Question: I need help preparing journal entries for each transaction then posting each transaction to the appropriate ledger account!! Thank you!! As the recently appointed Controller

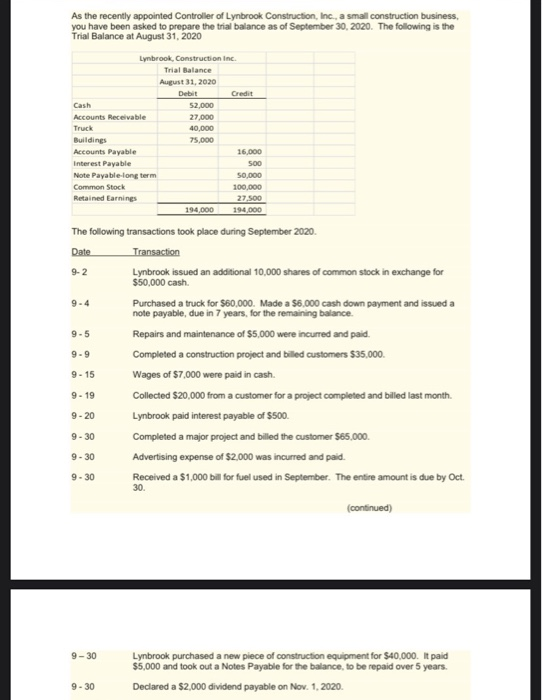

As the recently appointed Controller of Lynbrook Construction, Inc., a small construction business, you have been asked to prepare the trial balance as of September 30, 2020. The following is the Trial Balance at August 31, 2020 Lynbrook, Construction Inc. Trial Balance August 31, 2020 Debit Credit Cash 52,000 Accounts Receivable 27,000 Truck 40,000 Buildings 75,000 Accounts Payable 16,000 Interest Payable 500 Note Payable-long term 50,000 Common Stock 100.000 Retained Earnings 27.500 194,000 194.000 Date 9-4 9-5 9-9 The following transactions took place during September 2020. Transaction 9-2 Lynbrook issued an additional 10,000 shares of common stock in exchange for $50,000 cash. Purchased a truck for $60,000. Made a $6,000 cash down payment and issued a note payable, due in 7 years, for the remaining balance. Repairs and maintenance of $5,000 were incurred and paid. Completed a construction project and billed customers $35,000 9-15 Wages of $7,000 were paid in cash. Collected $20,000 from a customer for a project completed and biled last month Lynbrook paid interest payable of $500. Completed a major project and billed the customer $65,000. 9-30 Advertising expense of $2,000 was incurred and paid Received a $1,000 bill for fuel used in September. The entire amount is due by Oct. 30 (continued) 9-19 9-20 9-30 9.30 9-30 Lynbrook purchased a new piece of construction equipment for $40,000. It paid $5,000 and took out a Notes Payable for the balance to be repaid over 5 years. Declared a $2,000 dividend payable on Nov. 1, 2020. 9 - 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts