Question: i need help please :) Sara files as a single taxpayer for 2021. She has wage income of $90,000; net long-term capital gains of $30,000;

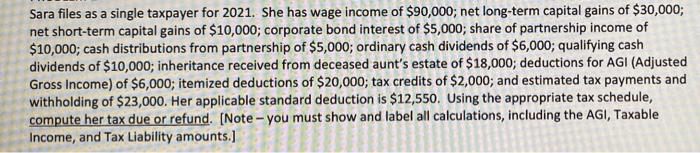

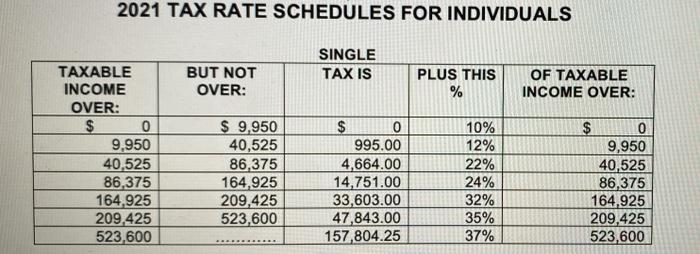

Sara files as a single taxpayer for 2021. She has wage income of $90,000; net long-term capital gains of $30,000; net short-term capital gains of $10,000; corporate bond interest of $5,000; share of partnership income of $10,000; cash distributions from partnership of $5,000; ordinary cash dividends of $6,000; qualifying cash dividends of $10,000; inheritance received from deceased aunt's estate of $18,000; deductions for AGI (Adjusted Gross Income) of $6,000; itemized deductions of $20,000; tax credits of $2,000; and estimated tax payments and withholding of $23,000. Her applicable standard deduction is $12,550. Using the appropriate tax schedule, compute her tax due or refund. [Note - you must show and label all calculations, including the AGI, Taxable Income, and Tax Liability amounts.] 2021 TAX RATE SCHEDULES FOR INDIVIDUALS BUT NOT OVER: SINGLE TAX IS PLUS THIS % OF TAXABLE INCOME OVER: TAXABLE INCOME OVER: $ 0 9,950 40,525 86,375 164,925 209,425 523,600 $ 9,950 40,525 86,375 164,925 209,425 523,600 $ 0 995.00 4,664.00 14,751.00 33,603.00 47,843.00 157,804.25 10% 12% 22% 24% 32% 35% 37% $ 0 9,950 40,525 86,375 164,925 209,425 523,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts