Question: I need help solving these accounting questions. Problem - Adjusting Journal Entries - Prepare year end adjusting entries based on the following independent situations, assuming

I need help solving these accounting questions.

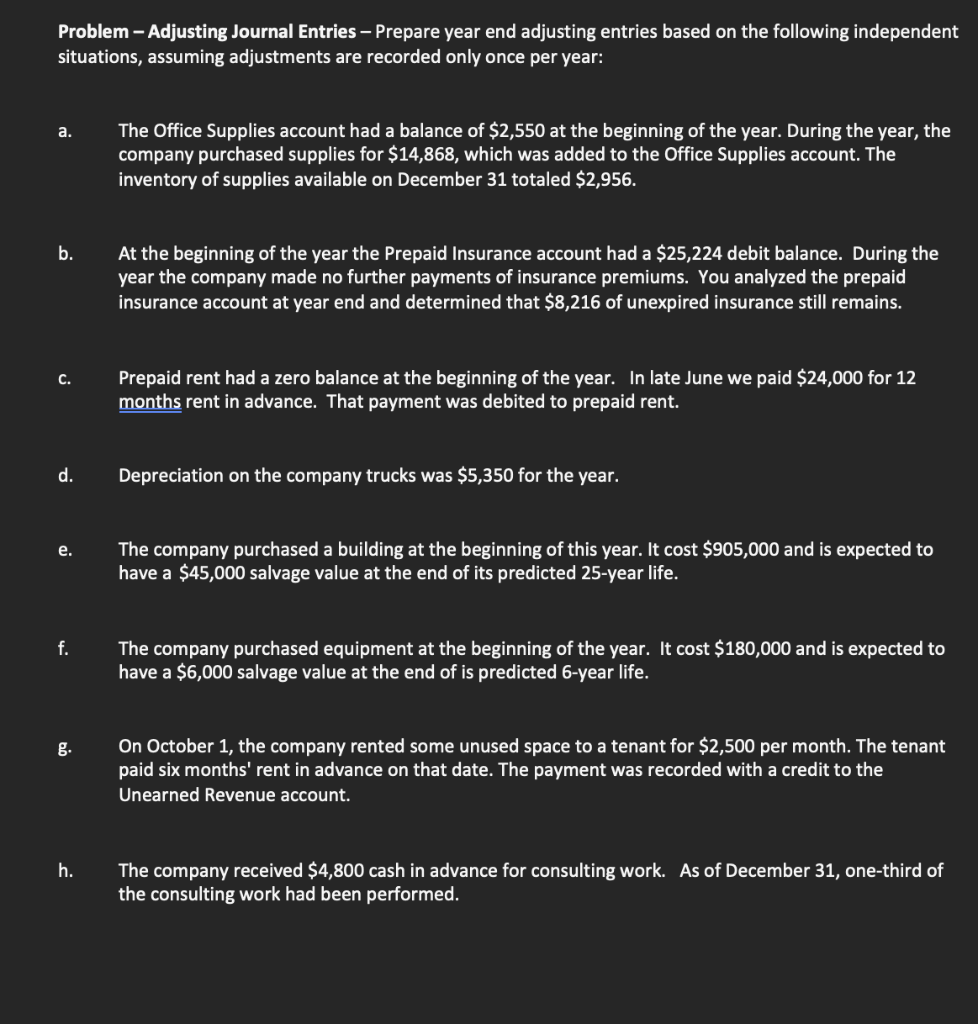

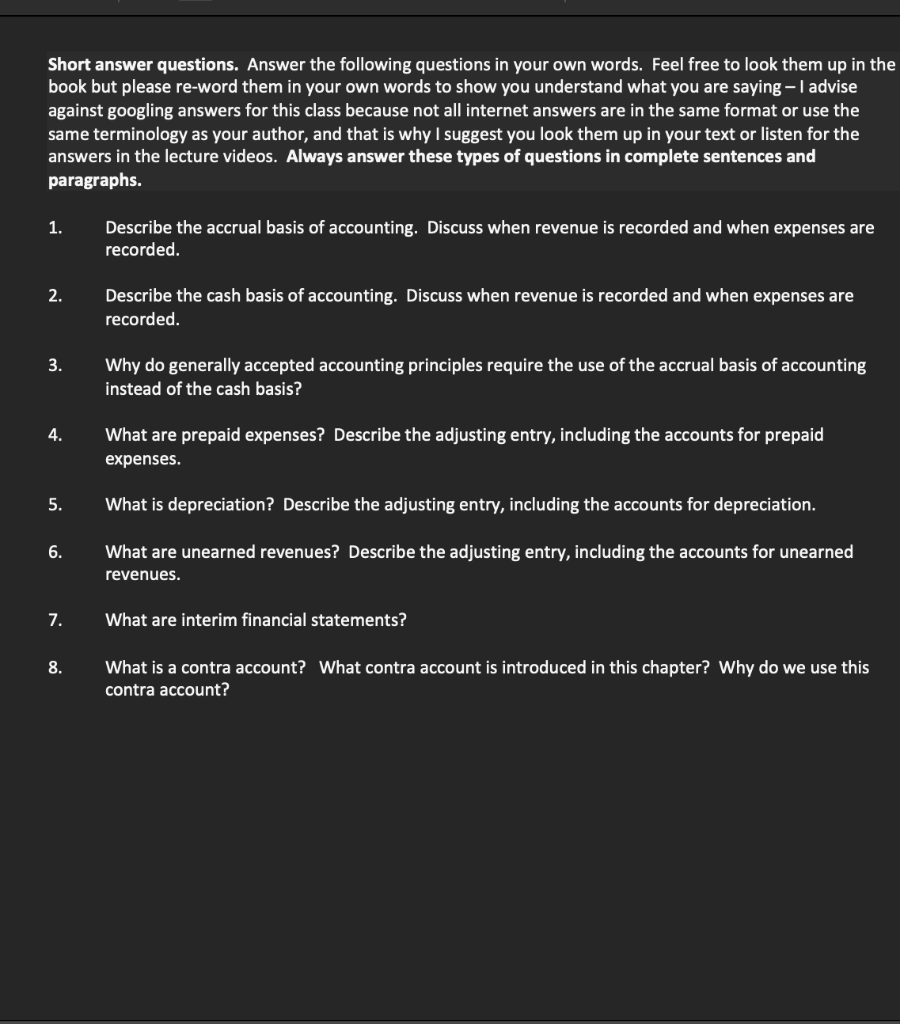

Problem - Adjusting Journal Entries - Prepare year end adjusting entries based on the following independent situations, assuming adjustments are recorded only once per year: a. The Office Supplies account had a balance of $2,550 at the beginning of the year. During the year, the company purchased supplies for $14,868, which was added to the Office Supplies account. The inventory of supplies available on December 31 totaled $2,956. b. At the beginning of the year the Prepaid Insurance account had a $25,224 debit balance. During the year the company made no further payments of insurance premiums. You analyzed the prepaid insurance account at year end and determined that $8,216 of unexpired insurance still remains. c. Prepaid rent had a zero balance at the beginning of the year. In late June we paid $24,000 for 12 months rent in advance. That payment was debited to prepaid rent. d. Depreciation on the company trucks was $5,350 for the year. e. The company purchased a building at the beginning of this year. It cost $905,000 and is expected to have a $45,000 salvage value at the end of its predicted 25 -year life. f. The company purchased equipment at the beginning of the year. It cost $180,000 and is expected to have a $6,000 salvage value at the end of is predicted 6-year life. g. On October 1, the company rented some unused space to a tenant for $2,500 per month. The tenant paid six months' rent in advance on that date. The payment was recorded with a credit to the Unearned Revenue account. h. The company received $4,800 cash in advance for consulting work. As of December 31 , one-third of the consulting work had been performed. Short answer questions. Answer the following questions in your own words. Feel free to look them up in th book but please re-word them in your own words to show you understand what you are saying - I advise against googling answers for this class because not all internet answers are in the same format or use the same terminology as your author, and that is why I suggest you look them up in your text or listen for the answers in the lecture videos. Always answer these types of questions in complete sentences and paragraphs. 1. Describe the accrual basis of accounting. Discuss when revenue is recorded and when expenses are recorded. 2. Describe the cash basis of accounting. Discuss when revenue is recorded and when expenses recorded. 3. Why do generally accepted accounting principles require the use of the accrual basis of accounting instead of the cash basis? 4. What are prepaid expenses? Describe the adjusting entry, including the accounts for prepaid expenses. 5. What is depreciation? Describe the adjusting entry, including the accounts for depreciation. 6. What are unearned revenues? Describe the adjusting entry, including the accounts for unearned revenues. 7. What are interim financial statements? 8. What is a contra account? What contra account is introduced in this chapter? Why do we use this contra account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts