Question: I need help solving for the Debt/Cap. and WACC. And if you could explain how to solve Miller and Modigliani Proposition I. Thanks. INE KITCHENWARE

I need help solving for the Debt/Cap. and WACC.

And if you could explain how to solve Miller and Modigliani Proposition I.

Thanks.

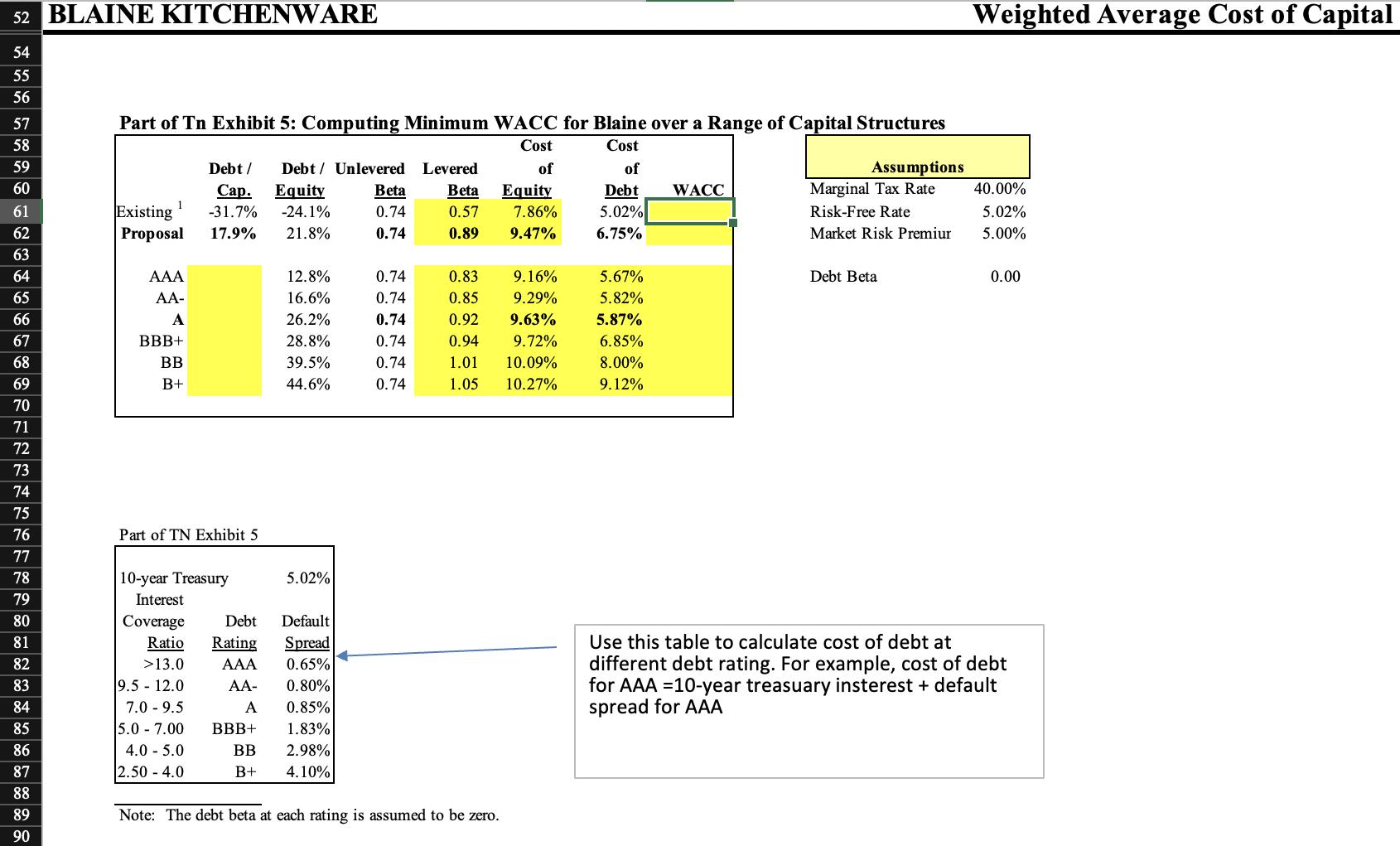

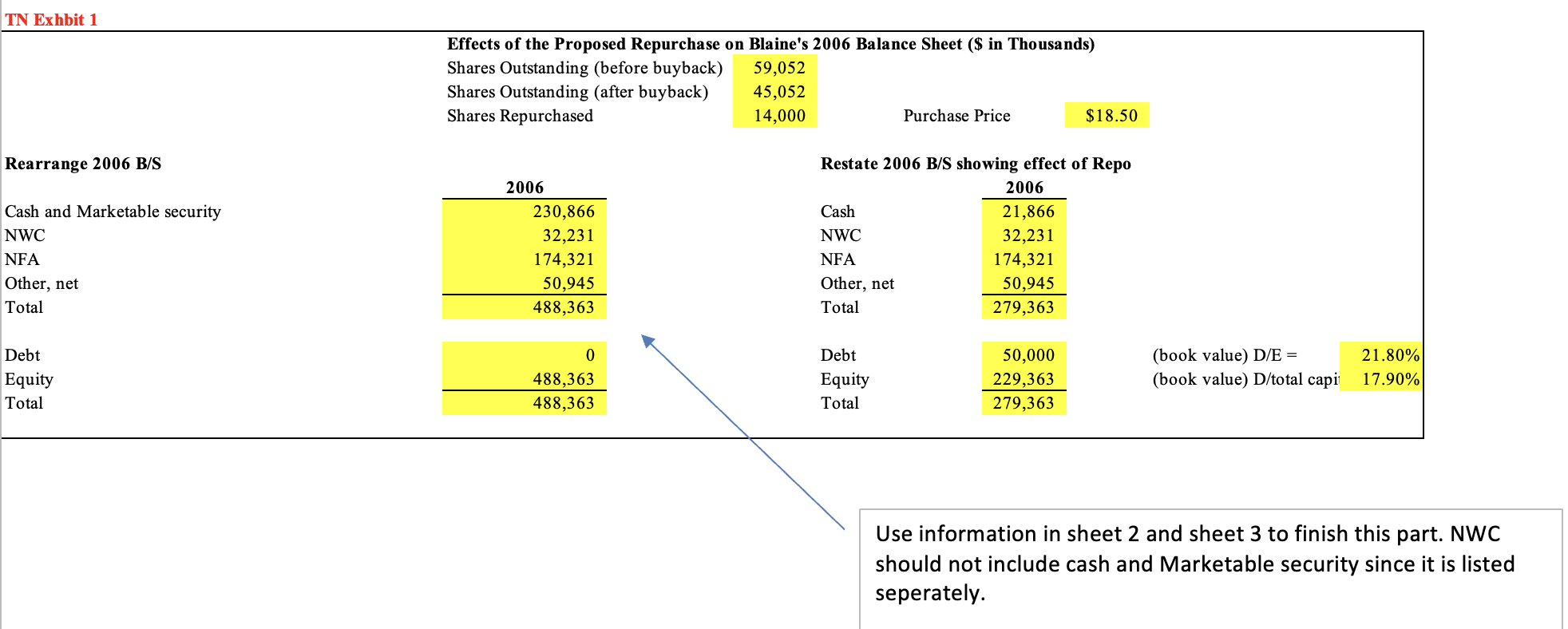

INE KITCHENWARE Weighted Average Cost of Capital Part of Tn Exhibit 5: Computing Minimum WACC for Blaine over a Range of Canital Structures Use this table to calculate cost of debt at different debt rating. For example, cost of debt for AAA=10-year treasuary insterest + default spread for AAA TN Exhbit 1 Effects of the Proposed Repurchase on Blaine's 2006 Balance Sheet (\$ in Thousands) Shares Outstanding (before buyback) 59,052 Shares Outstanding (after buyback) 45,052 Shares Repurchased Rearrange 2006B/S Restate 2006B/S showing effect of Repo Cash and Marketable security NWC Other, net Total 2006230,86632,231174,32150,945488,363 \begin{tabular}{lr} & \multicolumn{1}{c}{2006} \\ \cline { 2 - 2 } Cash & 21,866 \\ NWC & 32,231 \\ NFA & 174,321 \\ Other, net & 50,945 \\ \hline Total & 279,363 \end{tabular} Debt Equity Total Use information in sheet 2 and sheet 3 to finish this part. NWC should not include cash and Marketable security since it is listed seperately. INE KITCHENWARE Weighted Average Cost of Capital Part of Tn Exhibit 5: Computing Minimum WACC for Blaine over a Range of Canital Structures Use this table to calculate cost of debt at different debt rating. For example, cost of debt for AAA=10-year treasuary insterest + default spread for AAA TN Exhbit 1 Effects of the Proposed Repurchase on Blaine's 2006 Balance Sheet (\$ in Thousands) Shares Outstanding (before buyback) 59,052 Shares Outstanding (after buyback) 45,052 Shares Repurchased Rearrange 2006B/S Restate 2006B/S showing effect of Repo Cash and Marketable security NWC Other, net Total 2006230,86632,231174,32150,945488,363 \begin{tabular}{lr} & \multicolumn{1}{c}{2006} \\ \cline { 2 - 2 } Cash & 21,866 \\ NWC & 32,231 \\ NFA & 174,321 \\ Other, net & 50,945 \\ \hline Total & 279,363 \end{tabular} Debt Equity Total Use information in sheet 2 and sheet 3 to finish this part. NWC should not include cash and Marketable security since it is listed seperately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts