Question: I NEED HELP ONLY IN ONE QUESTION PROJECT COST AND PROCUREMENT Netsurf Inc. is a new tech company in the eastern seaside of Cape Town.

I NEED HELP ONLY IN ONE QUESTION

PROJECT COST AND PROCUREMENT

Netsurf Inc. is a new tech company in the eastern seaside of Cape Town. The company directors are now considering the installation of a new computer system using specially written software to streamline the businesss warehousing operations. The initial outlay on the project will be substantial. Nigel, who is one of the two directors, estimates that payments to the software house will be R 2 271 276 immediately, with a further R 1 703 457 in year 1 as well as equipment and installation and testing costs to the amount of R 3 361 488 during the same year. The plan is that the new system should go live in one years time. After that point the business should start to reap considerable benefits from what will be, essentially, a paperless ordering and shipment tracking system. The partners plan to reduce their staffing levels considerably during the first two years during which the system is in operation and there will be other cost saving benefits including a reduction in office storage space, stationery, postage and other costs. Because of the increased efficiency of the operation, the partners also expect substantial increases in sales. The net cash inflows forecast from the installation of the new systems are as follows:

| Year | Cash Flow (Rand) |

| 2 | 4 179 147 |

| 3 | 3 611 328 |

| 4 | 2 452 978 |

| 5 | 2 180 424 |

| 6 | 908 510 |

At the end of year six, the partners anticipate that the system will have to be scrapped and replaced with whatever is the latest technology at the time. There will be no residual value in the system at that point. The company has asked you to appraise the project to see how quickly it will pay back. You offer to appraise the project using discounted cash flow techniques, although Chris (who did a business course a few years ago) is distinctly sceptical about this approach: The good thing about payback is that you can see immediately how long its going to take to recoup the cost of the investment. Discounted cash flow doesnt make any sense to me. However, he agrees that it might just be helpful to see what the NPV of the project is, and he estimates the businesss cost of capital at 11%.

QUESTION 1 (10 Marks) Calculate the payback period for the project. I have managed to find the payback period:

2.1. Calculate the NPV of the project using 11% as the discount rate . *Round off PV calculations to whole numbers. *Use the template provided.

| Year | Cash Flow | Discount Factor @ 11% | (Discounted Cash Flow) Present Value |

| 0 | -R2,271,276 | 1 | -R2,271,276 |

| 1 | -R5,064,945 | 0.9009 | -R4,563,009 |

| 2 | R4,179,147 | 0.8116 | R3,391,796 |

| 3 | R3,611,328 | 0.7312 | R2,640,603 |

| 4 | R2,452,978 | 0.6587 | R1,615,777 |

| 5 | R2,180,424 | 0.5935 | R1,294,082 |

| 6 | R908,510 | 0.5346 | R485,689 |

| Net Present Value | R2,593,661 |

QUESTION

2.2) Briefly highlight the arguments in support of the point of view that discounted cash flow techniques are better than the payback analysis as a method of investment appraisal.

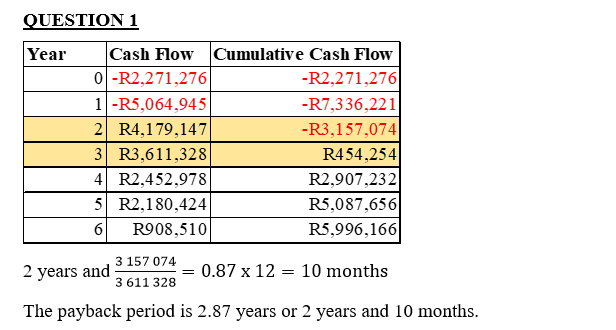

QUESTION 1 Year Cash Flow Cumulative Cash Flow 0 -R2,271,276 -R2,271,276 1 -R5,064,945 -R7,336,221 2 R4,179,147 -R3,157,074 3 R3,611,328 R454,254 4 R2,452,978 R2,907,232 5 R2,180,424 R5,087,656 6 R908,510 R5,996,166 = 3 157 074 2 years and 0.87 x 12 10 months 3 611 328 The payback period is 2.87 years or 2 years and 10 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts