Question: i need help please ! can you show calculations please ? NOTE: Investments II & III are mutually exclusive. Management has determined that these projects

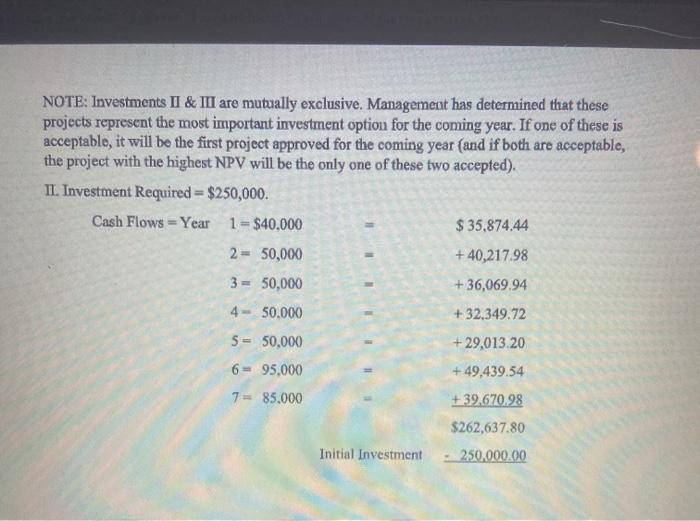

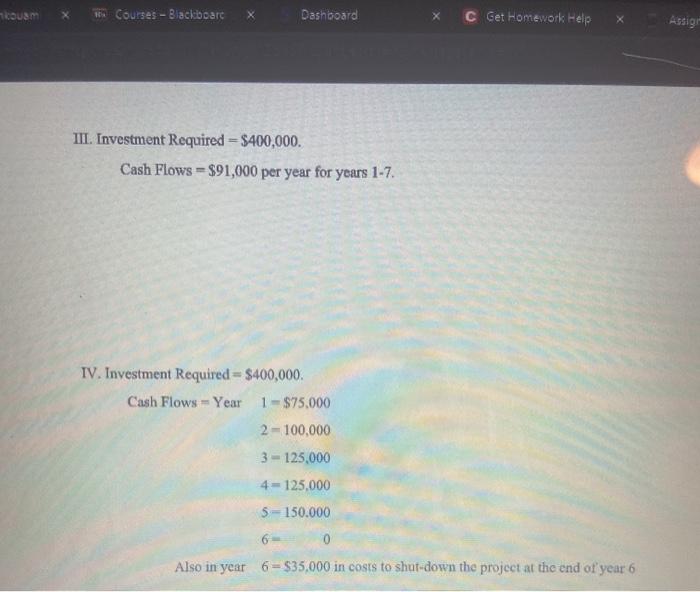

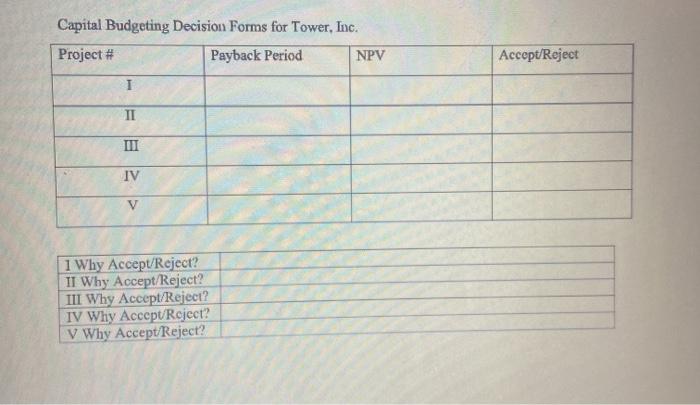

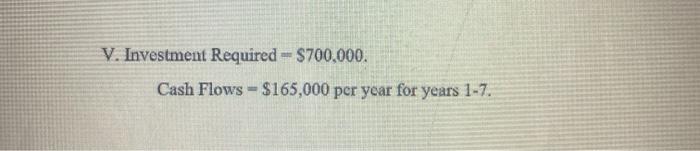

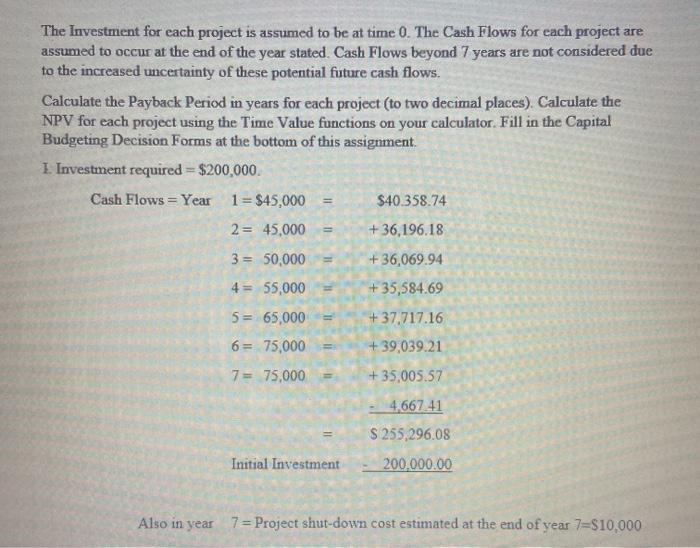

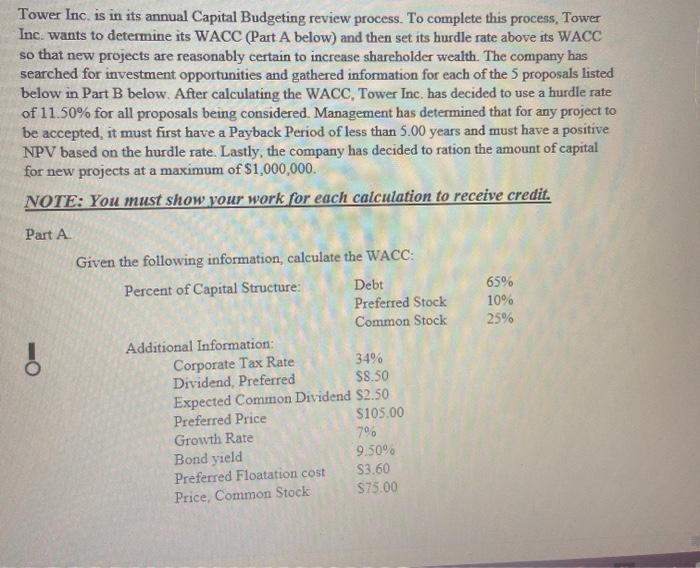

NOTE: Investments II & III are mutually exclusive. Management has determined that these projects represent the most important investment option for the coming year. If one of these is acceptable, it will be the first project approved for the coming year (and if both are acceptable, the project with the highest NPV will be the only one of these two accepted). II. Investment Required = $250,000. Cash Flows - Year 1 = $40.000 $ 35,874.44 2 - 50,000 +40,217.98 3 = 50,000 +36,069.94 4- 50.000 +32.349.72 +29,013.20 5 - 50,000 6 - 95,000 +49,439.54 +39.670.98 7 = 85.000 $262,637.80 Initial Investment 250,000.00 um X U Courses - Blackboard Dashboard C Get Homework Help Assig III. Investment Required - $400,000. Cash Flows = $91,000 per year for years 1-7. IV. Investment Required = $400,000. Cash Flows = Year 1-$75.000 2 = 100,000 3 - 125.000 4 =125,000 5- 150.000 6 0 Also in year 6 - $35,000 in costs to shut down the project at the end of year 6 Capital Budgeting Decision Forms for Tower, Inc. Project # Payback Period NPV Accept/Reject I II III IV 1 Why Accept/Reject? II Why Accept/Reject? III Why Accept/Reject? IV Why Accept/Rcjcct? V Why Accept Reject? V. Investment Required - $700,000. Cash Flows = $165,000 per year for years 1-7. The Investment for each project is assumed to be at time 0. The Cash Flows for each project are assumed to occur at the end of the year stated. Cash Flows beyond 7 years are not considered due to the increased uncertainty of these potential future cash flows. Calculate the Payback Period in years for each project (to two decimal places). Calculate the NPV for each project using the Time Value functions on your calculator, Fill in the Capital Budgeting Decision Forms at the bottom of this assignment. I. Investment required=$200,000 Cash Flows = Year 1 = $45,000 $40.358.74 2 = 45,000 +36,196.18 3 = 50,000 + 36,069.94 4 = 55,000 5= 65,000 11 + 35,584.69 +37.717.16 +39,039.21 +35,005.57 6 = 75,000 7 = 75,000 4,667.41 $ 255,296.08 200,000.00 Initial Investment Also in year 7 = Project shut-down cost estimated at the end of year 7=S10,000 Tower Inc is in its annual Capital Budgeting review process. To complete this process, Tower Inc. wants to determine its WACC (Part A below) and then set its hurdle rate above its WACC so that new projects are reasonably certain to increase shareholder wealth. The company has searched for investment opportunities and gathered information for each of the 5 proposals listed below in Part B below. After calculating the WACC, Tower Inc. has decided to use a hurdle rate of 11.50% for all proposals being considered. Management has determined that for any project to be accepted, it must first have a Payback Period of less than 5.00 years and must have a positive NPV based on the hurdle rate. Lastly, the company has decided to ration the amount of capital for new projects at a maximum of $1,000,000 NOTE: You must show your work for each calculation to receive credit. Part A 65% 10% 25% Given the following information, calculate the WACC: Percent of Capital Structure: Debt Preferred Stock Common Stock Additional Information: Corporate Tax Rate 34% Dividend, Preferred $8.50 Expected Common Dividend $2.50 Preferred Price S105.00 Growth Rate 79 Bond yield 9.50% Preferred Floatation cost $3.60 Price, Common Stock $75.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts