Question: I need help please write clear ezto.mhe Chapter 19 HW Question 2 (of 25) 2. 10.00 points JBL Aircraft manufactures and distributes aircraft parts and

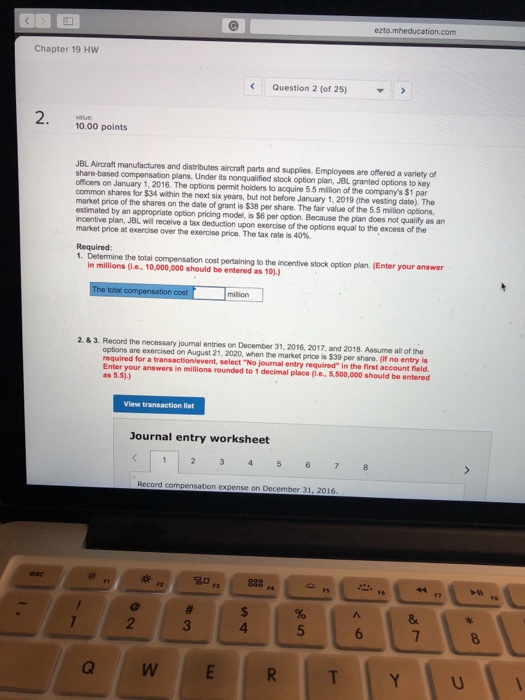

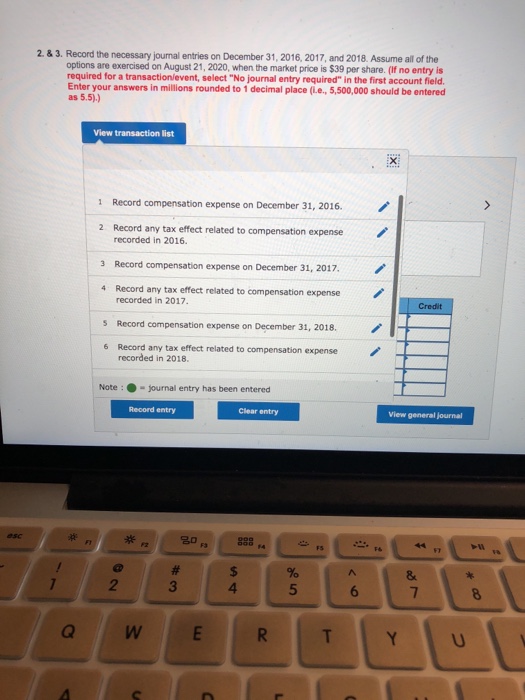

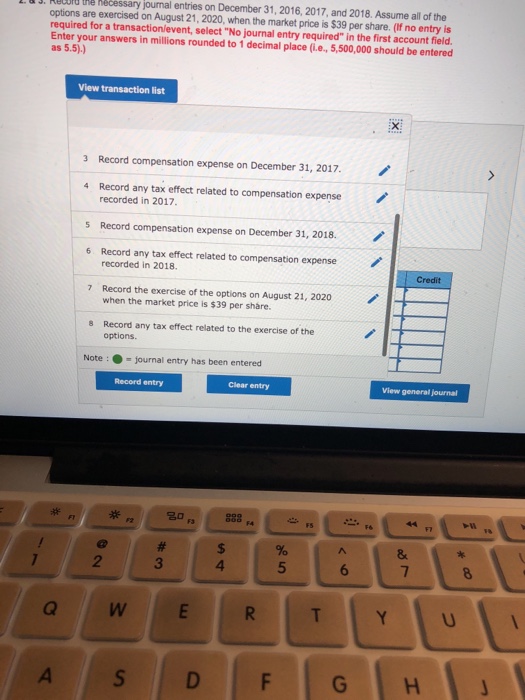

ezto.mhe Chapter 19 HW Question 2 (of 25) 2. 10.00 points JBL Aircraft manufactures and distributes aircraft parts and supplies. Employees are offered a variety of share-based compensation plans. Under its nonqualified stock option plan, JBL granted options to key officers on January 1, 2016. The options permit holders to acquire 5.5 million of the company's $1 par common shares for $34 within the next six years, but not before January 1, 2019 (the vesting date). The market price of the shares on the date of grant is $38 per share. The fair value of the 5.5 milion options estimated by an appropriate option pricing model, is $6 per option. Because the plan does not qualify as arn incentive plan, JBL will receive a tax deduction upon exercise of the options equal to the excess of the market price at exer ise over the exercise price. The tax rate is 40% Required 1. Determine the total compensation cost pertaining to the incentive stock option plan. (Enter your answer in millions (.e 10,000,000 should be entered as 10).) 2. & 3. Record the necessary jourmal entries on December 31, 2016, 2017, and 2018. Assume all of the options are exercised on August 21, 2020, when the market price is $39 per share. (If no entry is Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Journal entry worksheet mber 3 2 4 a ERTYIu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts