Question: I need help please Consider a bond that has a par value of $1,000, pays a coupon rate of 10% at the end of each

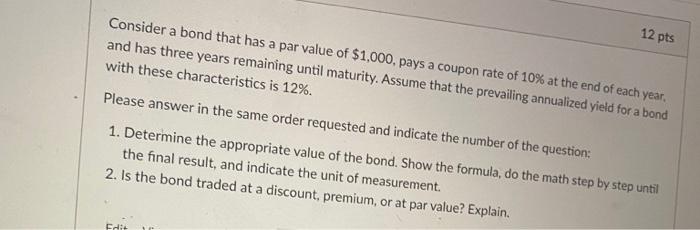

Consider a bond that has a par value of $1,000, pays a coupon rate of 10% at the end of each year, and has three years remaining until maturity. Assume that the prevailing annualized yield for a bond order requested and indicate the number of the question: 1. Determine the appropriate value of the bond. Show the formula, do the math step by step until the final result, and indicate the unit of measurement. 2. Is the bond traded at a discount, premium, or at par value? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts