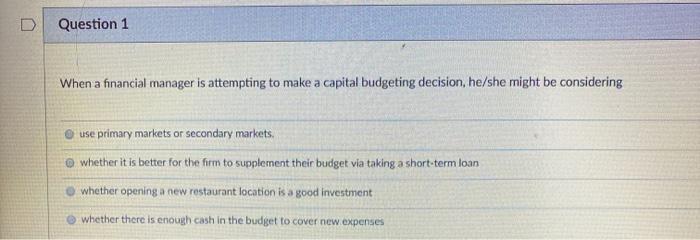

Question: I need help on these four. Thanks! Question 1 When a financial manager is attempting to make a capital budgeting decision, he/she might be considering

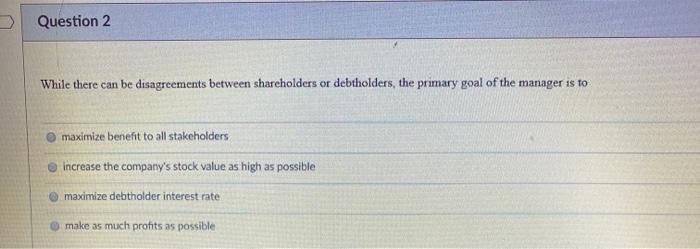

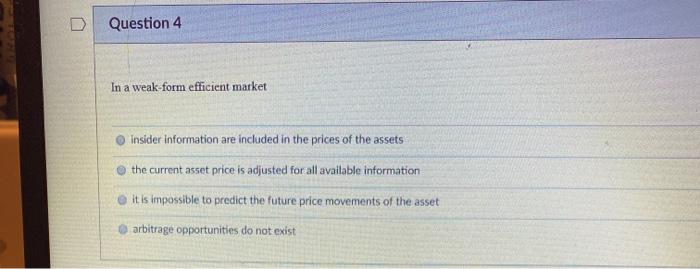

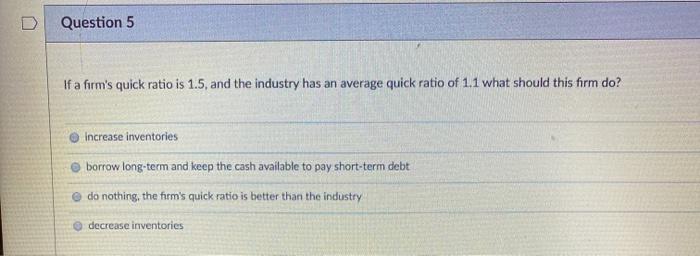

Question 1 When a financial manager is attempting to make a capital budgeting decision, he/she might be considering use primary markets or secondary markets, @ whether it is better for the firm to supplement their budget via taking a short-term loan whether opening a new restaurant location is a good investment whether there is enough cash in the budget to cover new expenses Question 2 While there can be disagreements between shareholders or debtholders, the primary goal of the manager is to maximize benefit to all stakeholders e increase the company's stock value as high as possible maximize debtholder interest rate make as much profits as possible Question 4 In a weak-form efficient market Insider information are included in the prices of the assets the current asset price is adjusted for all available information it is impossible to predict the future price movements of the asset arbitrage opportunities do not exist Question 5 If a firm's quick ratio is 1.5, and the industry has an average quick ratio of 1.1 what should this firm do? Increase inventories borrow long-term and keep the cash available to pay short-term debt e do nothing, the firm's quick ratio is better than the industry decrease inventories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts