Question: I need help!! Question 5 25 pts Question 4: Assuming, the S&P 500 is forecasted to return 10%, and the risk free rate is 3%

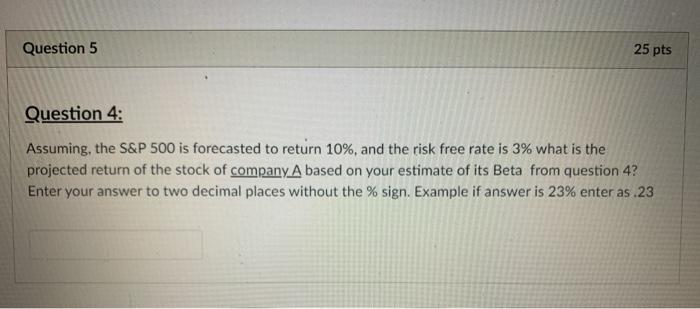

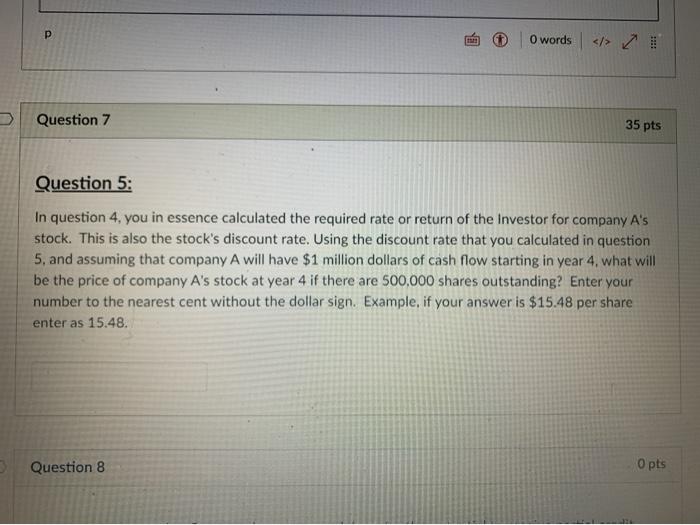

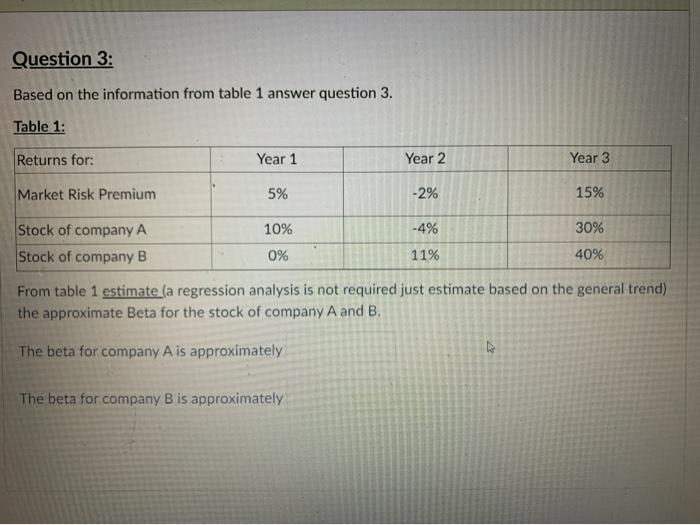

Question 5 25 pts Question 4: Assuming, the S&P 500 is forecasted to return 10%, and the risk free rate is 3% what is the projected return of the stock of company A based on your estimate of its Beta from question 4? Enter your answer to two decimal places without the % sign. Example if answer is 23% enter as 23 p O words > > Question 7 35 pts Question 5: In question 4. you in essence calculated the required rate or return of the investor for company A's stock. This is also the stock's discount rate. Using the discount rate that you calculated in question 5, and assuming that company A will have $1 million dollars of cash flow starting in year 4 what will be the price of company A's stock at year 4 if there are 500,000 shares outstanding? Enter your number to the nearest cent without the dollar sign. Example, if your answer is $15.48 per share enter as 15.48. Question 8 O pts Question 3: Based on the information from table 1 answer question 3. Table 1: Returns for: Year 1 Year 2 Year 3 Market Risk Premium 5% -2% 15% -4% 30% Stock of company A Stock of company B 10% 0% 11% 40% From table 1 estimate (a regression analysis is not required just estimate based on the general trend) the approximate Beta for the stock of company A and B. The beta for company A is approximately . The beta for company B is approximately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts