Question: i need help please with question 21 Question 20 1 pts Assume spot rate for Canadian Dollar is $0.9100 and the three-month forward rate is

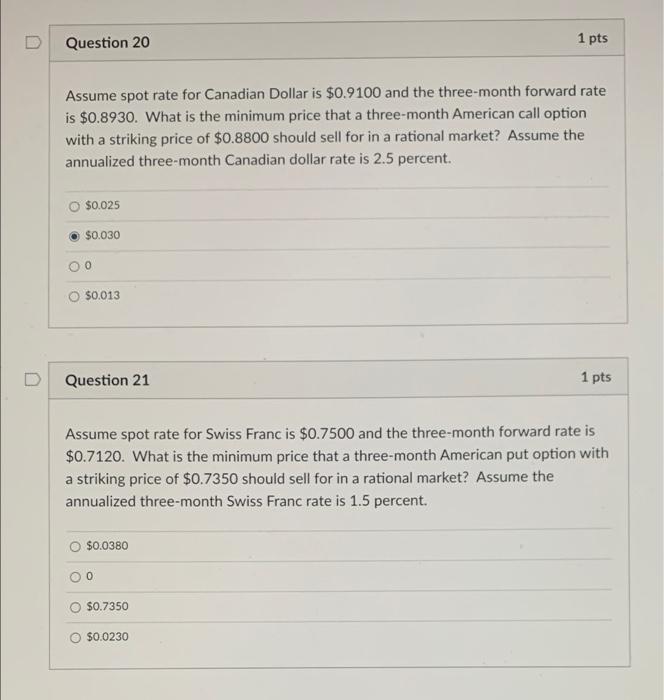

Question 20 1 pts Assume spot rate for Canadian Dollar is $0.9100 and the three-month forward rate is $0.8930. What is the minimum price that a three-month American call option with a striking price of $0.8800 should sell for in a rational market? Assume the annualized three-month Canadian dollar rate is 2.5 percent. O $0.025 $0.030 0 $0.013 Question 21 1 pts Assume spot rate for Swiss Franc is $0.7500 and the three-month forward rate is $0.7120. What is the minimum price that a three-month American put option with a striking price of $0.7350 should sell for in a rational market? Assume the annualized three-month Swiss Franc rate is 1.5 percent. $0.0380 Oo $0.7350 $0.0230

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts