Question: I need help solving problem 6, the correct answer is listed on the right A company just paid an annual dividend of $2.00 per share

I need help solving problem 6, the correct answer is listed on the right

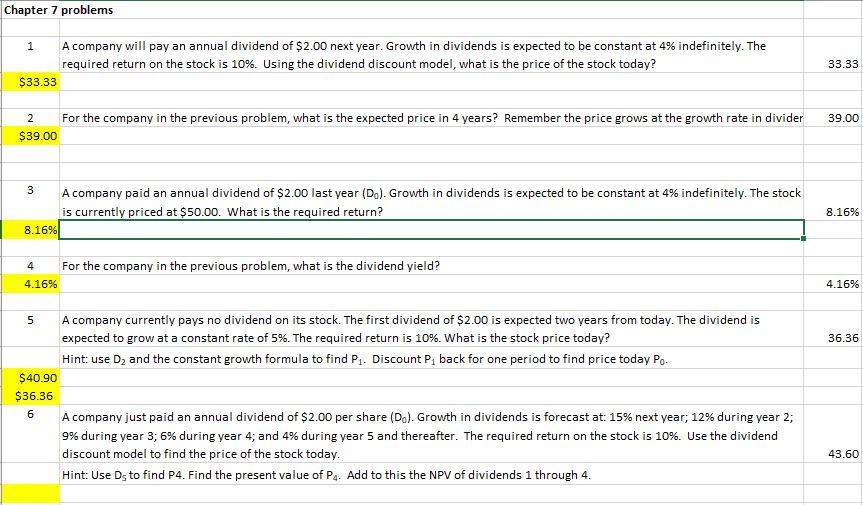

A company just paid an annual dividend of $2.00 per share (D0). Growth in dividends is forecast at: 15% next year; 12% during year 2; 9% during year 3; 6% during year 4; and 4% during year 5 and thereafter. The required return on the stock is 10%. Use the dividend discount model to find the price of the stock today.

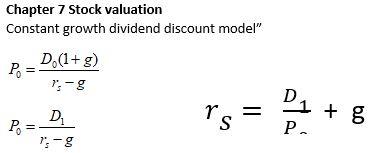

Chapter 7 Stock valuation Constant growth dividend discount model" Po D. (1+g) Da + 8 P = D. ig Ps = S 8 = P. Chapter 7 problems 1 A company will pay an annual dividend of $2.00 next year. Growth in dividends is expected to be constant at 4% indefinitely. The required return on the stock is 10%. Using the dividend discount model, what is the price of the stock today? $33.33 33.33 2 39.00 For the company in the previous problem, what is the expected price in 4 years? Remember the price grows at the growth rate in divider $39.00 3 A company paid an annual dividend of $2.00 last year (D). Growth in dividends is expected to be constant at 4% indefinitely. The stock is currently priced at $50.00. What is the required return? 8.16% 8.16% 4 For the company in the previous problem, what is the dividend yield? 4.16% 4.16% 5 36.36 A company currently pays no dividend on its stock. The first dividend of $2.00 is expected two years from today. The dividend is expected to grow at a constant rate of 5%. The required return is 10%. What is the stock price today? Hint: use D, and the constant growth formula to find P1. Discount P back for one period to find price today Po. $40.90 $36.36 A company just paid an annual dividend of $2.00 per share (Do). Growth in dividends is forecast at: 15% next year; 12% during year 2; 9% during year 3; 6% during year 4; and 4% during year 5 and thereafter. The required return on the stock is 10%. Use the dividend discount model to find the price of the stock today. Hint: Use Ds to find P4. Find the present value of Ps. Add to this the NPV of dividends 1 through 4. 6 43.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts