Question: I need help on this please, anyone? Factory Overhead Cost Variance Report Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead

I need help on this please, anyone?

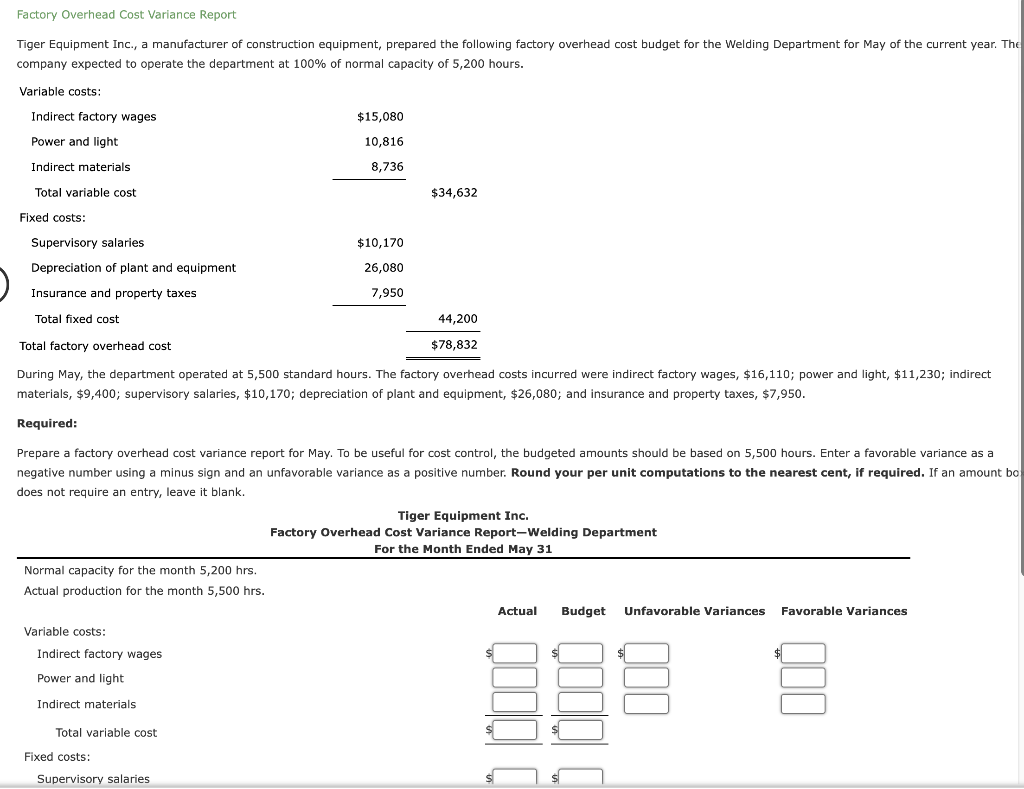

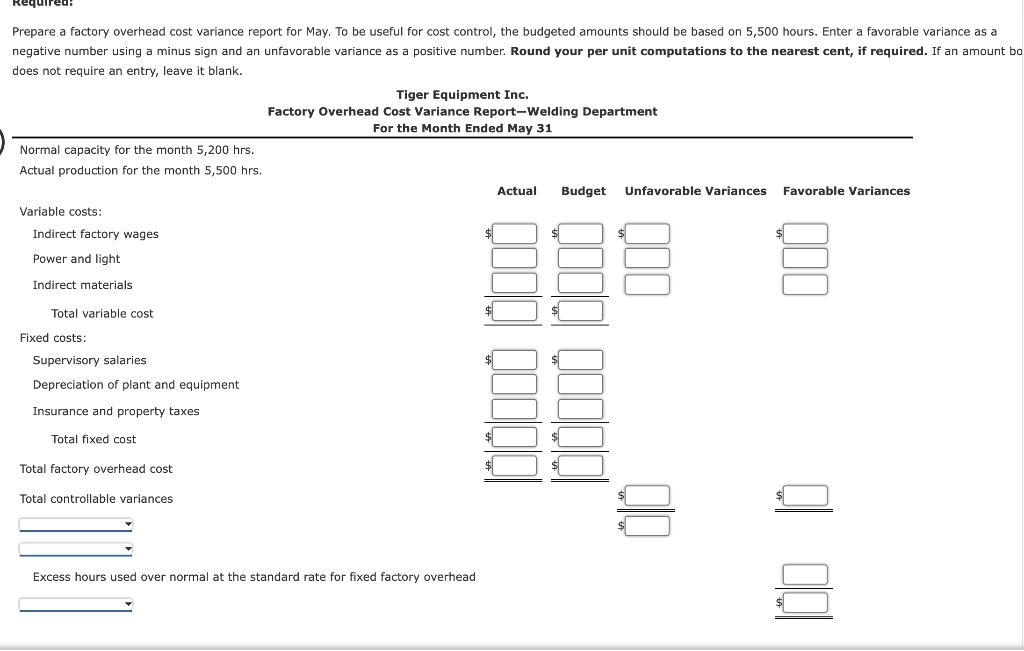

Factory Overhead Cost Variance Report Tiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. Th company expected to operate the department at 100% of normal capacity of 5,200 hours. During May, the department operated at 5,500 standard hours. The factory overhead costs incurred were indirect factory wages, $16,110; power and light, $11,230; indirect materials, $9,400; supervisory salaries, $10,170; depreciation of plant and equipment, $26,080; and insurance and property taxes, $7,950. Required: Prepare a factory overhead cost variance report for May. To be useful for cost control, the budgeted amounts should be based on 5,500 hours. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Round your per unit computations to the nearest cent, if required. If an amount be does not require an entry, leave it blank. Prepare a factory overhead cost variance report for May. To be useful for cost control, the budgeted amounts should be based on 5,500 hours. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Round your per unit computations to the nearest cent, if required. If an amount bo does not require an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts