Question: I need help Question 14 7.5 pts Bow Right Corp. issues a bond with a face value of $1000, coupon rate of 4.00%, and maturity

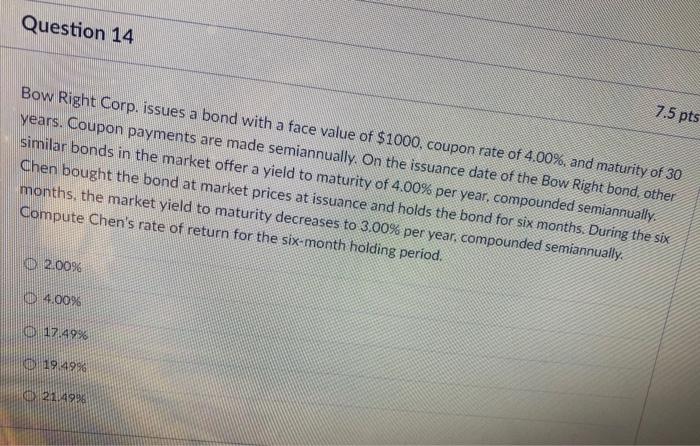

Question 14 7.5 pts Bow Right Corp. issues a bond with a face value of $1000, coupon rate of 4.00%, and maturity of 30 years. Coupon payments are made semiannually. On the issuance date of the Bow Right bond, other similar bonds in the market offer a yield to maturity of 4.00% per year, compounded semiannually. Chen bought the bond at market prices at issuance and holds the bond for six months. During the six months, the market yield to maturity decreases to 3.00% per year, compounded semiannually. Compute Chen's rate of return for the six-month holding period. 2.00% 4.00% 17.49% D 194996 021.4998

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts