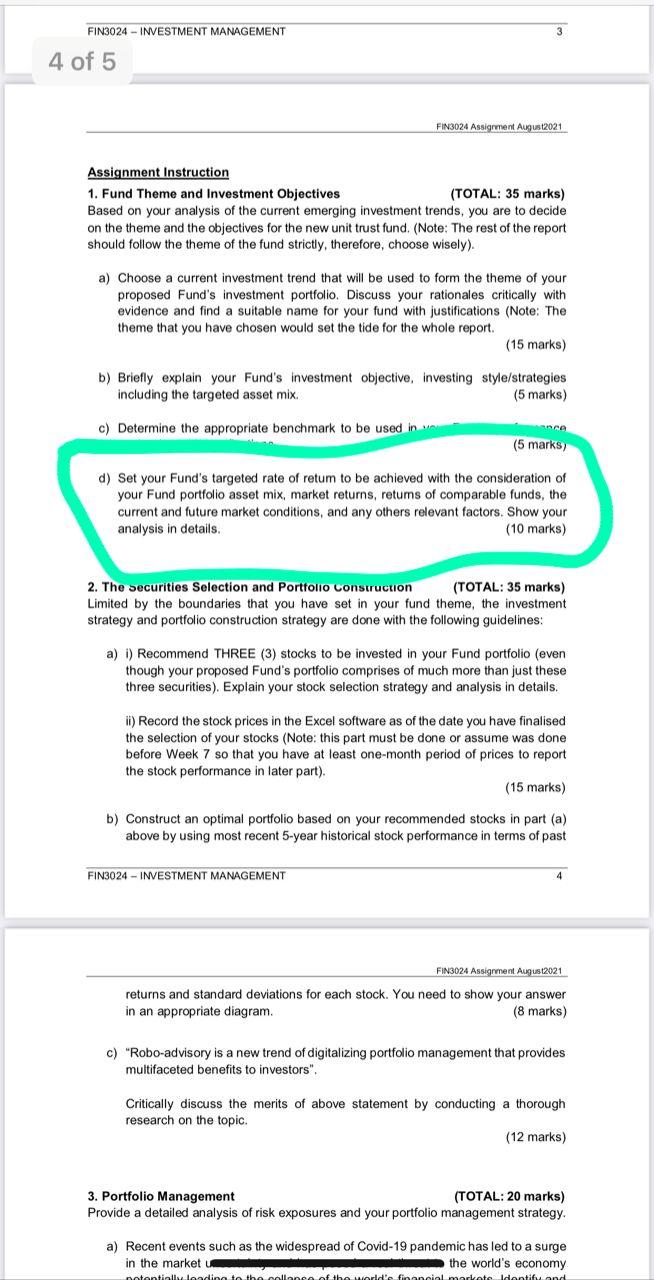

FIN3024 - INVESTMENT MANAGEMENT 3 4 of 5 FIN3024 Assigment August2021 Assignment Instruction 1. Fund Theme and Investment Objectives (TOTAL: 35 marks) Based on your analysis of the current emerging investment trends, you are to decide on the theme and the objectives for the new unit trust fund. (Note: The rest of the report should follow the theme of the fund strictly, therefore, choose wisely). a) Choose current investment trend that will be used to form the theme of your proposed Fund's investment portfolio. Discuss your rationales critically with evidence and find a suitable name for your fund with justifications (Note: The theme that you have chosen would set the tide for the whole report. (15 marks) b) Briefly explain your Fund's investment objective, investing style/strategies including the targeted asset mix. (5 marks) c) Determine the appropriate benchmark to be used in (5 marks) d) Set your Fund's targeted rate of retum to be achieved with the consideration of your Fund portfolio asset mix, market returns, retums of comparable funds, the current and future market conditions, and any others relevant factors. Show your analysis in details. (10 marks) 2. The Securities Selection and Portfolio Construction (TOTAL: 35 marks) Limited by the boundaries that you have set in your fund theme, the investment strategy and portfolio construction strategy are done with the following guidelines: a) ) Recommend THREE (3) stocks to be invested in your Fund portfolio (even though your proposed Fund's portfolio comprises of much more than just these three securities). Explain your stock selection strategy and analysis in details. ii) Record the stock prices in the Excel software as of the date you have finalised the selection of your stocks (Note: this part must be done or assume was done before Week 7 so that you have at least one-month period of prices to report the stock performance in later part). (15 marks) b) Construct an optimal portfolio based on your recommended stocks in part (a) above by using most recent 5-year historical stock performance in terms of past FIN3024 - INVESTMENT MANAGEMENT 4 FIN3024 Assigment August2021 returns and standard deviations for each stock. You need to show your answer in an appropriate diagram. (8 marks) c) "Robo-advisory is a new trend of digitalizing portfolio management that provides multifaceted benefits to investors". Critically discuss the merits of above statement by conducting a thorough research on the topic. (12 marks) 3. Portfolio Management (TOTAL: 20 marks) Provide a detailed analysis of risk exposures and your portfolio management strategy. a) Recent events such as the widespread of Covid-19 pandemic has led to a surge in the market the world's economy potentially leading to the collage of the weddle financial markete Identify and FIN3024 - INVESTMENT MANAGEMENT 3 4 of 5 FIN3024 Assigment August2021 Assignment Instruction 1. Fund Theme and Investment Objectives (TOTAL: 35 marks) Based on your analysis of the current emerging investment trends, you are to decide on the theme and the objectives for the new unit trust fund. (Note: The rest of the report should follow the theme of the fund strictly, therefore, choose wisely). a) Choose current investment trend that will be used to form the theme of your proposed Fund's investment portfolio. Discuss your rationales critically with evidence and find a suitable name for your fund with justifications (Note: The theme that you have chosen would set the tide for the whole report. (15 marks) b) Briefly explain your Fund's investment objective, investing style/strategies including the targeted asset mix. (5 marks) c) Determine the appropriate benchmark to be used in (5 marks) d) Set your Fund's targeted rate of retum to be achieved with the consideration of your Fund portfolio asset mix, market returns, retums of comparable funds, the current and future market conditions, and any others relevant factors. Show your analysis in details. (10 marks) 2. The Securities Selection and Portfolio Construction (TOTAL: 35 marks) Limited by the boundaries that you have set in your fund theme, the investment strategy and portfolio construction strategy are done with the following guidelines: a) ) Recommend THREE (3) stocks to be invested in your Fund portfolio (even though your proposed Fund's portfolio comprises of much more than just these three securities). Explain your stock selection strategy and analysis in details. ii) Record the stock prices in the Excel software as of the date you have finalised the selection of your stocks (Note: this part must be done or assume was done before Week 7 so that you have at least one-month period of prices to report the stock performance in later part). (15 marks) b) Construct an optimal portfolio based on your recommended stocks in part (a) above by using most recent 5-year historical stock performance in terms of past FIN3024 - INVESTMENT MANAGEMENT 4 FIN3024 Assigment August2021 returns and standard deviations for each stock. You need to show your answer in an appropriate diagram. (8 marks) c) "Robo-advisory is a new trend of digitalizing portfolio management that provides multifaceted benefits to investors". Critically discuss the merits of above statement by conducting a thorough research on the topic. (12 marks) 3. Portfolio Management (TOTAL: 20 marks) Provide a detailed analysis of risk exposures and your portfolio management strategy. a) Recent events such as the widespread of Covid-19 pandemic has led to a surge in the market the world's economy potentially leading to the collage of the weddle financial markete Identify and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts