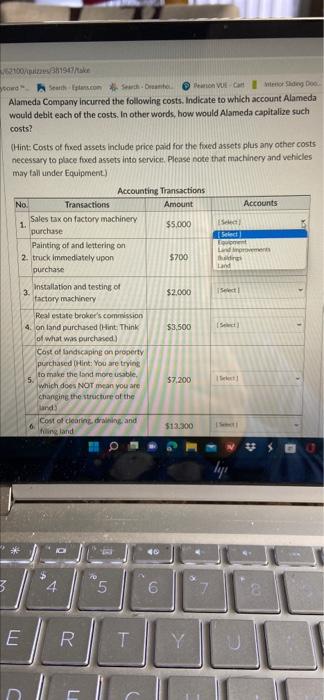

Question: i need help please 3100// Seatth con Seth Vulc Mid Do Alameda Company incurred the following costs. Indicate to which account Alameda would debit each

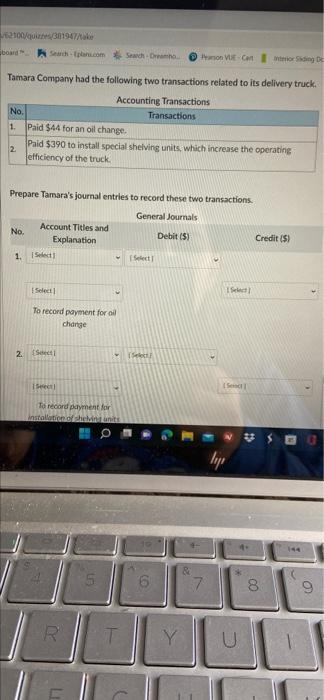

3100// Seatth con Seth Vulc Mid Do Alameda Company incurred the following costs. Indicate to which account Alameda would debit each of the costs. In other words, how would Alameda capitalize such costs? (Hint: Costs of fixed assets include price paid for the fixed assets plus any other costs necessary to place foed assets into service. Please note that machinery and vehicles may fall under Equipment) Accounting Transactions No Transactions Amount Accounts Sales tax on factory machinery 1. $5.000 IS purchase Painting of and lettering on 2. truck immediately upon $700 Land purchase Installation and testing of 3 factory machinery $2.000 Sied 2 $3,500 Real estate broker's commission 4. on and purchased (Hint: Think of what was purchased) Cost of landscaping on property purchased tint: You are trying to make the land more usable, which does NOT mean you are Changing the structure of the lands Cost of cleaning, draining and lingland 57.200 $13.300 lije e D 3 5 5 6 2 E R T T Y 2100/q/311947/ board hachpan.com Search Drama non Carter Tamara Company had the following two transactions related to its delivery truck. Accounting Transactions No Transactions 1. Paid $44 for an oil change. Paid $390 to install special shelving units, which increase the operating 2 ethiciency of the truck Prepare Tamara's journal entries to record these two transactions. General Journals Account Titles and No. Debit (5) Credit ($) Explanation 1. Select Select IS To record payment for all change 2. Seti SF Sed To record payment for installationshinta 32 hir 14 5 7 00 9 R T Y U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts