Question: I need help selecting the correct anwers. I'm not sure if the selected ones are correct? Discuss the major differences between the American Opportunity credit

I need help selecting the correct anwers. I'm not sure if the selected ones are correct?

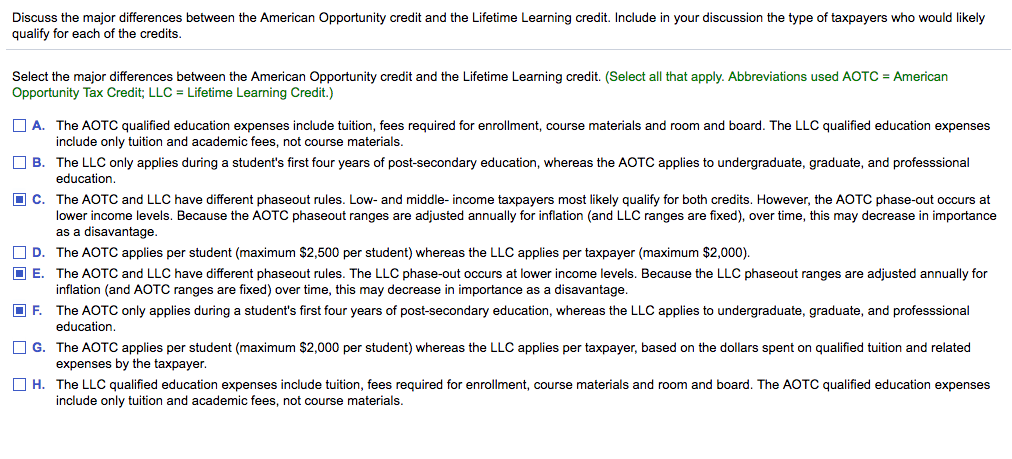

Discuss the major differences between the American Opportunity credit and the Lifetime Learning credit. Include in your discussion the type of taxpayers who would likely qualify for each of the credits. Select the major differences between the American Opportunity credit and the Lifetime Learning credit. (Select all that apply. Abbreviations used AOTC = American Opportunity Tax Credit:LLC = Lifetime Learning Credit.) A. The AOTC qualified education expenses include tuition, fees required for enrollment, course materials and room and board. The LLC qualified education expenses include only tuition and academic fees, not course materials. B. The LLC only applies during a student's first four years of post-secondary education, whereas the AOTC applies to undergraduate, graduate, and professional education. C. The AOTC and LLC have different phaseout rules. Low- and middle- income taxpayers most likely qualify for both credits. However, the AOTC phase-out occurs at lower income levels. Because the AOTC phaseout ranges are adjusted annually for inflation (and LLC ranges are fixed), over time, this may decrease in importance as a disadvantage. D. The AOTC applies per student (maximum exist2, 500 per student) whereas the LLC applies per taxpayer (maximum exist2, 000). E. The AOTC and LLC have different phaseout rules. The LLC phase-out occurs at lower income levels. Because the LLC phaseout ranges are adjusted annually for inflation (and AOTC ranges are fixed) over time, this may decrease in importance as a disadvantage. F. The AOTC only applies during a student's first four years of post-secondary education, whereas the LLC applies to undergraduate, graduate, and professional education. G. The AOTC applies per student (maximum exist2, 000 per student) whereas the LLC applies per taxpayer, based on the dollars spent on qualified tuition and related expenses by the taxpayer. H. The LLC qualified education expenses include tuition, fees required for enrollment, course materials and room and board. The AOTC qualified education expenses include only tuition and academic fees, not course materials

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts