Question: I Need help putting the notes from the word document into my excel spreadsheet Excel File Edit Data Window Help 100% 4-2 Mon 12:48 PM

I Need help putting the notes from the word document into my excel spreadsheet

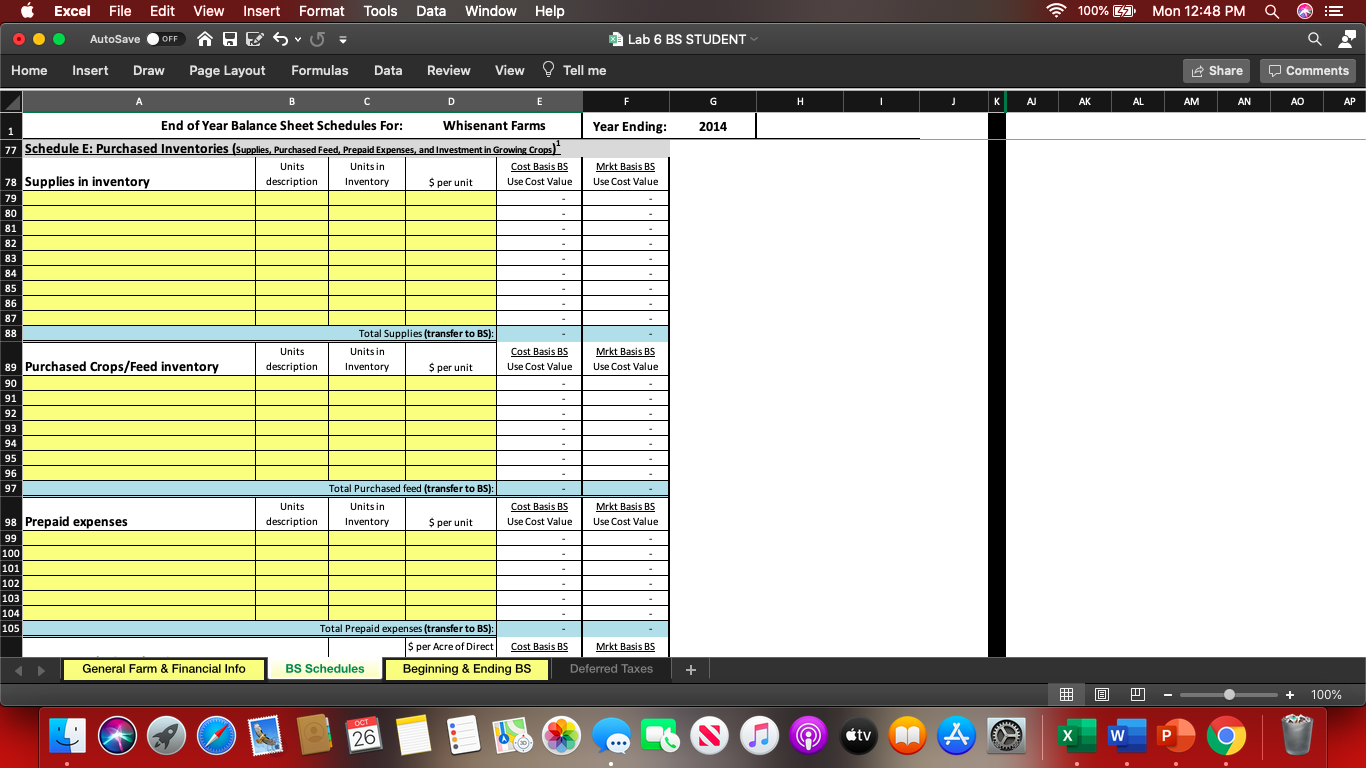

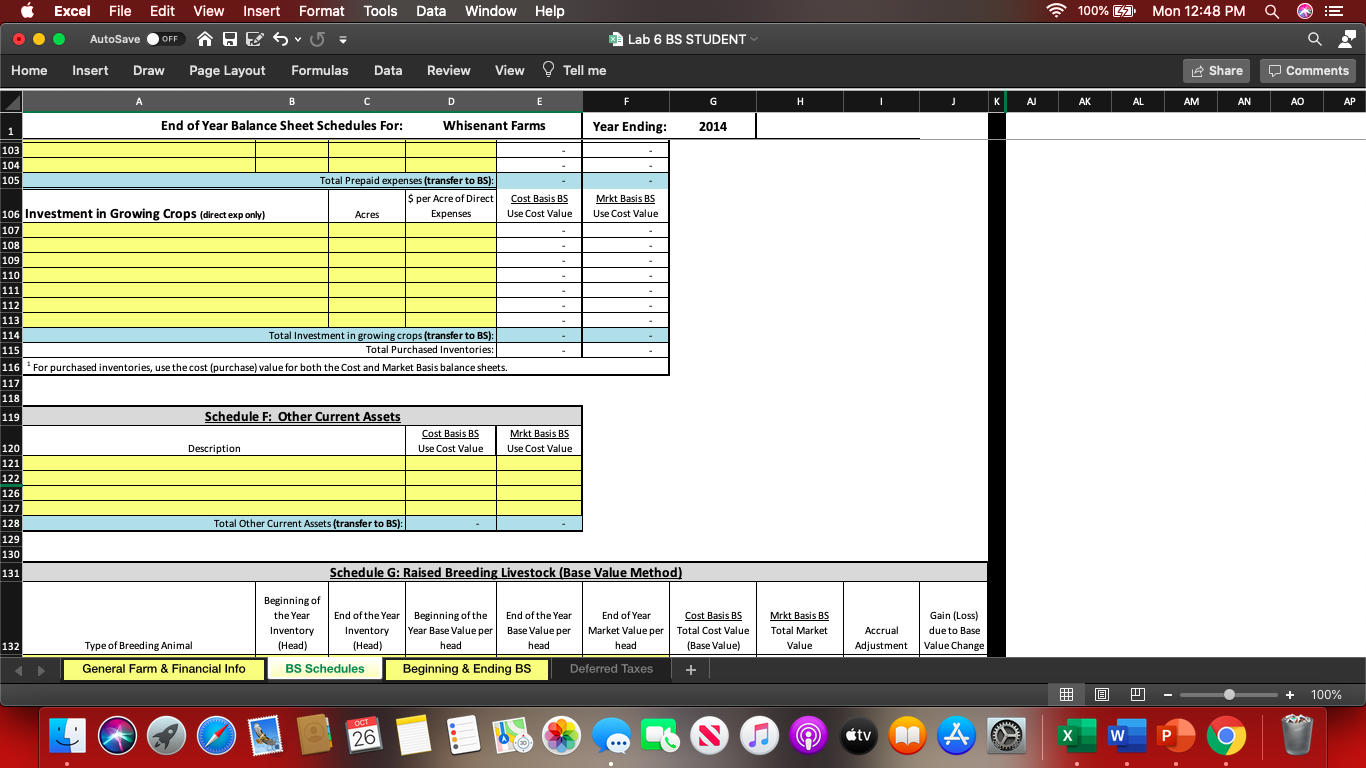

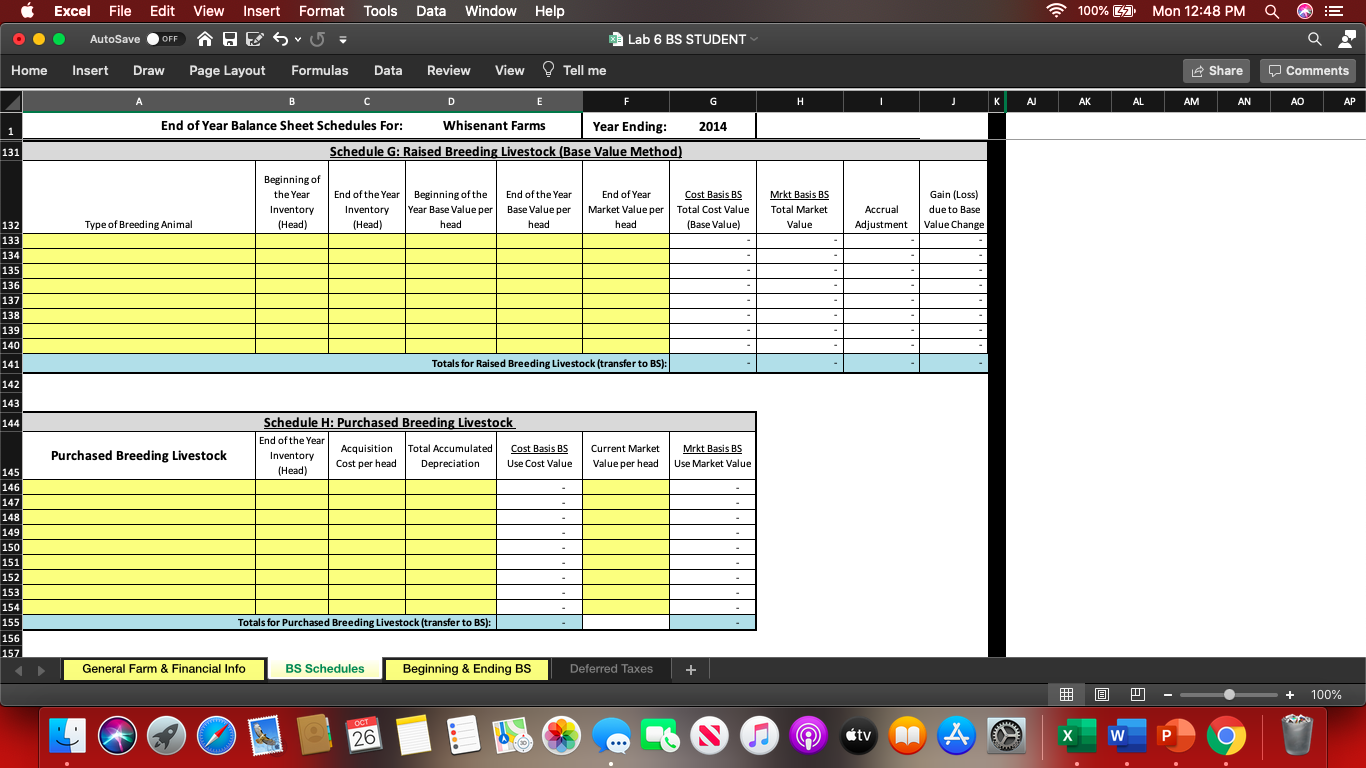

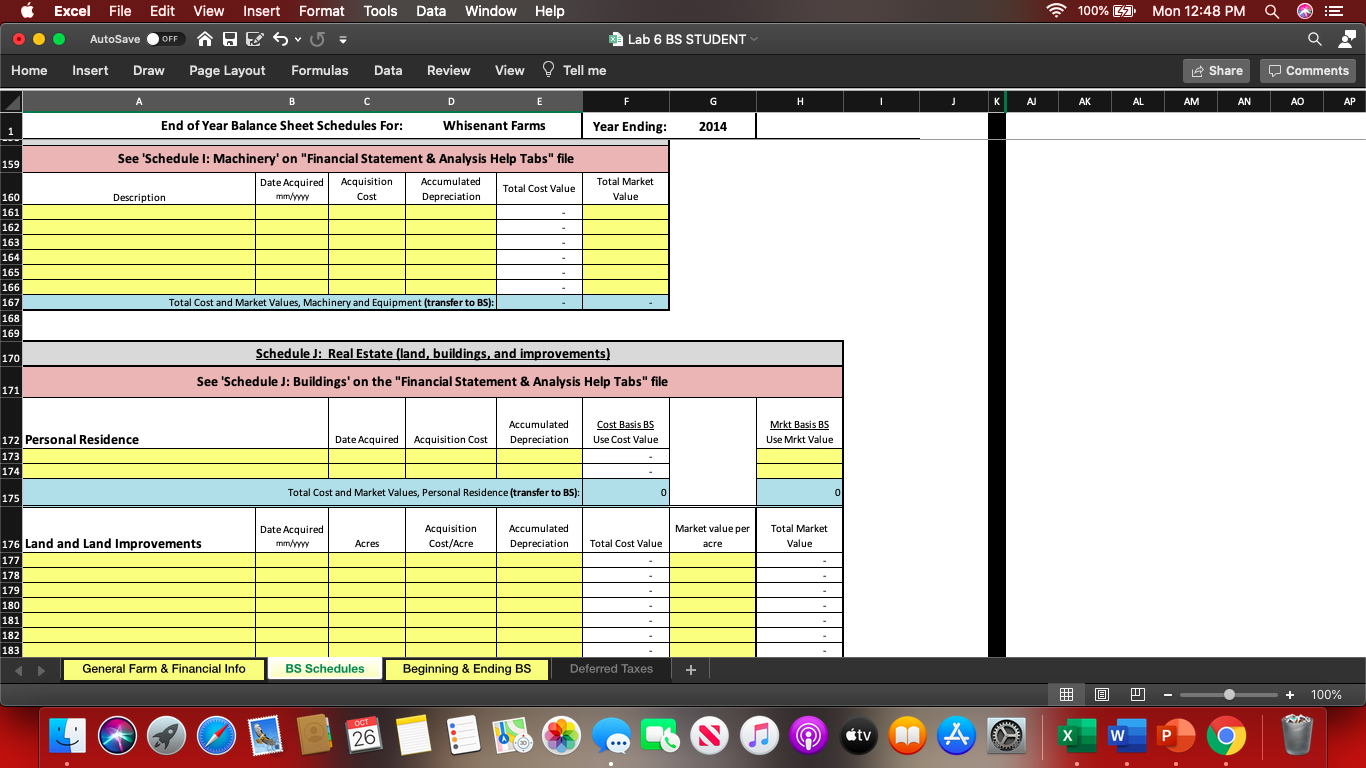

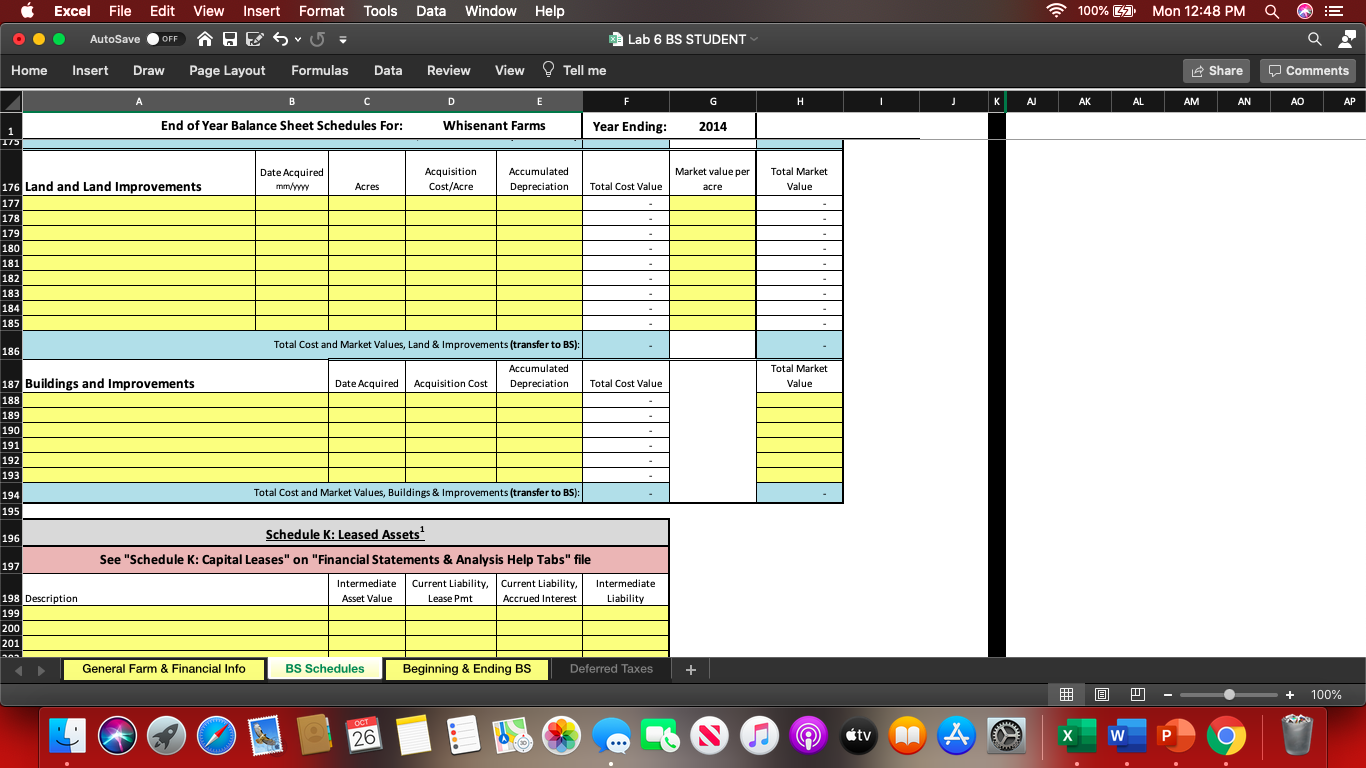

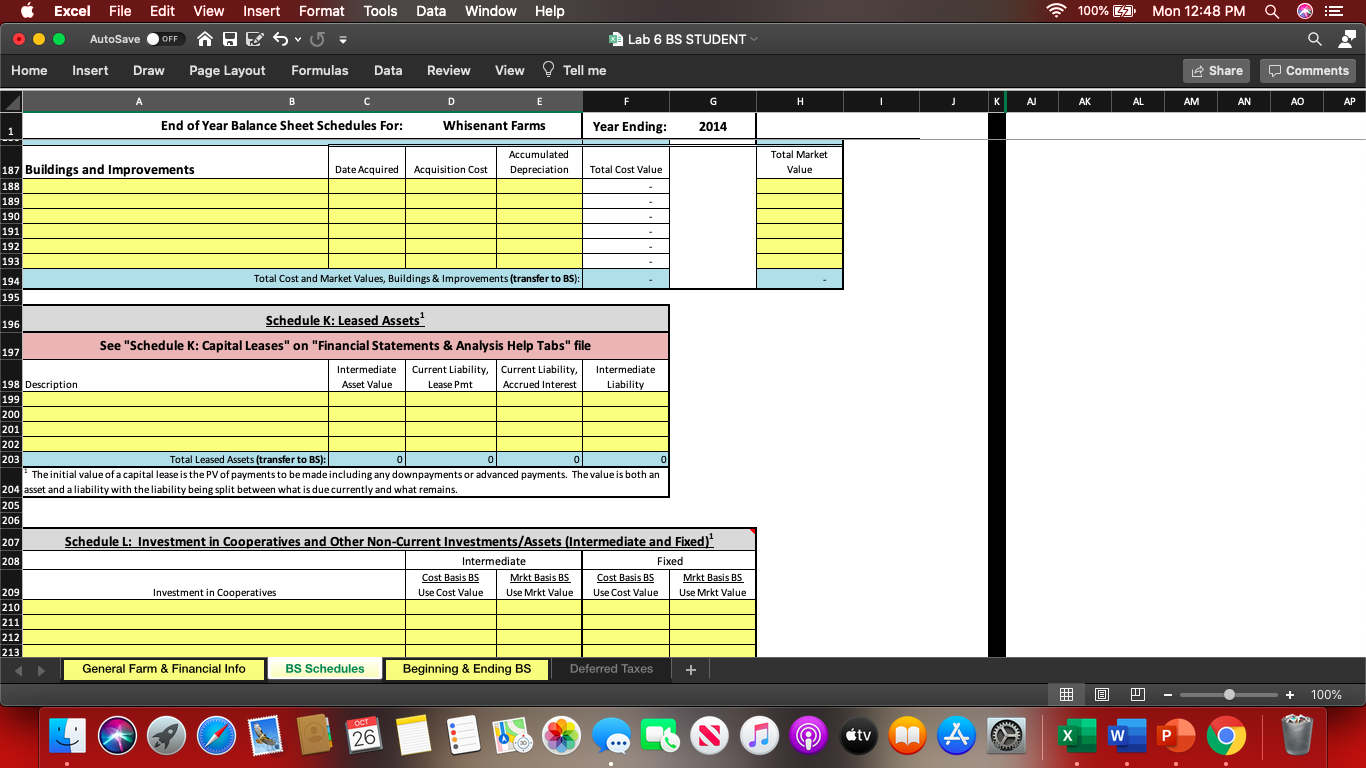

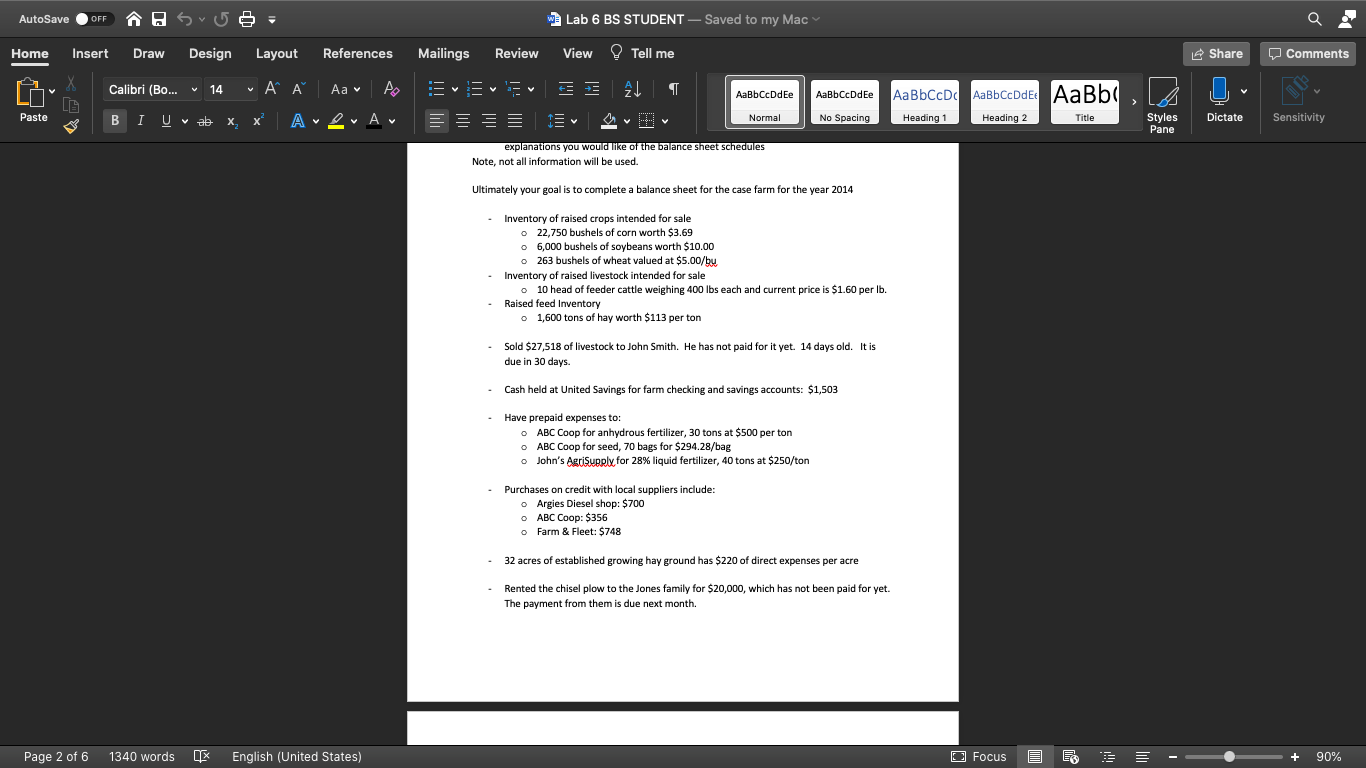

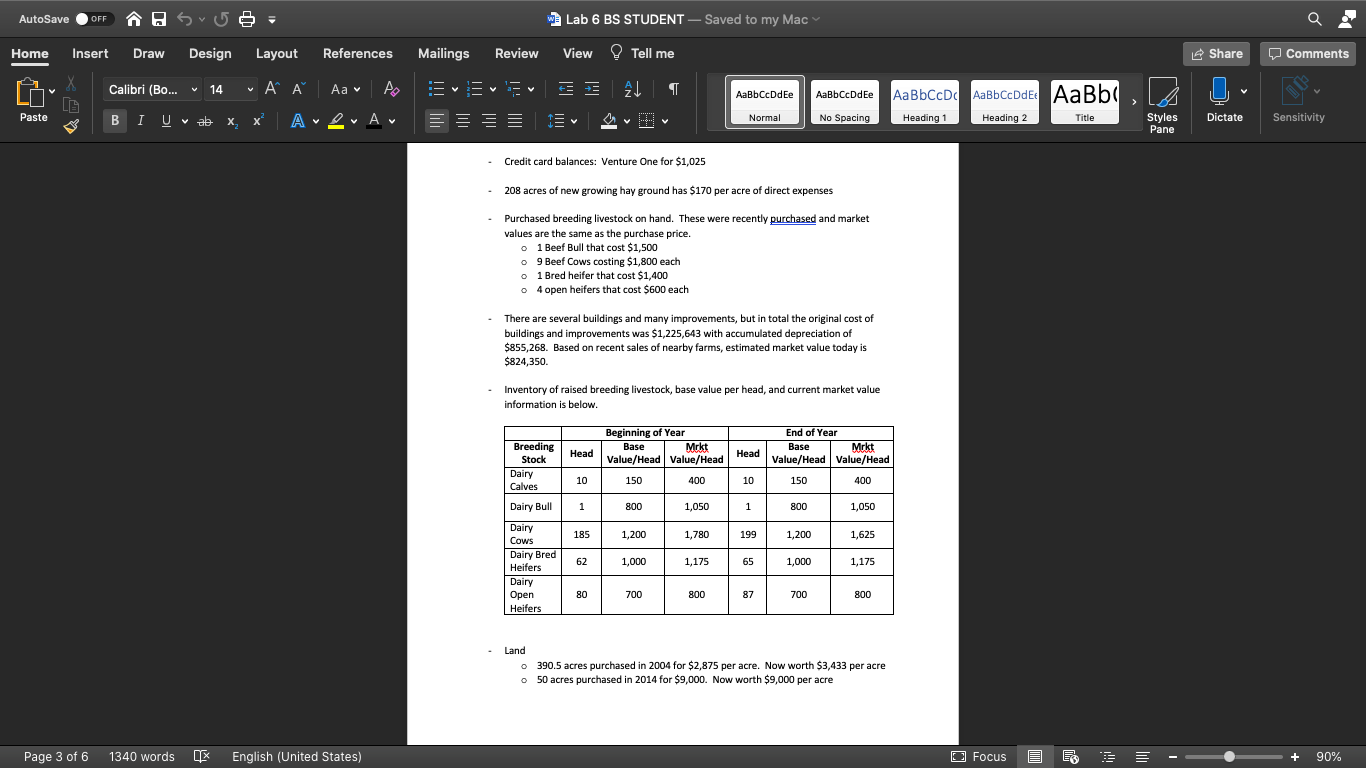

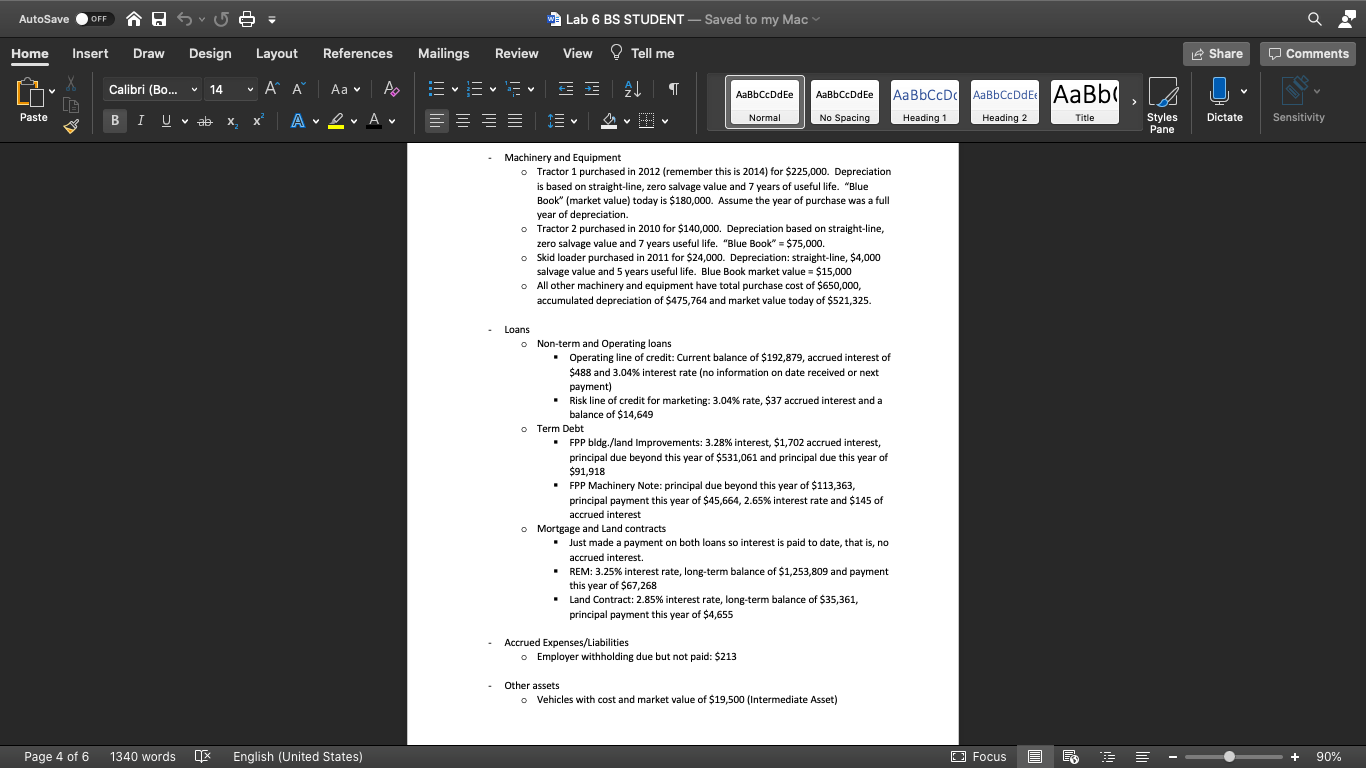

Excel File Edit Data Window Help 100% 4-2 Mon 12:48 PM E View Insert Format Tools BES = AutoSave OFF Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B F G . J KAJ AK AL AM AN AP Year Ending: 2014 A D E 1 End of Year Balance Sheet Schedules For: Whisenant Farms 77 Schedule E: Purchased Inventories (Supplies, Purchased Feed, Prepaid Expenses, and Investment in Growing Crops) Units Units in Cost Basis BS 78 Supplies in inventory description Inventory $ per unit Use Cost Value 79 Mrkt Basis BS Use Cost Value 80 81 82 83 84 85 86 87 88 Units description Total Supplies (transfer to BS): Units in S per unit Cost Basis BS Use Cost Value Mrkt Basis BS Use Cost Value Inventory 89 Purchased Crops/Feed inventory 90 91 92 93 94 95 96 97 Units description Total Purchased feed (transfer to BS): | Units in Inventory $ per unit Cost Basis BS Use Cost Value Mrkt Basis BS Use Cost Value 98 Prepaid expenses 99 100 101 102 103 104 105 Total Prepaid expenses (transfer to BS): $ per Acre of Direct Cost Basis BS Mrkt Basis BS BS Schedules Beginning & Ending BS Deferred Taxes General Farm & Financial Info + 3 + 100% OCT AM 26 0 (tv 4 W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF HESUS = Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B D E F . J KAJ AK AL AM AN AP 2014 End of Year Balance Sheet Schedules For: Whisenant Farms 1 Year Ending 103 104 105 Total Prepaid expenses (transfer to BS): $ per Acre of Direct Cost Basis BS Mrkt Basis BS 106 Investment in Growing Crops (direct exp only) Acres Expenses Use Cost Value Use Cost Value 107 108 109 110 111 112 113 114 Total Investment in growing crops (transfer to BS): 115 Total Purchased Inventories: 116 For purchased inventories, use the cost (purchase) value for both the cost and Market Basis balance sheets. 117 118 119 Schedule F: Other Current Assets Cost Basis BS Mrkt Basis BS 120 Description Use Cost Value Use Cost Value 121 122 126 127 128 Total Other Current Assets (transfer to BS): 129 130 131 Schedule G: Raised Breeding Livestock (Base Value Method) Beginning of the Year End of the Year Beginning of the End of the Year End of Year Cost Basis BS Inventory Inventory Year Base Value per Base Value per Market Value per Total Cost Value (Head) (Head) head head head (Base Value) BS Schedules Beginning & Ending BS Deferred Taxes + Mrkt Basis BS Total Market Value Accrual Adjustment Gain (Loss) due to Base Value Change 132 Type of Breeding Animal General Farm & Financial Info 3 + 100% OCT AM 26 tv N W Excel File Edit 100% 4-2 Mon 12:48 PM E AutoSave OFF View Insert Format Tools Data Window Help HESUS = Page Layout Formulas Data Review View Tell me Lab 6 BS STUDENT Q Home Insert Draw Share 0 Comments B D E F H J K A AK AL AM AN AP 1 1 2014 End of Year Balance Sheet Schedules For: Whisenant Farms Year Ending: Schedule G: Raised Breeding Livestock (Base Value Method) 131 Beginning of the Year Inventory (Head) End of the Year Inventory (Head) Beginning of the Year Base Value per head End of the Year Base Value per head End of Year Market Value per head Cost Basis BS Total Cost Value (Base Value) Mrkt Basis BS Total Market Value Accrual Adjustment Gain (Loss) due to Base Value Change Type of Breeding Animal 132 133 134 135 136 137 138 139 140 141 Totals for Raised Breeding Livestock (transfer to BS): | 142 143 144 Schedule H: Purchased Breeding Livestock End of the Year Acquisition Total Accumulated Cost Basis BS Inventory Cost per head (Head) Depreciation Use Cost Value Purchased Breeding Livestock Current Market Value per head Mrkt Basis BS Use Market Value 145 146 147 148 149 150 151 152 153 154 155 156 157 Totals for Purchased Breeding Livestock (transfer to BS): General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes + 3 + 100% OCT AM 26 0 tv 4 W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF HES 5 = Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B D E F . J KAJ AK AL AM AN AP End of Year Balance Sheet Schedules For: Whisenant Farms Year Ending: 2014 1 159 See 'Schedule 1: Machinery' on "Financial Statement & Analysis Help Tabs" file Date Acquired Acquisition Accumulated Total Cost Value Description mm/yyy Cost Depreciation Total Market Value 160 161 162 163 164 165 166 167 168 169 Total Cost and Market Values, Machinery and Equipment (transfer to BS): 170 Schedule ): Real Estate (land, buildings, and improvements) See 'Schedule J: Buildings' on the "Financial Statement & Analysis Help Tabs" file 171 Accumulated Depreciation Cost Basis BS Use Cost Value Mrkt Basis BS Use Mrkt Value Date Acquired Acquisition Cost 172 Personal Residence 173 174 Total Cost and Market Values, Personal Residence (transfer to BS): 175 0 0 Market value per Date Acquired mm/yyy Acquisition Cost/Acre Accumulated Depreciation Total Market Value Acres Total Cost Value acre 176 Land and Land Improvements 177 178 179 180 181 182 183 General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes + 3 + 100% OCT AM 26 (tv 4 W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF Sv= Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments A B D E F H J KAJ AK AL AM AN AP End of Year Balance Sheet Schedules For: Whisenant Farms Year Ending 2014 1 1 175 Date Acquired mm/yyyy Acquisition Market value per Accumulated Depreciation Total Market Value Acres Cost/Acre Total Cost Value acre 176 Land and Land Improvements 177 178 179 180 181 182 183 184 185 Total Cost and Market Values, Land & Improvements (transfer to BS): 186 Accumulated Depreciation Total Market Value Date Acquired Acquisition Cost Total Cost Value 187 Buildings and Improvements 188 189 190 191 192 193 194 Total Cost and Market Values, Buildings & Improvements (transfer to BS): 195 196 197 Schedule K: Leased Assets See "Schedule K: Capital Leases" on "Financial Statements & Analysis Help Tabs" file Intermediate Current Liability, Current Liability, Asset Value Lease Pmt Accrued Interest Intermediate Liability 198 Description 199 200 201 General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes 3 + 100% OCT AM 26 0 tvm W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF HESU- Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B D E F G H J KAJ AK AL AM AN AP End of Year Balance Sheet Schedules For: Whisenant Farms 1 1 2014 Year Ending: Accumulated Depreciation Total Market Value Date Acquired Acquisition Cost Total Cost Value 187 Buildings and Improvements 188 189 190 191 192 193 194 195 Total Cost and Market Values, Buildings & Improvements (transfer to BS): 0 0 0 0 196 Schedule K: Leased Assets See "Schedule K: Capital Leases" on "Financial Statements & Analysis Help Tabs" file 197 Intermediate Current Liability, Current Liability, Intermediate 198 Description Asset Value Lease Pmt Accrued Interest Liability 199 200 201 202 203 Total Leased Assets (transfer to BS): The initial value of a capital lease is the PV of payments to be made including any downpayments or advanced payments. The value is both an 204 asset and a liability with the liability being split between what is due currently and what remains. 205 206 207 Schedule L: Investment in Cooperatives and Other Non-Current Investments/Assets (Intermediate and Fixed)? 208 Intermediate Fixed Cost Basis BS Mrkt Basis BS Cost Basis BS Mrkt Basis BS 209 Investment in Cooperatives Use Cost Value Use Mrkt Value Use Cost Value Use Mrkt Value 210 211 212 213 General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes + 3 + 100% OCT AM 26 0 tvm W AutoSave OFF os 5- w Lab 6 BS STUDENT - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share o Comments Calibri (Bo... v 14 V A cDde AaBbCcDdEe " AI Aav A X APA AaBbCcDc AaBbCcDdEt AaBbc Paste B I U v ab v ale X Normal V Title 15 No Spacing Dictate Heading 1 V Heading 2 Styles Pane Sensitivity explanations you would like of the balance sheet schedules Note, not all information will be used. Ultimately your goal is to complete a balance sheet for the case farm for the year 2014 Inventory of raised crops intended for sale o 22,750 bushels of corn worth $3.69 6,000 bushels of soybeans worth $10.00 o 263 bushels of wheat valued at $5.00/bu Inventory of raised livestock intended for sale 10 head of feeder cattle weighing 400 lbs each and current price is $1.60 per lb. Raised feed Inventory o 1,600 tons of hay worth $113 per ton Sold $27,518 of livestock to John Smith. He has not paid for it yet. 14 days old. It is due in 30 days. - Cash held at United Savings for farm checking and savings accounts: $1,503 Have prepaid expenses to: ABC Coop for anhydrous fertilizer, 30 tons at $500 per ton ABC Coop for seed, 70 bags for $294.28/bag o John's AgriSupply for 28% liquid fertilizer, 40 tons at $250/ton Purchases on credit with local suppliers include: Argies Diesel shop: $700 ABC Coop: $356 O Farm & Fleet: $748 32 acres of established growing hay ground has $220 of direct expenses per acre Rented the chisel plow to the Jones family for $20,000, which has not been paid for yet. The payment from them is due next month. Page 2 of 6 1340 words English (United States) O Focus E + 90% AutoSave OFF os 5- w Lab 6 BS STUDENT - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share o Comments Calibri (Bo... v 14 V A AaBbCcDdEe AaBbCcDdEe " AI Aav A X APA AaBbCcDc AaBbCcDdEt AaBbc Paste B I U v ab v ale X Normal No Spacing Heading 1 V Title Heading 2 Dictate Styles Pane Sensitivity Credit card balances Venture One for $1,025 208 acres of new growing hay ground has $170 per acre of direct expenses Purchased breeding livestock on hand. These were recently purchased and market values are the same as the purchase price. o 1 Beef Bull that cost $1,500 9 Beef Cows costing $1,800 each o 1 Bred heifer that cost $1,400 o 4 open heifers that cost $600 each There are several buildings and many improvements, but in total the original cost of buildings and improvements was $1,225,643 with accumulated depreciation of $855,268. Based on recent sales of nearby farms, estimated market value today is $824,350. Inventory of raised breeding livestock, base value per head, and current market value information is below. Beginning of Year Base Mrkt Value/Head Value/Head Head Breeding Stock Dairy Calves Head End of Year Base Mrkt Value/Head Value/Head 150 400 10 150 400 10 Dairy Bull 1 800 1,050 1 800 1,050 185 1,200 1,780 199 1,200 1,625 62 1,000 1,175 65 1,000 1,175 Dairy Cows Dairy Bred Heifers Dairy Open Heifers 80 700 800 87 700 800 Land 390.5 acres purchased in 2004 for $2,875 per acre. Now worth $3,433 per acre 50 acres purchased in 2014 for $9,000. Now worth $9,000 per acre Page 3 of 6 1340 words English (United States) Focus E + 90% AutoSave OFF os 5- w Lab 6 BS STUDENT - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share o Comments Calibri (Bo... v 14 V AL cDde AaBbCcDdEe " AI Aav A X APA AaBbCcDc AaBbCcDdEt AaBbc Paste B I U v ab v ale X Normal 19 No Spacing V Heading 1 Title Heading 2 Dictate Styles Pane Sensitivity Machinery and Equipment Tractor 1 purchased in 2012 (remember this is 2014) for $225,000. Depreciation is based on straight-line, zero salvage value and 7 years of useful life. "Blue Book" (market value) today is $180,000. Assume the year of purchase was a full year of depreciation. o Tractor 2 purchased in 2010 for $140,000. Depreciation based on straight-line, zero salvage value and 7 years useful life. "Blue Book" = $75,000. Skid loader purchased in 2011 for $24,000. Depreciation straight-line, $4,000 salvage value and 5 years useful life. Blue Book market value = $15,000 All other machinery and equipment have total purchase cost of $650,000, accumulated depreciation of $475,764 and market value today of $521,325. Loans Non-term and Operating loans Operating line of credit: Current balance of $192,879, accrued interest of $488 and 3.04% interest rate (no information on date received or next payment) Risk line of credit for marketing: 3.04% rate, $37 accrued interest and a balance of $14,649 Term Debt FPP bldg./land Improvements: 3.28% interest, $1,702 accrued interest, principal due beyond this year of $531,061 and principal due this year of $91,918 FPP Machinery Note: principal due beyond this year of $113,363, principal payment this year of $45,664,2.65% interest rate and $145 of accrued interest o Mortgage and Land contracts Just made a payment on both loans so interest is paid to date, that is, no accrued interest. REM: 3.25% interest rate, long-term balance of $1,253,809 and payment this year of $67,268 Land Contract: 2.85% interest rate, long-term balance of $35,361, principal payment this year of $4,655 Accrued Expenses/Liabilities Employer withholding due but not paid: $213 Other assets o Vehicles with cost and market value of $19,500 (Intermediate Asset) Page 4 of 6 1340 words English (United States) Focus E + 90% Excel File Edit Data Window Help 100% 4-2 Mon 12:48 PM E View Insert Format Tools BES = AutoSave OFF Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B F G . J KAJ AK AL AM AN AP Year Ending: 2014 A D E 1 End of Year Balance Sheet Schedules For: Whisenant Farms 77 Schedule E: Purchased Inventories (Supplies, Purchased Feed, Prepaid Expenses, and Investment in Growing Crops) Units Units in Cost Basis BS 78 Supplies in inventory description Inventory $ per unit Use Cost Value 79 Mrkt Basis BS Use Cost Value 80 81 82 83 84 85 86 87 88 Units description Total Supplies (transfer to BS): Units in S per unit Cost Basis BS Use Cost Value Mrkt Basis BS Use Cost Value Inventory 89 Purchased Crops/Feed inventory 90 91 92 93 94 95 96 97 Units description Total Purchased feed (transfer to BS): | Units in Inventory $ per unit Cost Basis BS Use Cost Value Mrkt Basis BS Use Cost Value 98 Prepaid expenses 99 100 101 102 103 104 105 Total Prepaid expenses (transfer to BS): $ per Acre of Direct Cost Basis BS Mrkt Basis BS BS Schedules Beginning & Ending BS Deferred Taxes General Farm & Financial Info + 3 + 100% OCT AM 26 0 (tv 4 W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF HESUS = Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B D E F . J KAJ AK AL AM AN AP 2014 End of Year Balance Sheet Schedules For: Whisenant Farms 1 Year Ending 103 104 105 Total Prepaid expenses (transfer to BS): $ per Acre of Direct Cost Basis BS Mrkt Basis BS 106 Investment in Growing Crops (direct exp only) Acres Expenses Use Cost Value Use Cost Value 107 108 109 110 111 112 113 114 Total Investment in growing crops (transfer to BS): 115 Total Purchased Inventories: 116 For purchased inventories, use the cost (purchase) value for both the cost and Market Basis balance sheets. 117 118 119 Schedule F: Other Current Assets Cost Basis BS Mrkt Basis BS 120 Description Use Cost Value Use Cost Value 121 122 126 127 128 Total Other Current Assets (transfer to BS): 129 130 131 Schedule G: Raised Breeding Livestock (Base Value Method) Beginning of the Year End of the Year Beginning of the End of the Year End of Year Cost Basis BS Inventory Inventory Year Base Value per Base Value per Market Value per Total Cost Value (Head) (Head) head head head (Base Value) BS Schedules Beginning & Ending BS Deferred Taxes + Mrkt Basis BS Total Market Value Accrual Adjustment Gain (Loss) due to Base Value Change 132 Type of Breeding Animal General Farm & Financial Info 3 + 100% OCT AM 26 tv N W Excel File Edit 100% 4-2 Mon 12:48 PM E AutoSave OFF View Insert Format Tools Data Window Help HESUS = Page Layout Formulas Data Review View Tell me Lab 6 BS STUDENT Q Home Insert Draw Share 0 Comments B D E F H J K A AK AL AM AN AP 1 1 2014 End of Year Balance Sheet Schedules For: Whisenant Farms Year Ending: Schedule G: Raised Breeding Livestock (Base Value Method) 131 Beginning of the Year Inventory (Head) End of the Year Inventory (Head) Beginning of the Year Base Value per head End of the Year Base Value per head End of Year Market Value per head Cost Basis BS Total Cost Value (Base Value) Mrkt Basis BS Total Market Value Accrual Adjustment Gain (Loss) due to Base Value Change Type of Breeding Animal 132 133 134 135 136 137 138 139 140 141 Totals for Raised Breeding Livestock (transfer to BS): | 142 143 144 Schedule H: Purchased Breeding Livestock End of the Year Acquisition Total Accumulated Cost Basis BS Inventory Cost per head (Head) Depreciation Use Cost Value Purchased Breeding Livestock Current Market Value per head Mrkt Basis BS Use Market Value 145 146 147 148 149 150 151 152 153 154 155 156 157 Totals for Purchased Breeding Livestock (transfer to BS): General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes + 3 + 100% OCT AM 26 0 tv 4 W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF HES 5 = Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B D E F . J KAJ AK AL AM AN AP End of Year Balance Sheet Schedules For: Whisenant Farms Year Ending: 2014 1 159 See 'Schedule 1: Machinery' on "Financial Statement & Analysis Help Tabs" file Date Acquired Acquisition Accumulated Total Cost Value Description mm/yyy Cost Depreciation Total Market Value 160 161 162 163 164 165 166 167 168 169 Total Cost and Market Values, Machinery and Equipment (transfer to BS): 170 Schedule ): Real Estate (land, buildings, and improvements) See 'Schedule J: Buildings' on the "Financial Statement & Analysis Help Tabs" file 171 Accumulated Depreciation Cost Basis BS Use Cost Value Mrkt Basis BS Use Mrkt Value Date Acquired Acquisition Cost 172 Personal Residence 173 174 Total Cost and Market Values, Personal Residence (transfer to BS): 175 0 0 Market value per Date Acquired mm/yyy Acquisition Cost/Acre Accumulated Depreciation Total Market Value Acres Total Cost Value acre 176 Land and Land Improvements 177 178 179 180 181 182 183 General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes + 3 + 100% OCT AM 26 (tv 4 W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF Sv= Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments A B D E F H J KAJ AK AL AM AN AP End of Year Balance Sheet Schedules For: Whisenant Farms Year Ending 2014 1 1 175 Date Acquired mm/yyyy Acquisition Market value per Accumulated Depreciation Total Market Value Acres Cost/Acre Total Cost Value acre 176 Land and Land Improvements 177 178 179 180 181 182 183 184 185 Total Cost and Market Values, Land & Improvements (transfer to BS): 186 Accumulated Depreciation Total Market Value Date Acquired Acquisition Cost Total Cost Value 187 Buildings and Improvements 188 189 190 191 192 193 194 Total Cost and Market Values, Buildings & Improvements (transfer to BS): 195 196 197 Schedule K: Leased Assets See "Schedule K: Capital Leases" on "Financial Statements & Analysis Help Tabs" file Intermediate Current Liability, Current Liability, Asset Value Lease Pmt Accrued Interest Intermediate Liability 198 Description 199 200 201 General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes 3 + 100% OCT AM 26 0 tvm W Excel File Edit View Insert Format Tools Data Window Help 100% 4-2 Mon 12:48 PM E AutoSave OFF HESU- Lab 6 BS STUDENT Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments B D E F G H J KAJ AK AL AM AN AP End of Year Balance Sheet Schedules For: Whisenant Farms 1 1 2014 Year Ending: Accumulated Depreciation Total Market Value Date Acquired Acquisition Cost Total Cost Value 187 Buildings and Improvements 188 189 190 191 192 193 194 195 Total Cost and Market Values, Buildings & Improvements (transfer to BS): 0 0 0 0 196 Schedule K: Leased Assets See "Schedule K: Capital Leases" on "Financial Statements & Analysis Help Tabs" file 197 Intermediate Current Liability, Current Liability, Intermediate 198 Description Asset Value Lease Pmt Accrued Interest Liability 199 200 201 202 203 Total Leased Assets (transfer to BS): The initial value of a capital lease is the PV of payments to be made including any downpayments or advanced payments. The value is both an 204 asset and a liability with the liability being split between what is due currently and what remains. 205 206 207 Schedule L: Investment in Cooperatives and Other Non-Current Investments/Assets (Intermediate and Fixed)? 208 Intermediate Fixed Cost Basis BS Mrkt Basis BS Cost Basis BS Mrkt Basis BS 209 Investment in Cooperatives Use Cost Value Use Mrkt Value Use Cost Value Use Mrkt Value 210 211 212 213 General Farm & Financial Info BS Schedules Beginning & Ending BS Deferred Taxes + 3 + 100% OCT AM 26 0 tvm W AutoSave OFF os 5- w Lab 6 BS STUDENT - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share o Comments Calibri (Bo... v 14 V A cDde AaBbCcDdEe " AI Aav A X APA AaBbCcDc AaBbCcDdEt AaBbc Paste B I U v ab v ale X Normal V Title 15 No Spacing Dictate Heading 1 V Heading 2 Styles Pane Sensitivity explanations you would like of the balance sheet schedules Note, not all information will be used. Ultimately your goal is to complete a balance sheet for the case farm for the year 2014 Inventory of raised crops intended for sale o 22,750 bushels of corn worth $3.69 6,000 bushels of soybeans worth $10.00 o 263 bushels of wheat valued at $5.00/bu Inventory of raised livestock intended for sale 10 head of feeder cattle weighing 400 lbs each and current price is $1.60 per lb. Raised feed Inventory o 1,600 tons of hay worth $113 per ton Sold $27,518 of livestock to John Smith. He has not paid for it yet. 14 days old. It is due in 30 days. - Cash held at United Savings for farm checking and savings accounts: $1,503 Have prepaid expenses to: ABC Coop for anhydrous fertilizer, 30 tons at $500 per ton ABC Coop for seed, 70 bags for $294.28/bag o John's AgriSupply for 28% liquid fertilizer, 40 tons at $250/ton Purchases on credit with local suppliers include: Argies Diesel shop: $700 ABC Coop: $356 O Farm & Fleet: $748 32 acres of established growing hay ground has $220 of direct expenses per acre Rented the chisel plow to the Jones family for $20,000, which has not been paid for yet. The payment from them is due next month. Page 2 of 6 1340 words English (United States) O Focus E + 90% AutoSave OFF os 5- w Lab 6 BS STUDENT - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share o Comments Calibri (Bo... v 14 V A AaBbCcDdEe AaBbCcDdEe " AI Aav A X APA AaBbCcDc AaBbCcDdEt AaBbc Paste B I U v ab v ale X Normal No Spacing Heading 1 V Title Heading 2 Dictate Styles Pane Sensitivity Credit card balances Venture One for $1,025 208 acres of new growing hay ground has $170 per acre of direct expenses Purchased breeding livestock on hand. These were recently purchased and market values are the same as the purchase price. o 1 Beef Bull that cost $1,500 9 Beef Cows costing $1,800 each o 1 Bred heifer that cost $1,400 o 4 open heifers that cost $600 each There are several buildings and many improvements, but in total the original cost of buildings and improvements was $1,225,643 with accumulated depreciation of $855,268. Based on recent sales of nearby farms, estimated market value today is $824,350. Inventory of raised breeding livestock, base value per head, and current market value information is below. Beginning of Year Base Mrkt Value/Head Value/Head Head Breeding Stock Dairy Calves Head End of Year Base Mrkt Value/Head Value/Head 150 400 10 150 400 10 Dairy Bull 1 800 1,050 1 800 1,050 185 1,200 1,780 199 1,200 1,625 62 1,000 1,175 65 1,000 1,175 Dairy Cows Dairy Bred Heifers Dairy Open Heifers 80 700 800 87 700 800 Land 390.5 acres purchased in 2004 for $2,875 per acre. Now worth $3,433 per acre 50 acres purchased in 2014 for $9,000. Now worth $9,000 per acre Page 3 of 6 1340 words English (United States) Focus E + 90% AutoSave OFF os 5- w Lab 6 BS STUDENT - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share o Comments Calibri (Bo... v 14 V AL cDde AaBbCcDdEe " AI Aav A X APA AaBbCcDc AaBbCcDdEt AaBbc Paste B I U v ab v ale X Normal 19 No Spacing V Heading 1 Title Heading 2 Dictate Styles Pane Sensitivity Machinery and Equipment Tractor 1 purchased in 2012 (remember this is 2014) for $225,000. Depreciation is based on straight-line, zero salvage value and 7 years of useful life. "Blue Book" (market value) today is $180,000. Assume the year of purchase was a full year of depreciation. o Tractor 2 purchased in 2010 for $140,000. Depreciation based on straight-line, zero salvage value and 7 years useful life. "Blue Book" = $75,000. Skid loader purchased in 2011 for $24,000. Depreciation straight-line, $4,000 salvage value and 5 years useful life. Blue Book market value = $15,000 All other machinery and equipment have total purchase cost of $650,000, accumulated depreciation of $475,764 and market value today of $521,325. Loans Non-term and Operating loans Operating line of credit: Current balance of $192,879, accrued interest of $488 and 3.04% interest rate (no information on date received or next payment) Risk line of credit for marketing: 3.04% rate, $37 accrued interest and a balance of $14,649 Term Debt FPP bldg./land Improvements: 3.28% interest, $1,702 accrued interest, principal due beyond this year of $531,061 and principal due this year of $91,918 FPP Machinery Note: principal due beyond this year of $113,363, principal payment this year of $45,664,2.65% interest rate and $145 of accrued interest o Mortgage and Land contracts Just made a payment on both loans so interest is paid to date, that is, no accrued interest. REM: 3.25% interest rate, long-term balance of $1,253,809 and payment this year of $67,268 Land Contract: 2.85% interest rate, long-term balance of $35,361, principal payment this year of $4,655 Accrued Expenses/Liabilities Employer withholding due but not paid: $213 Other assets o Vehicles with cost and market value of $19,500 (Intermediate Asset) Page 4 of 6 1340 words English (United States) Focus E + 90%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts