Question: I need help please Name ACCT 6335 Class Case 3 Droog Co. is a retailer dealing in a single product. Beginning inventory at January 1

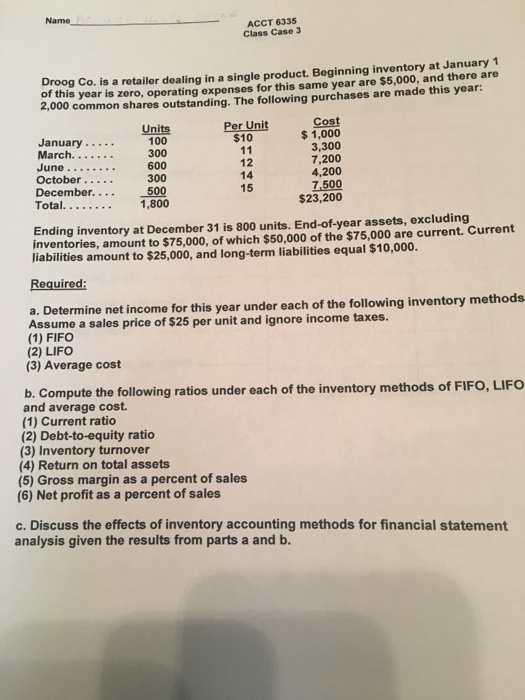

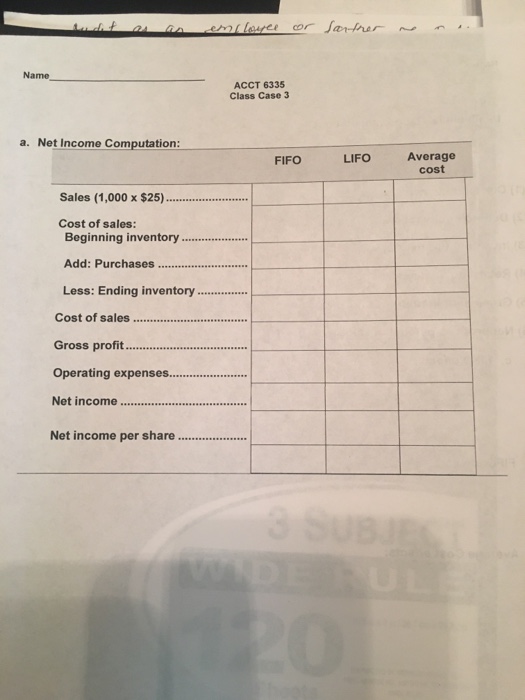

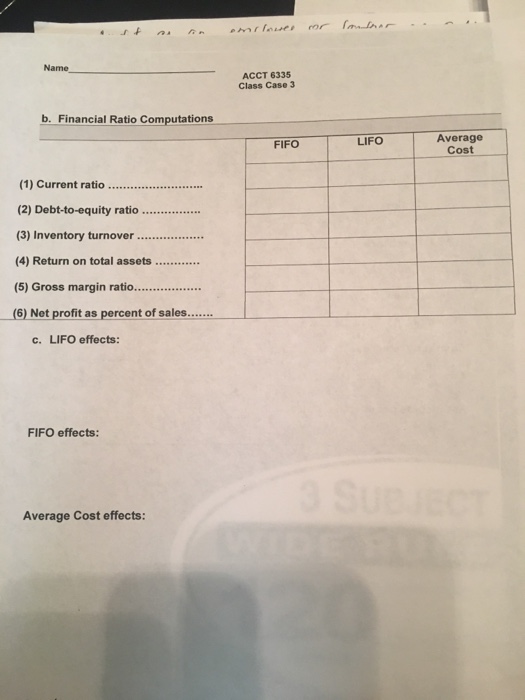

Name ACCT 6335 Class Case 3 Droog Co. is a retailer dealing in a single product. Beginning inventory at January 1 of this year is zero, operating expenses for this same year are $5,000, and there are 2,000 common shares outstanding. The following purchases are made this year: Cost $1,000 3,300 7,200 4,200 7.500 $23,200 Per Unit $10 Units 100 300 600 300 December.. ..500 January.... June October. 12 14 15 Ending inventory at December 31 is 800 units. End-of-year assets, excluding inventories, amount to $75,000, of which $50,000 of the $75,000 are current. Current liabilitios amount to $25,000, and long-term liabilities equal $10,000. Required: a. Determine net income for this year under each of the following inventory methods Assume a sales price of $25 per unit and ignore income taxes. (1) FIFO (2) LIFO (3) Average cost b. Compute the following ratios under each of the inventory methods of FIFO, LIFO and average cost. (1) Current ratio (2) Debt-to-equity ratio (3) Inventory turnover (4) Return on total assets (5) Gross margin as a percent of sales (6) Net profit as a percent of sales c. Discuss the effects of inventory accounting methods for financial statement analysis given the results from parts a and b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts