Question: I need help solving steps 1,2 and 3 IV. ONE MORE TIME! Building an Amortization Table & an Interest-Only Loan Schedule (Review Question) Assume you

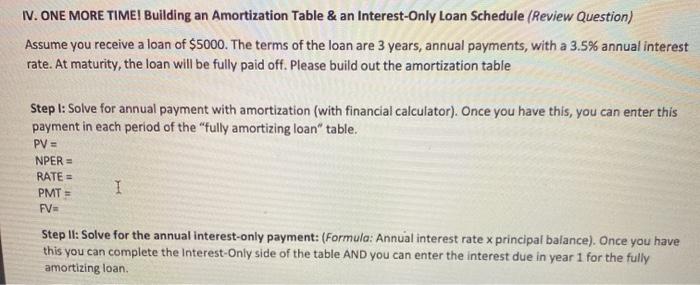

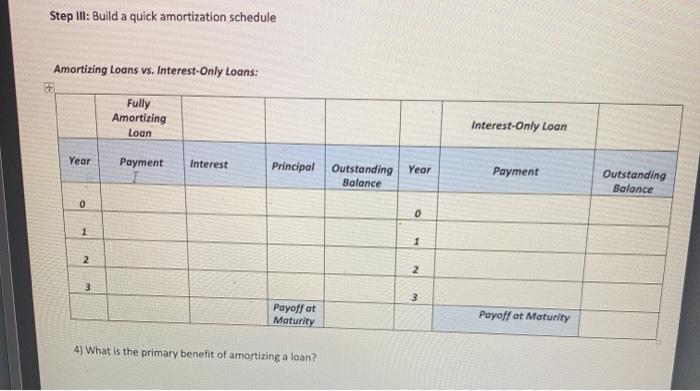

IV. ONE MORE TIME! Building an Amortization Table & an Interest-Only Loan Schedule (Review Question) Assume you receive a loan of $5000. The terms of the loan are 3 years, annual payments, with a 3.5% annual interest rate. At maturity, the loan will be fully paid off. Please build out the amortization table Step : Solve for annual payment with amortization (with financial calculator). Once you have this, you can enter this payment in each period of the "fully amortizing loan" table. PV = NPER= RATE = PMT = FV I Step It: Solve for the annual interest-only payment: (Formula: Annual interest rate x principal balance). Once you have this you can complete the Interest-Only side of the table AND you can enter the interest due in year 1 for the fully amortizing loan Step 1: Build a quick amortization schedule Amortizing Loans vs. Interest-Only Loans: Fully Amortizing Loan Interest-Only Loan Year Payment Interest Principal Outstanding Year Balance Payment Outstanding Balance 0 0 1 1 2 2 3 3 Payoff at Maturity Payoff at Maturity 4) What is the primary benefit of amortizing a loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts