Question: I need help please solving this question, please. Thank you. 11. Which of the following bonds would have the largest change in price (in percentage

I need help please solving this question, please. Thank you.

I need help please solving this question, please. Thank you.

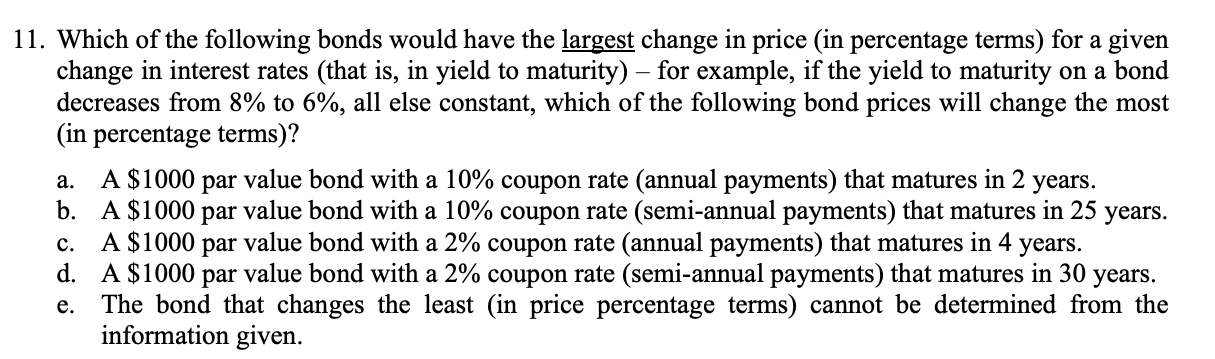

11. Which of the following bonds would have the largest change in price (in percentage terms) for a given change in interest rates (that is, in yield to maturity) - for example, if the yield to maturity on a bond decreases from 8% to 6%, all else constant, which of the following bond prices will change the most (in percentage terms)? a. A $1000 par value bond with a 10% coupon rate (annual payments) that matures in 2 years. b. A $1000 par value bond with a 10% coupon rate (semi-annual payments) that matures in 25 years. c. A $1000 par value bond with a 2% coupon rate (annual payments) that matures in 4 years. d. A $1000 par value bond with a 2% coupon rate (semi-annual payments) that matures in 30 years. e. The bond that changes the least (in price percentage terms) cannot be determined from the information given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts