Question: I need help solving question 6. Thank you !! 4) The following is the Fama-French Three Factor model estimated for ECN Inc. [Notice here for

I need help solving question 6. Thank you !!

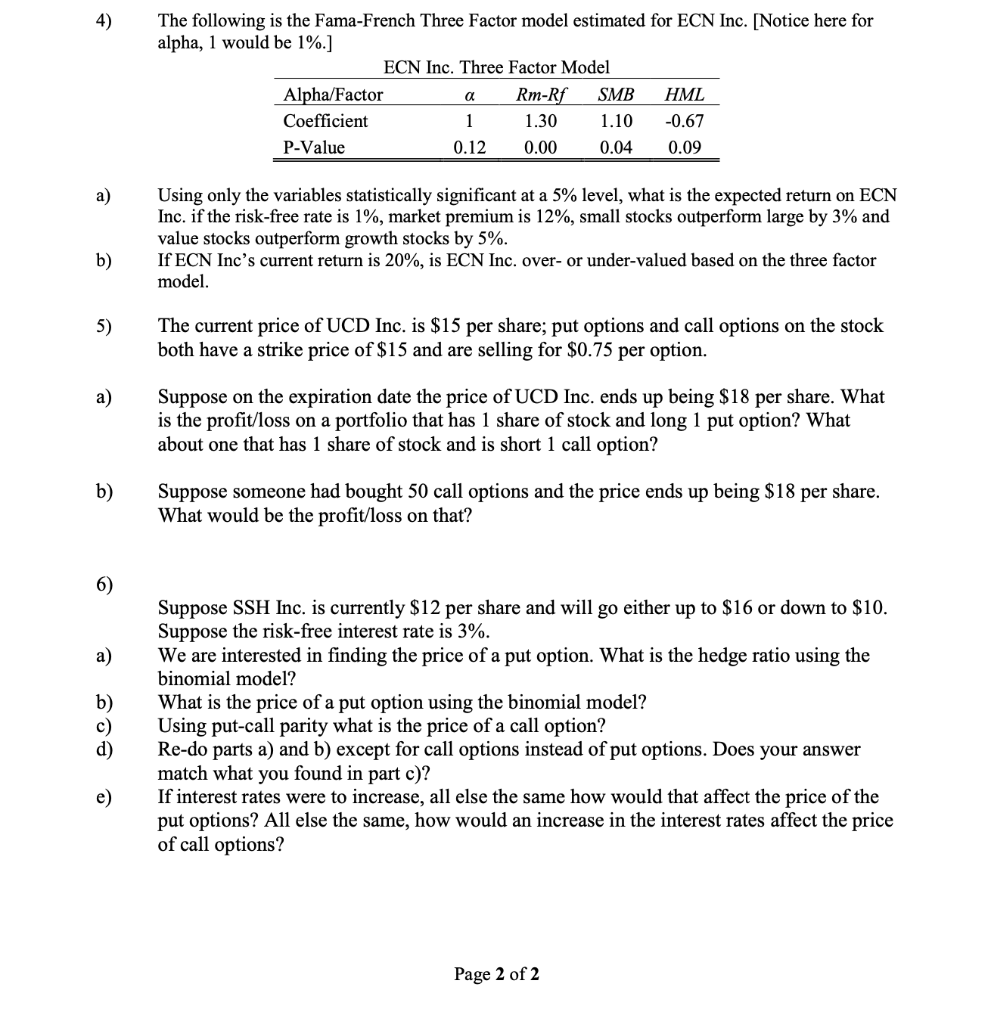

4) The following is the Fama-French Three Factor model estimated for ECN Inc. [Notice here for alpha, 1 would be 1%.] ECN Inc. Three Factor Model Alpha/Factor Rm-Rf SMB HML Coefficient 1 1.30 -0.67 P-Value 0.12 0.00 0.04 0.09 1.10 a) Using only the variables statistically significant at a 5% level, what is the expected return on ECN Inc. if the risk-free rate is 1%, market premium is 12%, small stocks outperform large by 3% and value stocks outperform growth stocks by 5%. If ECN Inc's current return is 20%, is ECN Inc. over- or under-valued based on the three factor model. b) 5) The current price of UCD Inc. is $15 per share; put options and call options on the stock both have a strike price of $15 and are selling for $0.75 per option. a) Suppose on the expiration date the price of UCD Inc. ends up being $18 per share. What is the profit/loss on a portfolio that has 1 share of stock and long 1 put option? What about one that has 1 share of stock and is short 1 call option? b) Suppose someone had bought 50 call options and the price ends up being $18 per share. What would be the profit/loss on that? 6) a) b) c) d) Suppose SSH Inc. is currently $12 per share and will go either up to $16 or down to $10. Suppose the risk-free interest rate is 3%. We are interested in finding the price of a put option. What is the hedge ratio using the binomial model? What is the price of a put option using the binomial model? Using put-call parity what is the price of a call option? Re-do parts a) and b) except for call options instead of put options. Does your answer match what you found in part c)? If interest rates were to increase, all else the same how would that affect the price of the put options? All else the same, how would an increase in the interest rates affect the price of call options? e) Page 2 of 2 4) The following is the Fama-French Three Factor model estimated for ECN Inc. [Notice here for alpha, 1 would be 1%.] ECN Inc. Three Factor Model Alpha/Factor Rm-Rf SMB HML Coefficient 1 1.30 -0.67 P-Value 0.12 0.00 0.04 0.09 1.10 a) Using only the variables statistically significant at a 5% level, what is the expected return on ECN Inc. if the risk-free rate is 1%, market premium is 12%, small stocks outperform large by 3% and value stocks outperform growth stocks by 5%. If ECN Inc's current return is 20%, is ECN Inc. over- or under-valued based on the three factor model. b) 5) The current price of UCD Inc. is $15 per share; put options and call options on the stock both have a strike price of $15 and are selling for $0.75 per option. a) Suppose on the expiration date the price of UCD Inc. ends up being $18 per share. What is the profit/loss on a portfolio that has 1 share of stock and long 1 put option? What about one that has 1 share of stock and is short 1 call option? b) Suppose someone had bought 50 call options and the price ends up being $18 per share. What would be the profit/loss on that? 6) a) b) c) d) Suppose SSH Inc. is currently $12 per share and will go either up to $16 or down to $10. Suppose the risk-free interest rate is 3%. We are interested in finding the price of a put option. What is the hedge ratio using the binomial model? What is the price of a put option using the binomial model? Using put-call parity what is the price of a call option? Re-do parts a) and b) except for call options instead of put options. Does your answer match what you found in part c)? If interest rates were to increase, all else the same how would that affect the price of the put options? All else the same, how would an increase in the interest rates affect the price of call options? e) Page 2 of 2

Step by Step Solution

There are 3 Steps involved in it

Ive displayed the image you uploaded Ill now proceed to analyze the contents of the image to help you solve question 6 Let me take a closer look at the details It seems that the image is related to th... View full answer

Get step-by-step solutions from verified subject matter experts