Question: i need help please. i dont understand this practice Decision Making Under Uncertainty and Risk: PRACTICE 1: The company Mutual Benefits has S 500.000 available

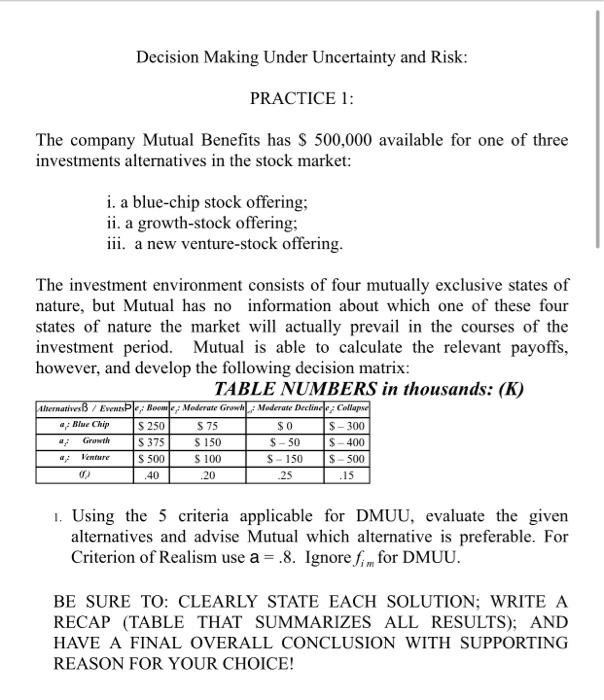

Decision Making Under Uncertainty and Risk: PRACTICE 1: The company Mutual Benefits has S 500.000 available for one of three investments alternatives in the stock market: i. a blue-chip stock offering; ii. a growth-stock offering; iii. a new venture-stock offering. The investment environment consists of four mutually exclusive states of nature, but Mutual has no information about which one of these four states of nature the market will actually prevail in the courses of the investment period. Mutual is able to calculate the relevant payoffs, however, and develop the following decision matrix: TABLE NUMBERS in thousands: (K) Alternatives B / Ewal Bowl Moderate Grow , Moderate Decliner: Collapse 4: Blue Chip S 250 $75 $0 S-300 Growth S 375 S 150 S-50 S-400 2: Venture S 500 S 100 - 150 $-500 0 .40 .20 25 .15 1. Using the 5 criteria applicable for DMUU, evaluate the given alternatives and advise Mutual which alternative is preferable. For Criterion of Realism use a = .8. Ignore fi for DMUU. BE SURE TO: CLEARLY STATE EACH SOLUTION; WRITE A RECAP (TABLE THAT SUMMARIZES ALL RESULTS); AND HAVE A FINAL OVERALL CONCLUSION WITH SUPPORTING REASON FOR YOUR CHOICE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts