Question: I need help, please help me with these questions. thank you 1 Based on the following information, answer the questions '25, paid semiannually. The yeld

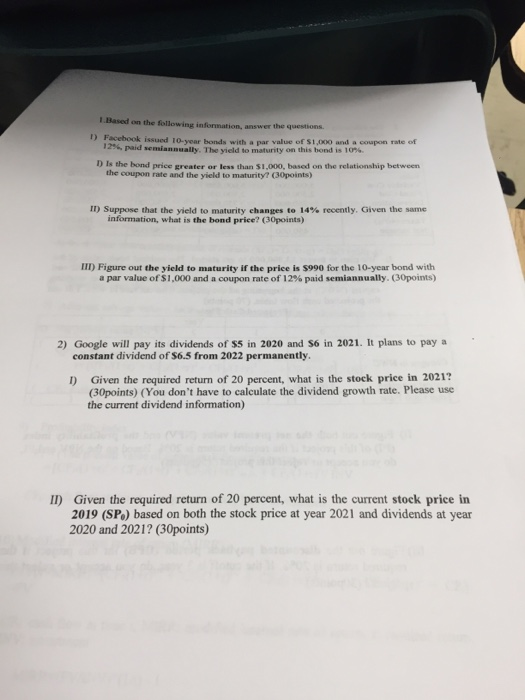

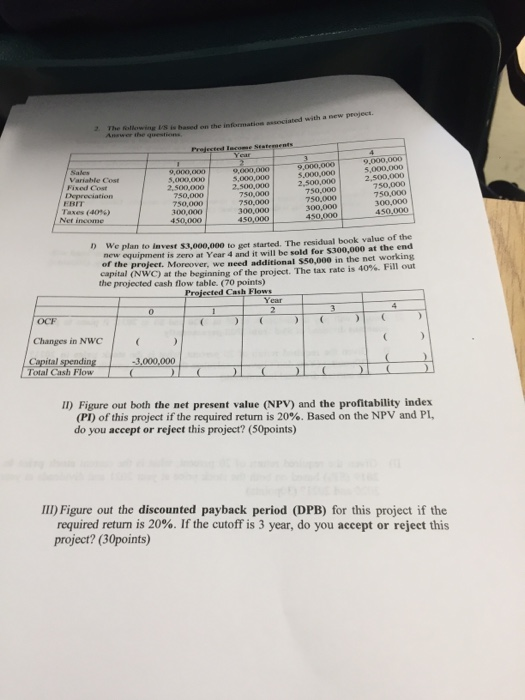

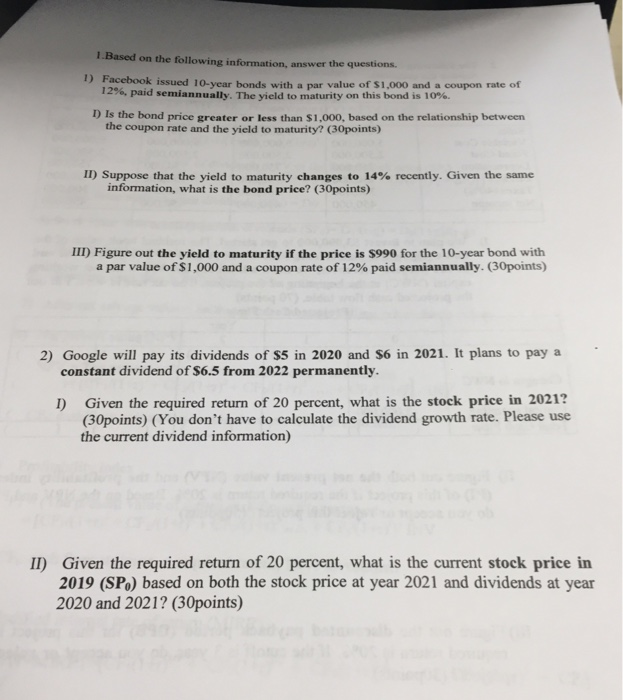

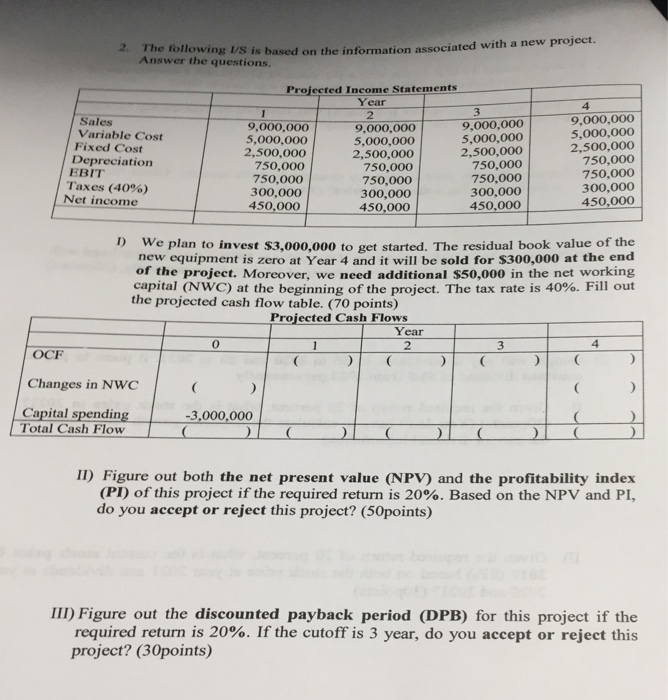

1 Based on the following information, answer the questions '25, paid semiannually. The yeld to maturity on this bond is 10%. the coupon rate and the yield to maturity? (30points) issued 10-year bonds with a par value of $1,000 and a coupon rate of D Is the bond price greater or less than $1,000, based on the relationship between m suppose that the yield to maturity changes to 14% recently. Given the same information, what is the bond priee? (30points) IIID Figure out the yield to maturity if the price is $990 for the 10-year bond with a par value of $1,000 and a coupon rate of 12% paid semiannually. (30points) 2) Google will pay its dividends of S5 in 2020 and $6 in 2021. It plans to pay a constant dividend of S6.5 from 2022 permanently ) Given the required return of 20 percent, what is the stock price in 2021? (30points) (You don't have to calculate the dividend growth rate. Please use the current dividend information) II) Given the required return of 20 percent, what is the current stock price in 2019 (SPo) based on both the stock price at year 2021 and dividends at year 2020 and 2021? (30points) 2 The following VS is based on the information guest 9.000,000 9,000,000 5,000,000 2.500,000 750,000 750,000 300,000 9,000,00o 5,000,000 2,500,000 750,000 750,000 300,000 450.000 5,000,000 2,500,000 750,000 750,000 300,000 450.000 Variable Cost 5,000,000 2,500,000 750,000 750,000 300,000 450,000 BIT Taxes (40%) e plan to invest 3,000,000 to got started. The residual book value of the new equipment is zero at Year 4 and it will be sold for $300,000 at the end the projeet. Moreover, we need additional $50,000 in the net working capital (NWC) at the beginning of the project. The tax rate is 40%. Fill out of the projected cash flow table. (70 points) ieeted Cash Flows OCF Changes in NWC ital 3,000,000 Total Cash Flow Il) Figure out both the net present value (NPV) and the profitability index (PI) of this project if the required return is 20%. Based on the NPV and PI, do you accept or rejeet this project? (50points) III) Figure out the discounted payback period (DPB) for this project if the required return is 20%. If the cutoff is 3 year, do you accept or reject this project? (30points) 1.Based on the following information, answer the questions. 1) Facebook issued 10-year bonds with a par value of $1,000 and a coupon rate of 12%, paid semiannually. The yield to maturity on this bond is 10%. D Is the bond price greater or less than $1,000, based on the relationship between the coupon rate and the yield to maturity? (30points) 11) Suppose that the yield to maturity changes to 14% recently. Given the same information, what is the bond price? (30points) II) Figure out the yield to maturity if the price is $990 for the 10-year bond with a par value of$1,000 and a coupon rate of 12% paid semiannually. (30points) 2) Google will pay its dividends of $5 in 2020 and $6 in 2021. It plans to pay a constant dividend of $6.5 from 2022 permanently. D Given the required return of 20 percent, what is the stock price in 2021? (30points) (You don't have to calculate the dividend growth rate. Please use the current dividend information) II) Given the required return of 20 percent, what is the current stock price in 2019 (SPo) based on both the stock price at year 2021 and dividends at year 2020 and 2021? (30points) The following VS is based on the information associated with a nevw Answer the questions. 2. Projected Income Statements Year 9,000,000 5,000,000 Sales Variable Cost Fixed Cost Depreciation EBIT Taxes (40%) 9,000,000 5,000,000 2,500,000 750,000o 750,000 300,000 450,000 9,000,000 5,000,000 2,500,000 750,000 750,000 300,000 450,000 5,000,000 2,500,000 750,000 750,000 750,00O 300,000 450,000 Net income 450,000 D We plan to invest s3,000,000 to get started. The residual book value of the new equipment is zero at Year 4 and it will be sold for $300,000 at the end of the project. Moreover, we need additional $50,000 in the net working capital (NWC) at the beginning of the project. The tax rate is 40%. Fill out the projected cash flow table. (70 points) Projected Cash Flows Year 0 4 OCF Changes in NWC Capital spending Total Cash Flow 3,000,000 0 II) Figure out both the net present value (NPV) and the profitability index (PI) of this project if the required return is 20%. Based on the NPV and PI, do you accept or reject this project? (50points) II) Figure out the discounted payback period (DPB) for this project if the required return is 20%. If the cutoff is 3 year, do you accept or reject this project? (30points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts