Question: i need help showing work for this problem the answer is already posted. 4. Suppose you tracked performance of 4 portfolio managers for the last

i need help showing work for this problem the answer is already posted.

i need help showing work for this problem the answer is already posted.

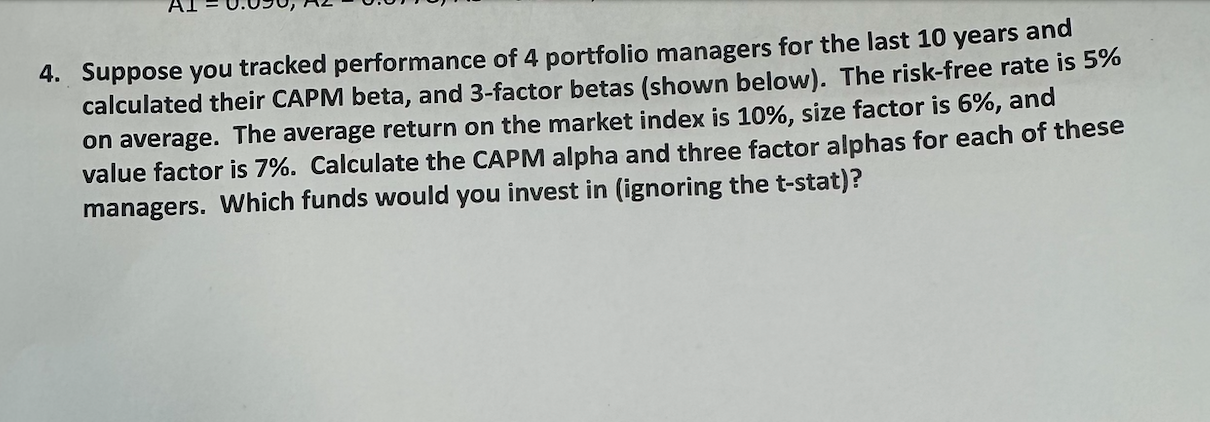

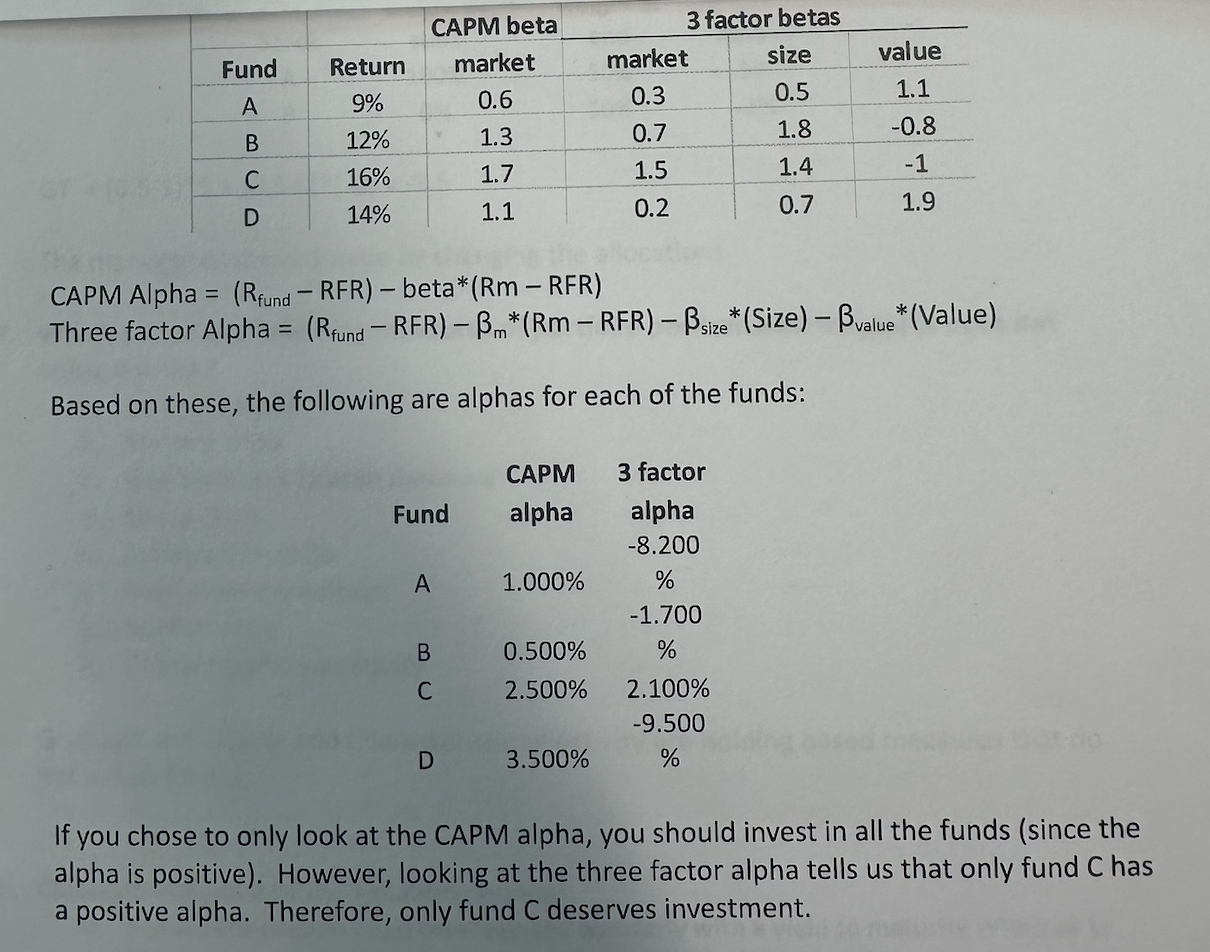

4. Suppose you tracked performance of 4 portfolio managers for the last 10 years and calculated their CAPM beta, and 3 -factor betas (shown below). The risk-free rate is 5% on average. The average return on the market index is 10%, size factor is 6%, and value factor is 7%. Calculate the CAPM alpha and three factor alphas for each of these managers. Which funds would you invest in (ignoring the t-stat)? CAPM Alpha =(RfundRFR) beta (RmRFR) Three factor Alpha =(RfundRFR)m(RmRFR)size( Size )value( Value ) Based on these, the following are alphas for each of the funds: If you chose to only look at the CAPM alpha, you should invest in all the funds (since the alpha is positive). However, looking at the three factor alpha tells us that only fund C has a positive alpha. Therefore, only fund C deserves investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts