Question: I need help please! Much appreciated. Required information Problem 18-45 (LO 18-2) (AlgO) [The following information applies to the questions displayed below.] Volunteer Corporation reported

I need help please!

Much appreciated.

![(AlgO) [The following information applies to the questions displayed below.] Volunteer Corporation](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ee10764ab7d_81366ee1075f331b.jpg)

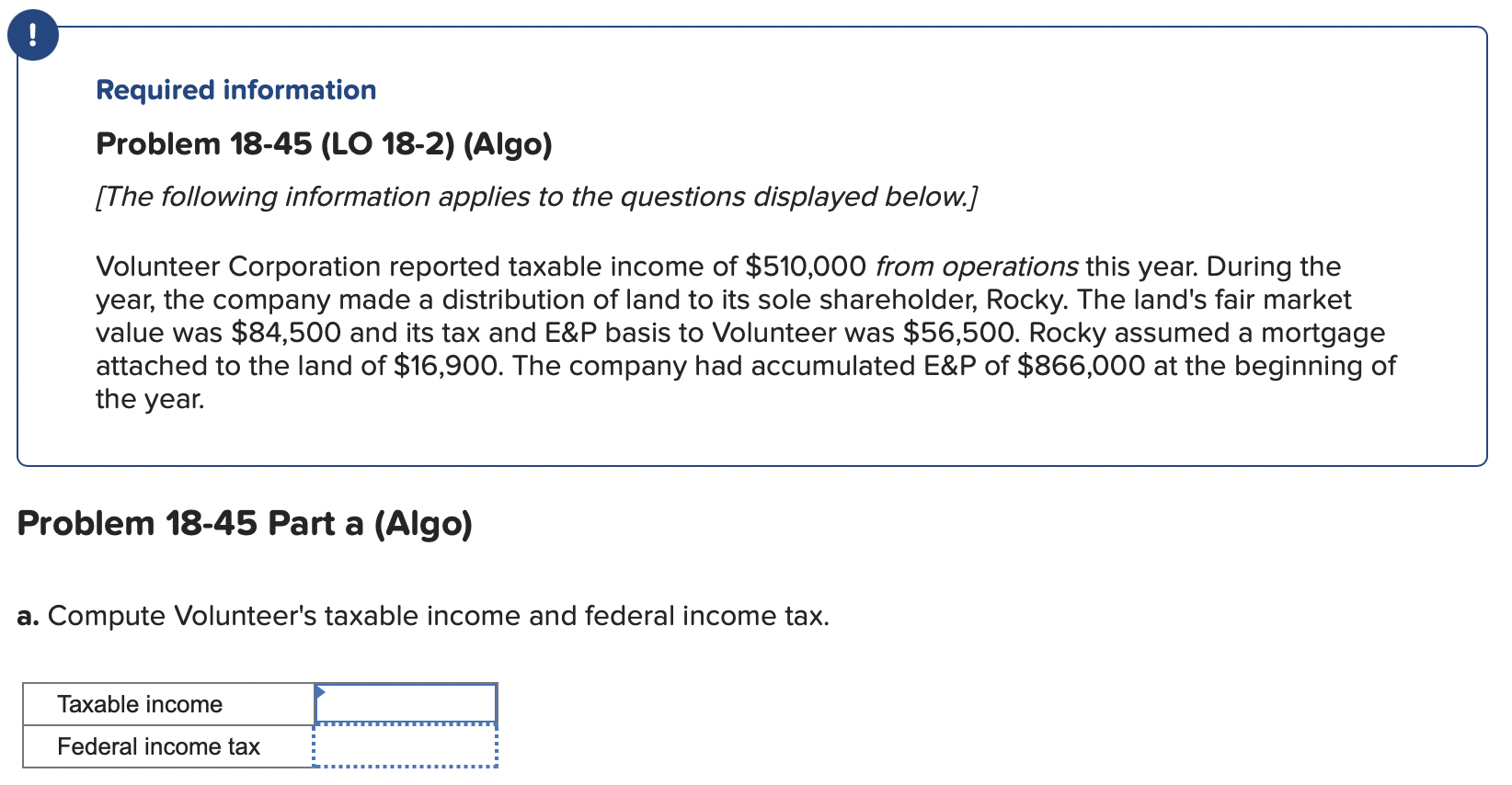

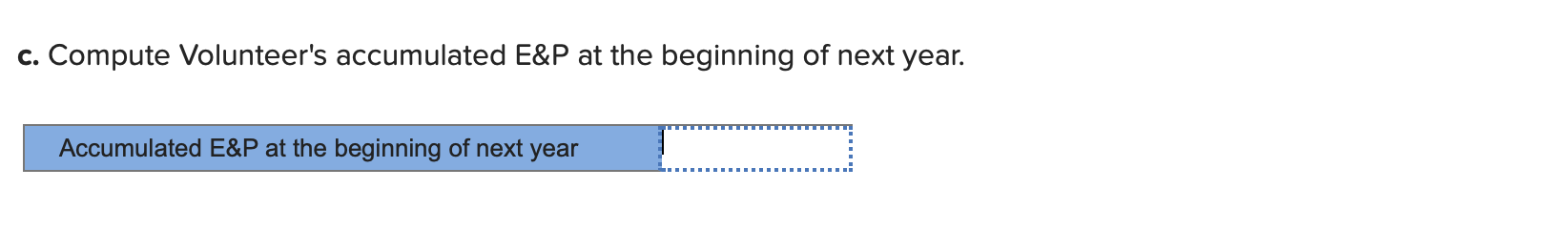

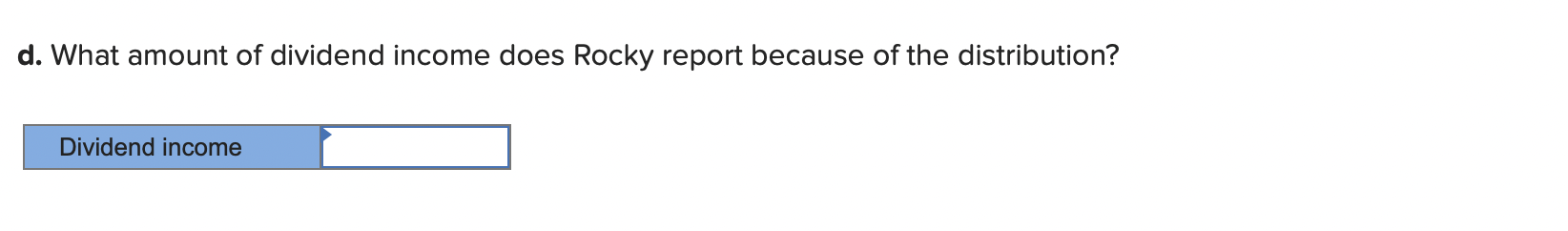

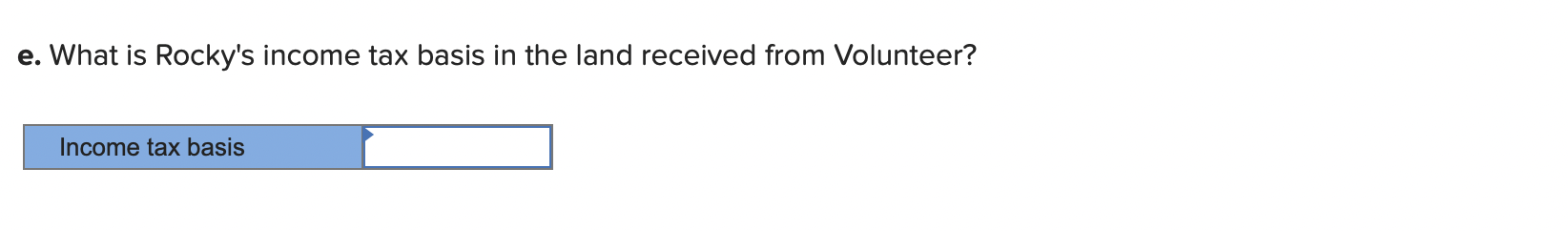

Required information Problem 18-45 (LO 18-2) (AlgO) [The following information applies to the questions displayed below.] Volunteer Corporation reported taxable income of $510,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky. The land's fair market value was $84,500 and its tax and E\&P basis to Volunteer was $56,500. Rocky assumed a mortgage attached to the land of $16,900. The company had accumulated E\&P of $866,000 at the beginning of the year. Problem 18-45 Part a (Algo) a. Compute Volunteer's taxable income and federal income tax. b. Compute Volunteer's current E\&P. c. Compute Volunteer's accumulated E\&P at the beginning of next year. d. What amount of dividend income does Rocky report because of the distribution? e. What is Rocky's income tax basis in the land received from Volunteer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts