Question: I need help on the sections without a green checkmark. especially the last 3 parts. Thank you very much Excel Activity: Bond Valuation Clifford Clark

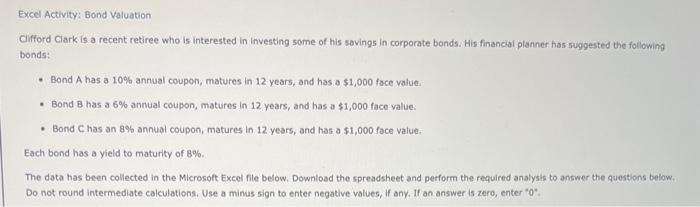

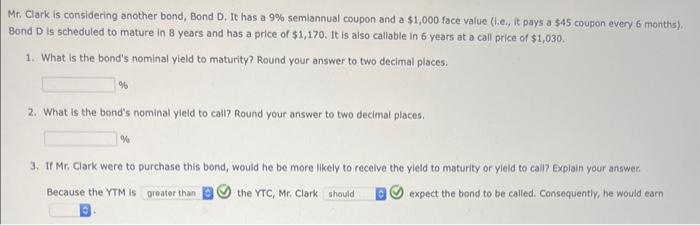

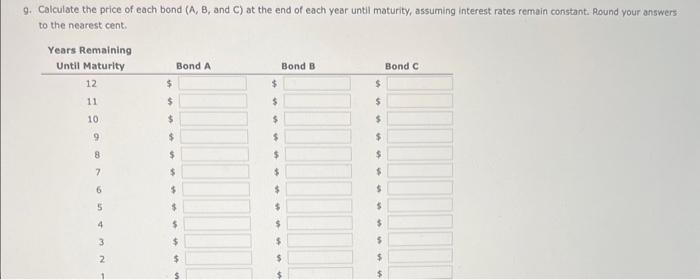

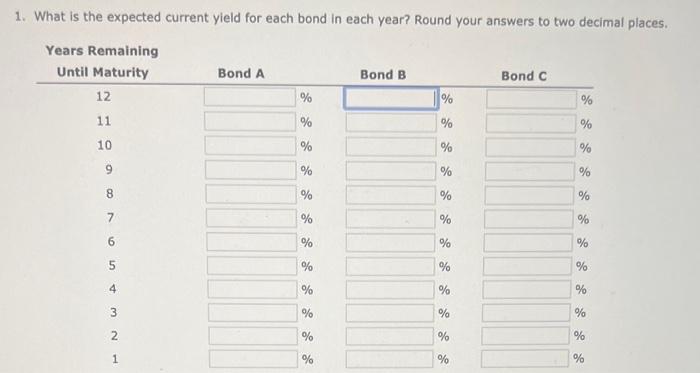

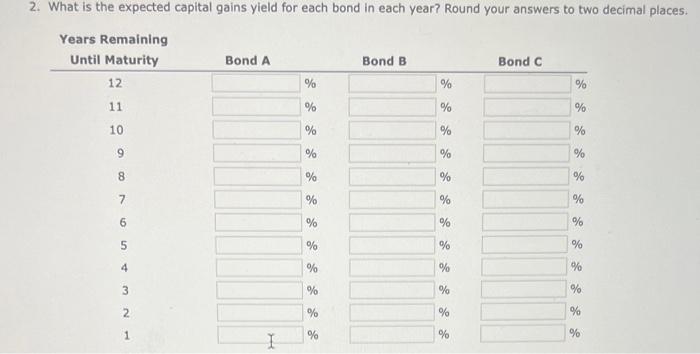

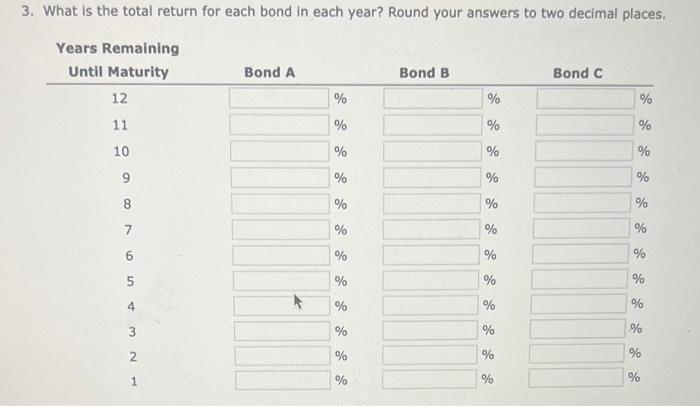

Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has a 10% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 6% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 8%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter "0". Mr. Clark is considering another bond, Bond D. It has a 9% semiannual coupon and a $1,000 face value (li.e, it pays a $45 coupon every 6 months). Bond D is scheduled to mature in 8 years and has a price of $1,170. It is aiso callable in 6 years at a call price of $1,030. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. 2. What is the bond's nominal yield to call? Round your answer to two decimal places. % 3. If Mr. Clark were to purchase this bond, would he be more likely to recelve the yleld to maturity or yleld to call? Explain your answee Because the VTM is the YTc, Mr, Clark expect the bond to be called. Consequently, he would earn 9. Calculate the price of each bond (A,B, and C) at the end of each year until maturity, assuming interest rates remain constant: Round your answers to the nearest cent. 1. What is the expected current yield for each bond in each year? Round your answers to two decimal places. 2. What is the expected capital gains yield for each bond in each year? Round your answers to two decimal places. Years Remaining 3. What is the total return for each bond in each year? Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts