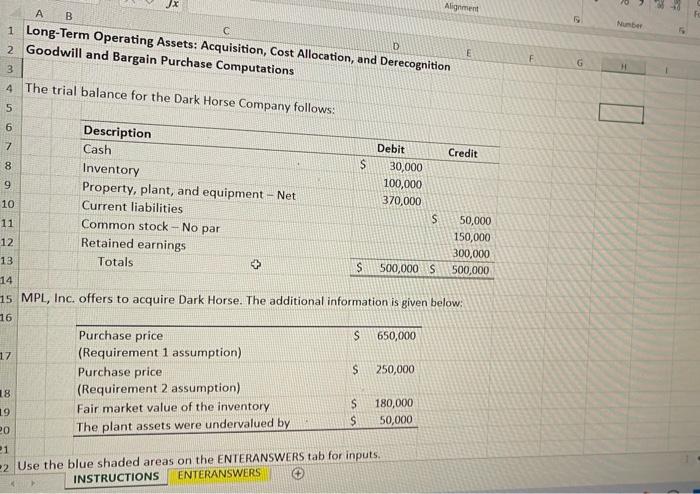

Question: I need help please Long-Term Operating Assets: Acquisit 2 Goodwill and Bargain Purchase Computations Allocation, and Derecognition The trial balance for the Dark Horse Company

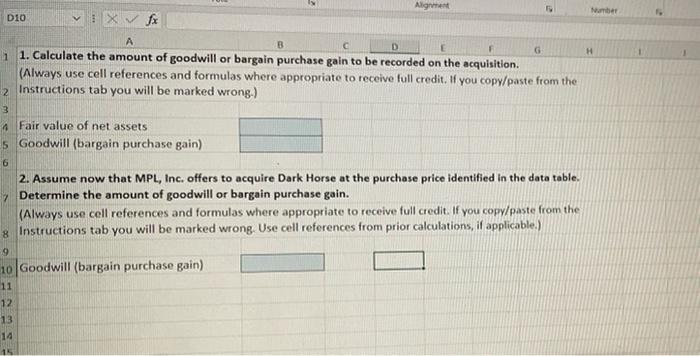

Long-Term Operating Assets: Acquisit 2 Goodwill and Bargain Purchase Computations Allocation, and Derecognition The trial balance for the Dark Horse Company follows: MPL, Inc. offers to acquire Dark Horse. The additional information is given below: Use the blue shaded areas on the ENIERANSWERS tab for inputs. INSTRUCTIONS 1. Calculate the amount of goodwill or bargain purchase gain to be recorded on the acquisition. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong.) 2. Assume now that MPL, Inc, offers to acquire Dark Horse at the purchase price identified in the data table. Determine the amount of goodwill or bargain purchase gain. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Use cell references from prior calculations, if applicable.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts