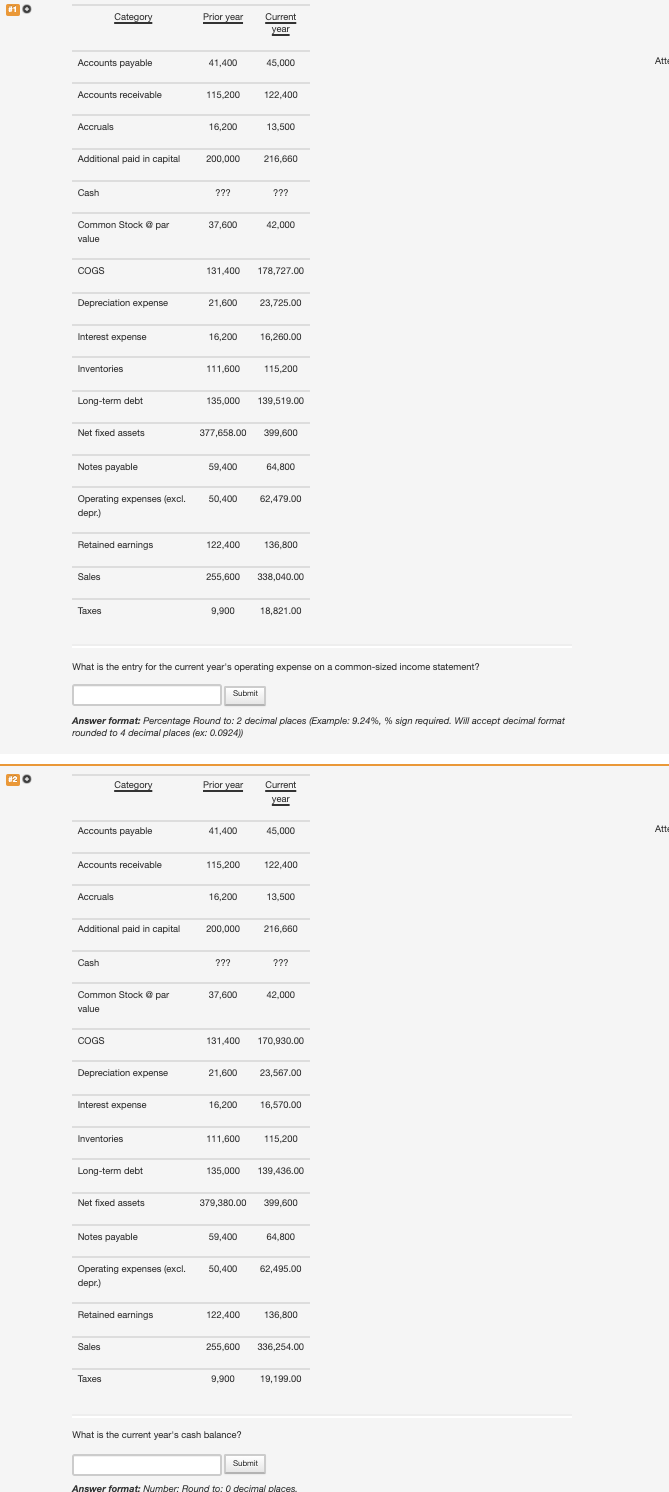

Question: i need help please explain it. 10 Category Prior year Current year Accounts payable 41,400 45,000 Atte Accounts receivable 115,200 122,400 Accruals 16,200 13,500 Additional

i need help please explain it.

10 Category Prior year Current year Accounts payable 41,400 45,000 Atte Accounts receivable 115,200 122,400 Accruals 16,200 13,500 Additional paid in capital 200.000 216,660 Cash ??? ??? 37,600 Common Stock @ par value 42,000 COGS 131.400 178,727.00 Depreciation expense 21,600 23,725.00 Interest expense 16,200 16,260.00 Inventories 111,600 115,200 Long-term debt 135,000 139,519.00 Net fixed assets 377,658.00 399.600 Notes payable 59,400 64,800 50,400 62,479.00 Operating expenses (excl. depr.) Retained earnings 122.400 136,800 Sales 255,600 338,040.00 Taxes 9.900 18,821.00 What is the entry for the current year's operating expense on a common-sized income statement? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. WW accept decimal format rounded to 4 decimal places (ex: 0.0924)) #2 O Category Prior year Current year Accounts payable 41,400 45,000 Atte Accounts receivable 115.200 122.400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash 222 ??? 37,600 42,000 Common Stock par value COGS 131.60 131.400 170,930.00 Depreciation expense 21,600 23,567.00 Interest expense 16,200 16,570.00 Inventories 111,600 115,200 Long-term debt 135,000 139,436.00 Net fixed assets 379,380.00 399,600 Notes payable 59,400 64,800 50,400 62,495.00 Operating expenses (excl. depr.) Retained earnings 122,400 136,800 Sales 255,600 336,254.00 Taxes 9.900 19,199.00 What is the current year's cash balance? Subrnit Answer format: Number: Round to: O decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts