Question: I need help showing me the breakdowns on this assignment in Excel please Susan Smith is age 45 and plans to retire in 15 years

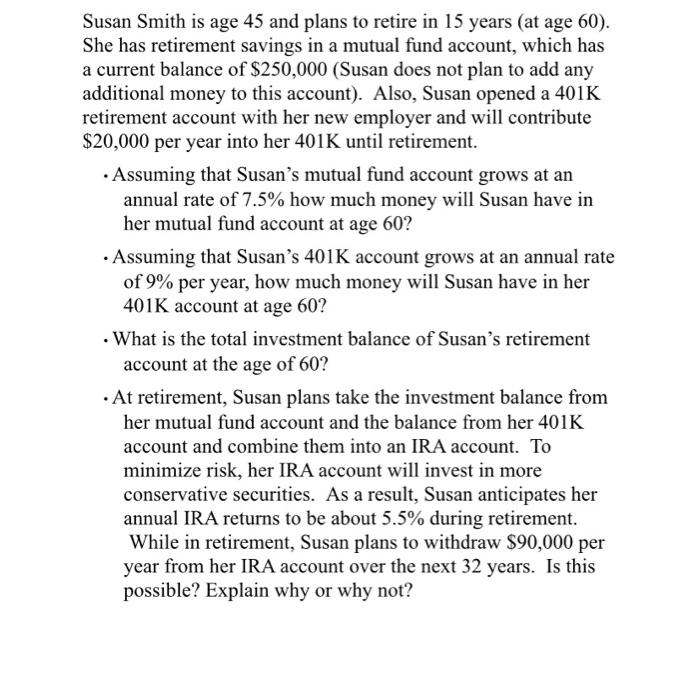

Susan Smith is age 45 and plans to retire in 15 years (at age 60). She has retirement savings in a mutual fund account, which has a current balance of $250,000 (Susan does not plan to add any additional money to this account). Also, Susan opened a 401K retirement account with her new employer and will contribute $20,000 per year into her 401K until retirement. Assuming that Susan's mutual fund account grows at an annual rate of 7.5% how much money will Susan have in her mutual fund account at age 60? Assuming that Susan's 401K account grows at an annual rate of 9% per year, how much money will Susan have in her 401K account at age 60? . What is the total investment balance of Susan's retirement account at the age of 60? At retirement, Susan plans take the investment balance from her mutual fund account and the balance from her 401K account and combine them into an IRA account. To minimize risk, her IRA account will invest in more conservative securities. As a result, Susan anticipates her annual IRA returns to be about 5.5% during retirement. While in retirement, Susan plans to withdraw $90,000 per year from her IRA account over the next 32 years. Is this possible? Explain why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts