Question: I NEED HELP PLZZZ Read the requirements. Data table Requirement 1. Compute the product cost per game produced under absorption costing and under variable costing.

I NEED HELP PLZZZ

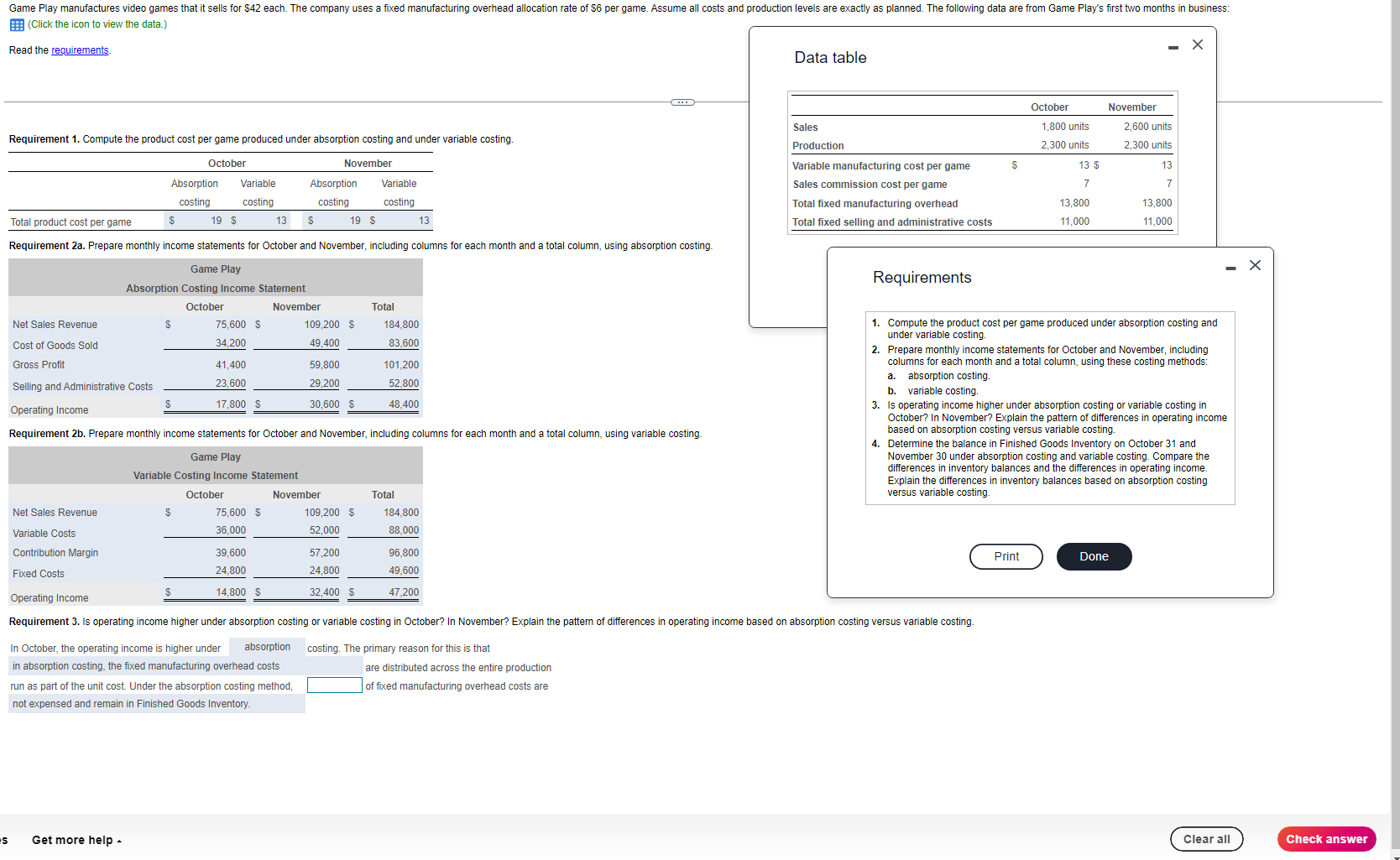

Read the requirements. Data table Requirement 1. Compute the product cost per game produced under absorption costing and under variable costing. Requirement 2a. Prepare monthly income statements for October and November, including columns for each month and a total column, using absorption costing. Requirements 1. Compute the product cost per game produced under absorption costing and under variable costing. 2. Prepare monthly income statements for October and November, including columns for each month and a total column, using these costing methods: a. absorption costing b. variable costing. 3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income Requirement 2b. Prepare monthly income statements for October and November, including columns for each month and a total column, using variable costing based on absorption costing versus variable costing. 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on absorption costing versus variable costing. In October, the operating income is higher under costing. The primary reason for this is that in absorption costing, the fixed manufacturing overhead costs are distributed across the entire production run as part of the unit cost. Under the absorption costing method, of fixed manufacturing overhead costs are not expensed and remain in Finished Goods Inventory Read the requirements. Data table Requirement 1. Compute the product cost per game produced under absorption costing and under variable costing. Requirement 2a. Prepare monthly income statements for October and November, including columns for each month and a total column, using absorption costing. Requirements 1. Compute the product cost per game produced under absorption costing and under variable costing. 2. Prepare monthly income statements for October and November, including columns for each month and a total column, using these costing methods: a. absorption costing b. variable costing. 3. Is operating income higher under absorption costing or variable costing in October? In November? Explain the pattern of differences in operating income Requirement 2b. Prepare monthly income statements for October and November, including columns for each month and a total column, using variable costing based on absorption costing versus variable costing. 4. Determine the balance in Finished Goods Inventory on October 31 and November 30 under absorption costing and variable costing. Compare the differences in inventory balances and the differences in operating income. Explain the differences in inventory balances based on absorption costing versus variable costing. In October, the operating income is higher under costing. The primary reason for this is that in absorption costing, the fixed manufacturing overhead costs are distributed across the entire production run as part of the unit cost. Under the absorption costing method, of fixed manufacturing overhead costs are not expensed and remain in Finished Goods Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts