Question: I need help really bad with this one. The last person fell asleep on me or stop responding before they fully answered the question. -

I need help really bad with this one. The last person fell asleep on me or stop responding before they fully answered the question.

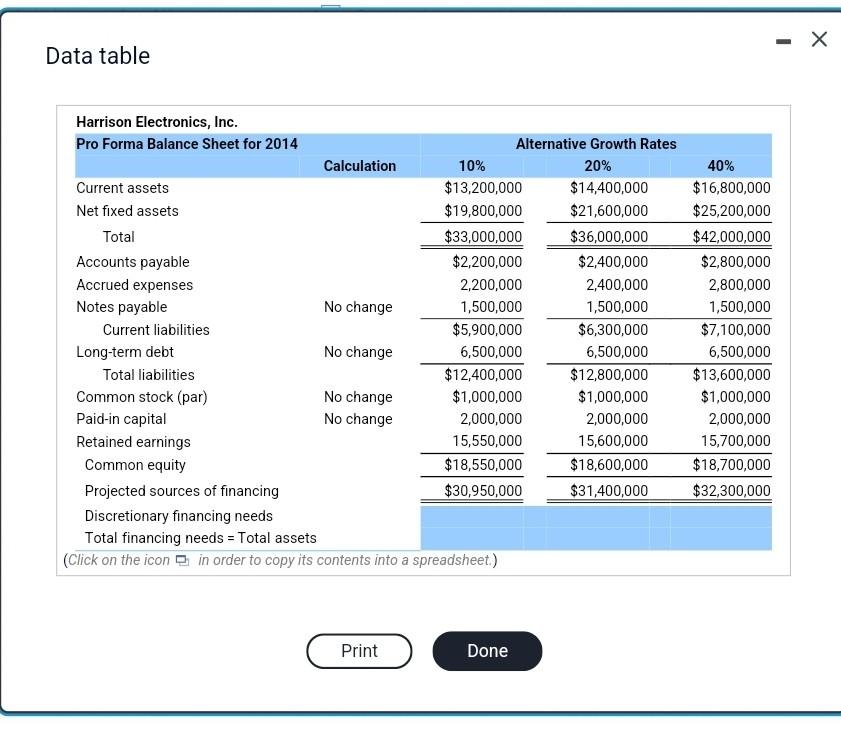

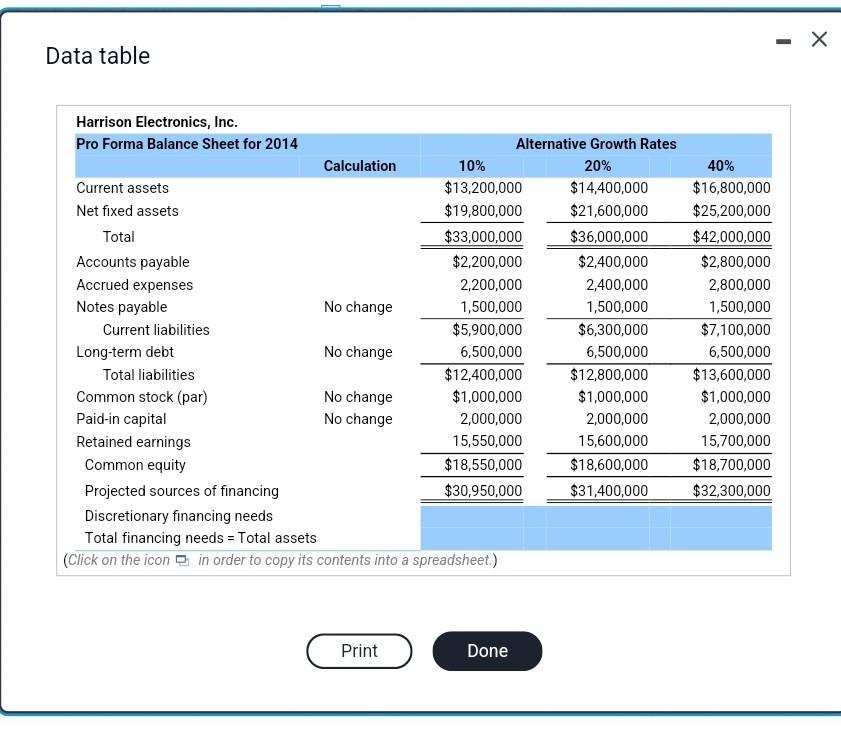

- Data table Harrison Electronics, Inc. Pro Forma Balance Sheet for 2014 Alternative Growth Rates Calculation 10% 20% Current assets $13,200,000 $14,400,000 Net fixed assets $19,800,000 $21,600,000 Total $33,000,000 $36,000,000 Accounts payable $2,200,000 $2,400,000 Accrued expenses 2,200,000 2,400,000 Notes payable No change 1,500,000 1,500,000 Current liabilities $5,900,000 $6,300,000 Long-term debt No change 6,500,000 6,500,000 Total liabilities $12,400,000 $12,800,000 Common stock (par) No change $1,000,000 $1,000,000 Paid-in capital No change 2,000,000 2,000,000 Retained earnings 15,550,000 15,600,000 Common equity $18,550,000 $18,600,000 Projected sources of financing $30,950,000 $31,400,000 Discretionary financing needs Total financing needs = Total assets (Click on the icon in order to copy its contents into a spreadsheet.) 40% $16,800,000 $25,200,000 $42,000,000 $2,800,000 2,800,000 1,500,000 $7,100,000 6,500,000 $13,600,000 $1,000,000 2,000,000 15,700,000 $18,700,000 $32,300,000 Print Done - Data table Harrison Electronics, Inc. Pro Forma Balance Sheet for 2014 Alternative Growth Rates Calculation 10% 20% Current assets $13,200,000 $14,400,000 Net fixed assets $19,800,000 $21,600,000 Total $33,000,000 $36,000,000 Accounts payable $2,200,000 $2,400,000 Accrued expenses 2,200,000 2,400,000 Notes payable No change 1,500,000 1,500,000 Current liabilities $5,900,000 $6,300,000 Long-term debt No change 6,500,000 6,500,000 Total liabilities $12,400,000 $12,800,000 Common stock (par) No change $1,000,000 $1,000,000 Paid-in capital No change 2,000,000 2,000,000 Retained earnings 15,550,000 15,600,000 Common equity $18,550,000 $18,600,000 Projected sources of financing $30,950,000 $31,400,000 Discretionary financing needs Total financing needs = Total assets (Click on the icon in order to copy its contents into a spreadsheet.) 40% $16,800,000 $25,200,000 $42,000,000 $2,800,000 2,800,000 1,500,000 $7,100,000 6,500,000 $13,600,000 $1,000,000 2,000,000 15,700,000 $18,700,000 $32,300,000 Print Done - Data table Harrison Electronics, Inc. Pro Forma Balance Sheet for 2014 Alternative Growth Rates Calculation 10% 20% Current assets $13,200,000 $14,400,000 Net fixed assets $19,800,000 $21,600,000 Total $33,000,000 $36,000,000 Accounts payable $2,200,000 $2,400,000 Accrued expenses 2,200,000 2,400,000 Notes payable No change 1,500,000 1,500,000 Current liabilities $5,900,000 $6,300,000 Long-term debt No change 6,500,000 6,500,000 Total liabilities $12,400,000 $12,800,000 Common stock (par) No change $1,000,000 $1,000,000 Paid-in capital No change 2,000,000 2,000,000 Retained earnings 15,550,000 15,600,000 Common equity $18,550,000 $18,600,000 Projected sources of financing $30,950,000 $31,400,000 Discretionary financing needs Total financing needs = Total assets (Click on the icon in order to copy its contents into a spreadsheet.) 40% $16,800,000 $25,200,000 $42,000,000 $2,800,000 2,800,000 1,500,000 $7,100,000 6,500,000 $13,600,000 $1,000,000 2,000,000 15,700,000 $18,700,000 $32,300,000 Print Done - Data table Harrison Electronics, Inc. Pro Forma Balance Sheet for 2014 Alternative Growth Rates Calculation 10% 20% Current assets $13,200,000 $14,400,000 Net fixed assets $19,800,000 $21,600,000 Total $33,000,000 $36,000,000 Accounts payable $2,200,000 $2,400,000 Accrued expenses 2,200,000 2,400,000 Notes payable No change 1,500,000 1,500,000 Current liabilities $5,900,000 $6,300,000 Long-term debt No change 6,500,000 6,500,000 Total liabilities $12,400,000 $12,800,000 Common stock (par) No change $1,000,000 $1,000,000 Paid-in capital No change 2,000,000 2,000,000 Retained earnings 15,550,000 15,600,000 Common equity $18,550,000 $18,600,000 Projected sources of financing $30,950,000 $31,400,000 Discretionary financing needs Total financing needs = Total assets (Click on the icon in order to copy its contents into a spreadsheet.) 40% $16,800,000 $25,200,000 $42,000,000 $2,800,000 2,800,000 1,500,000 $7,100,000 6,500,000 $13,600,000 $1,000,000 2,000,000 15,700,000 $18,700,000 $32,300,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts