Question: I need help on this problem A manufactured product has the following information for June. Standard (6 lbs.@$8 per lb.) (2 hrs. @ $17 per

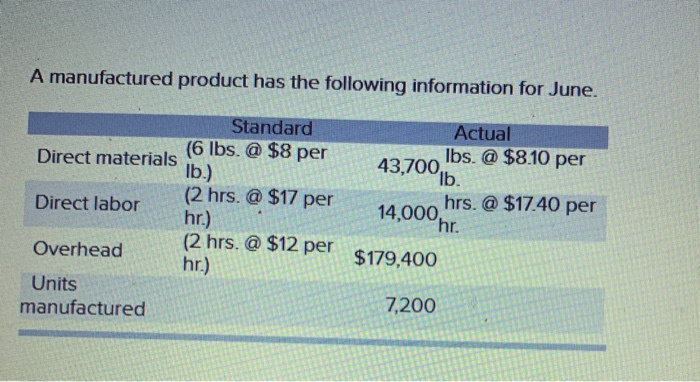

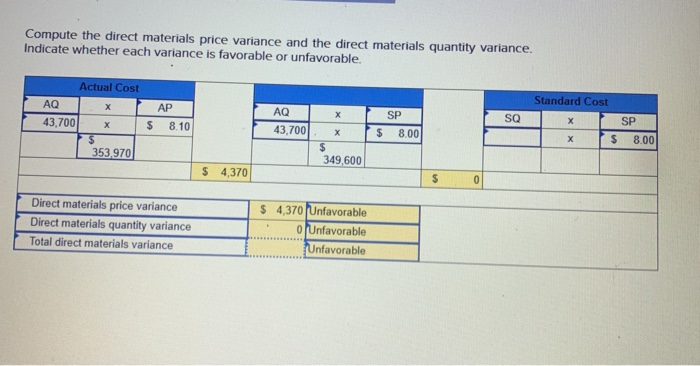

A manufactured product has the following information for June. Standard (6 lbs.@$8 per lb.) (2 hrs. @ $17 per hr.) (2 hrs. @ $12 per hr.) Actual Ibs.@$8.10 per Ib. hrs.@ $17.40 per hr. Direct materials 43,700 Direct labor 14,000 Overhead $179,400 Units 7,200 manufactured Compute the direct materials price variance and the direct materials quantity variance. Indicate whether each variance is favorable or unfavorable. Actual Cost Standard Cost AQ AP AQ SP SQ SP 43,700 $ 353,970 $ 8.10 43,700 $ 8.00 8.00 X $ $ 349,600 $ 4,370 $ 0 Direct materials price variance S 4,370 Unfavorable oUnfavorable Unfavorable Direct materials quantity variance Total direct materials variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts