Question: I need help please 1 Please complete Problem as follows: NOTE: ALL 5 STEPS ARE PART OF THE SAME PROBLEM. COMPLETE ALL FOR POINTS. 4

I need help please

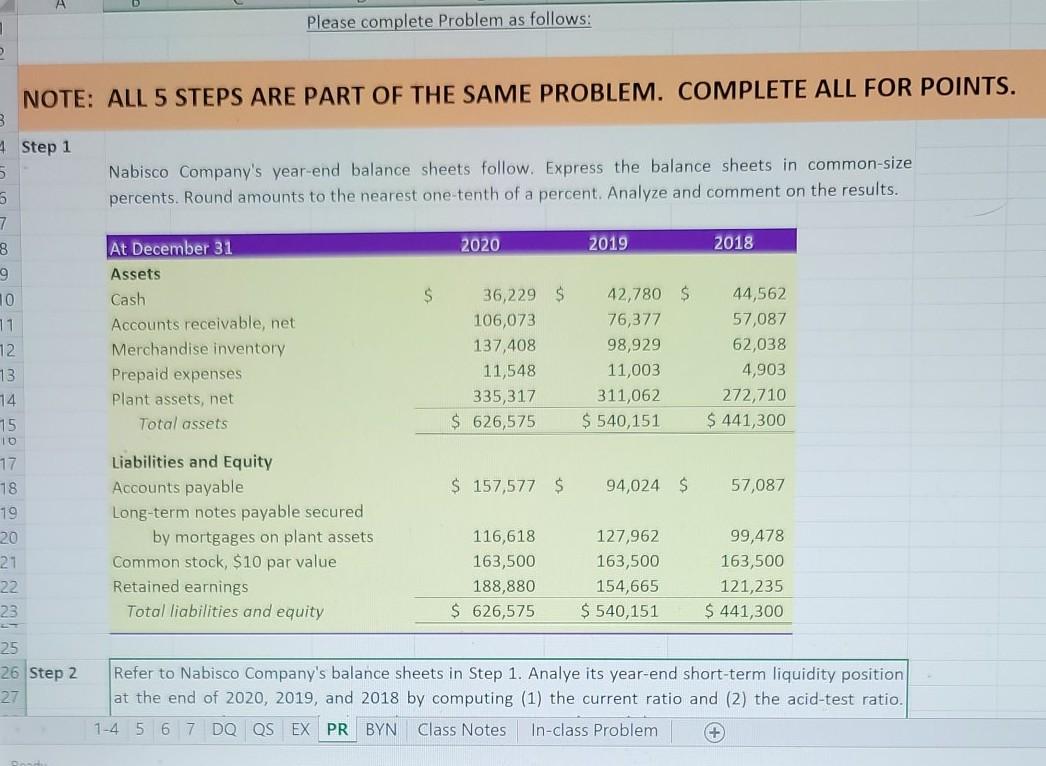

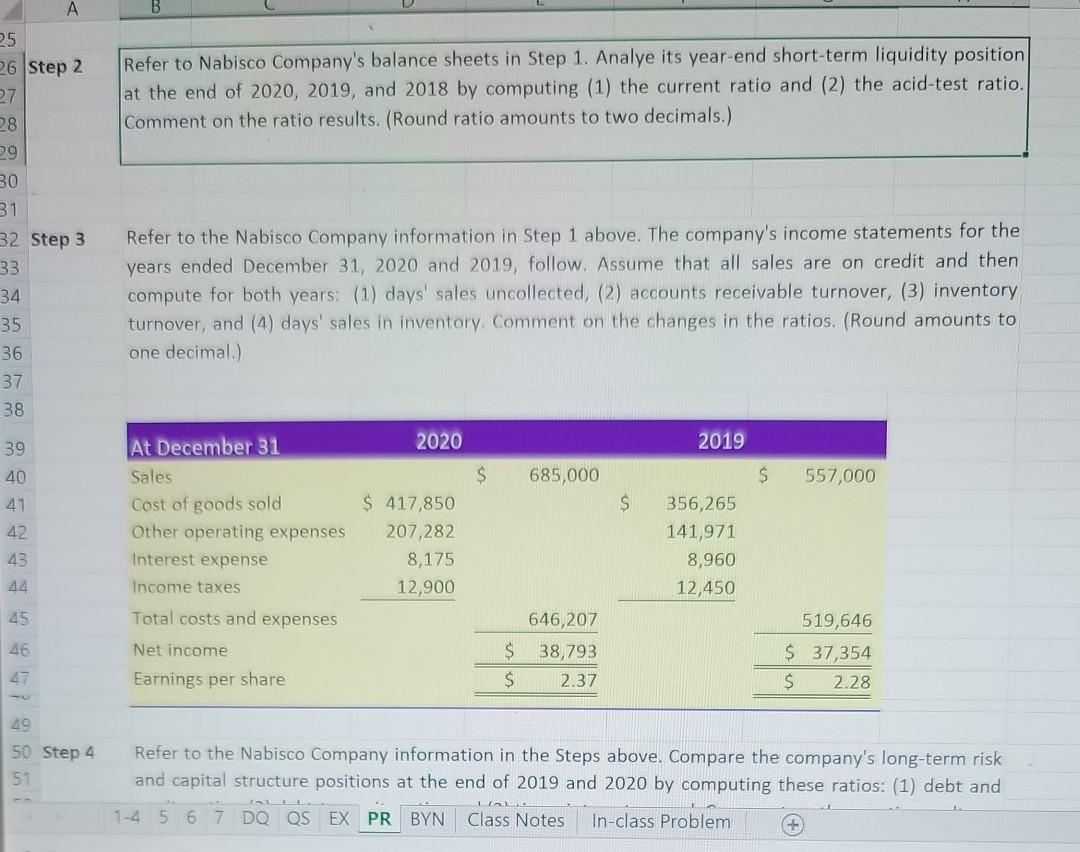

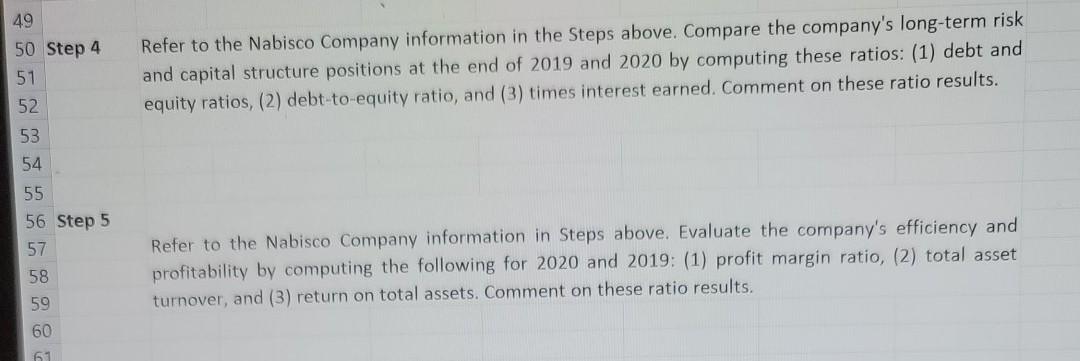

1 Please complete Problem as follows: NOTE: ALL 5 STEPS ARE PART OF THE SAME PROBLEM. COMPLETE ALL FOR POINTS. 4 Step 1 5 Nabisco Company's year-end balance sheets follow. Express the balance sheets in common-size percents. Round amounts to the nearest one tenth of a percent. Analyze and comment on the results. 5 2020 2019 2018 $ 7 8 9 10 11 12 73 14 15 10 17 18 19 20 21 22 23 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets 36,229 $ 106,073 137,408 11,548 335,317 $ 626,575 42,780 $ 76,377 98,929 11,003 311,062 $ 540,151 44,562 57,087 62,038 4,903 272,710 $ 441,300 $ 157,577 $ 94,024 $ 57,087 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 116,618 163,500 188,880 $ 626,575 127,962 163,500 154,665 $ 540,151 99,478 163,500 121,235 $ 441,300 25 26 Step 2 27 Refer to Nabisco Company's balance sheets in Step 1. Analye its year-end short-term liquidity position at the end of 2020, 2019, and 2018 by computing (1) the current ratio and (2) the acid-test ratio. 1-4 5 6 7 DO QS EX PR BYN Class Notes In-class Problem + A Refer to Nabisco Company's balance sheets in Step 1. Analye its year-end short-term liquidity position at the end of 2020, 2019, and 2018 by computing (1) the current ratio and (2) the acid-test ratio. Comment on the ratio results. (Round ratio amounts to two decimals.) 25 26 Step 2 27 28 29 30 31 32 Step 3 33 34 35 36 37 38 Refer to the Nabisco Company information in Step 1 above. The company's income statements for the years ended December 31, 2020 and 2019, follow. Assume that all sales are on credit and then compute for both years: (1) days' sales uncollected, (2) accounts receivable turnover, (3) inventory turnover, and (4) days' sales in inventory. Comment on the changes in the ratios. (Round amounts to one decimal) 2020 2019 $ 685,000 $ 557,000 39 40 41 42 43 $ At December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses Net income Earnings per share $ 417,850 207,282 8,175 12,900 356,265 141,971 8,960 12,450 44 45 46 $ $ 646,207 38,793 2.37 519,646 $ 37,354 $ 2.28 47 49 50 Step 4 51 Refer to the Nabisco Company information in the Steps above. Compare the company's long-term risk and capital structure positions at the end of 2019 and 2020 by computing these ratios: (1) debt and 1-4 5 6 7 DO QS EX PR BYN Class Notes In-class Problem + IL 49 50 Step 4 51 Refer to the Nabisco Company information in the Steps above. Compare the company's long-term risk and capital structure positions at the end of 2019 and 2020 by computing these ratios: (1) debt and equity ratios, (2) debt-to-equity ratio, and (3) times interest earned. Comment on these ratio results. 52 53 54 55 56 Step 5 57 58 59 60 Refer to the Nabisco Company information in Steps above. Evaluate the company's efficiency and profitability by computing the following for 2020 and 2019: (1) profit margin ratio, (2) total asset turnover, and (3) return on total assets. Comment on these ratio results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts