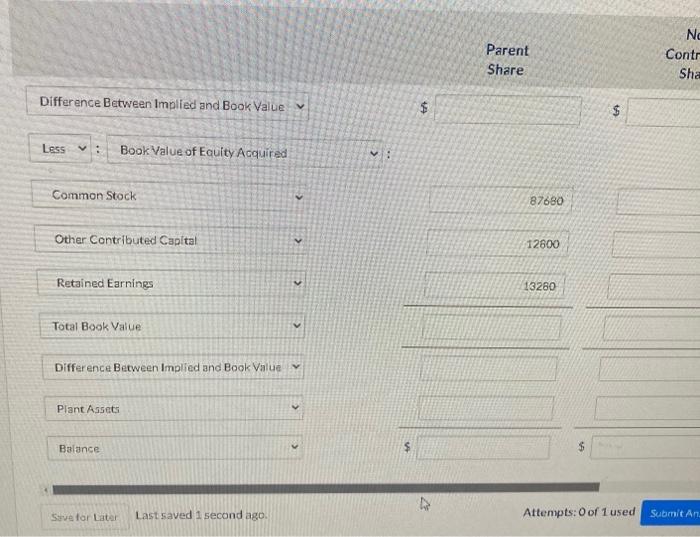

Question: i need help preparing a schedule to compute the different between book value and equity and value implied by the purchase price. any different between

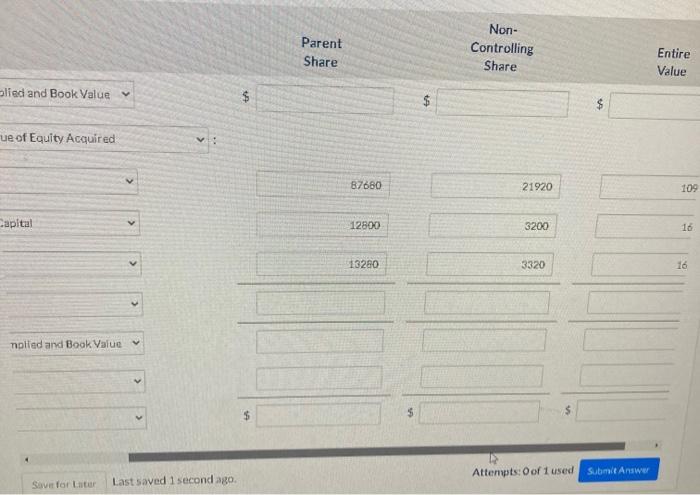

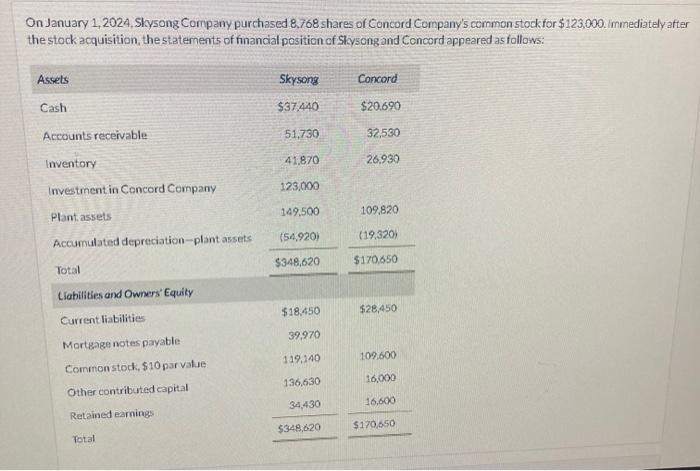

Parent Share Difference Between Implied and Book Value v Less : Book Value of Equity Acquired Common Stock Other Contributed Capltal Retained Earnings Total Book Value Difference Between Implied and Book Value Plant Assets Baiance Strefor Later Last saved I second ago. Attempts: 0 of 1 used Parent Share Non- Controlling Share Entire Value 87680 21920 $ ue of Equity Acquired Aapital 12800 $ $ nolied and Book Value Save for Litur Last saved 1 second ago. Atternpts: O of 1 used Submit Answer On January 1,2024, Skysong Company purchased 8,768 shares of Concord Company's common stockfor $123,000. Immediately after the stock acquisition, the staternents of financial position of Skysong and Concord appeared as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts